Wood Mackenzie: Floating rig utilization back to pre-COVID levels while dayrates up by 40%

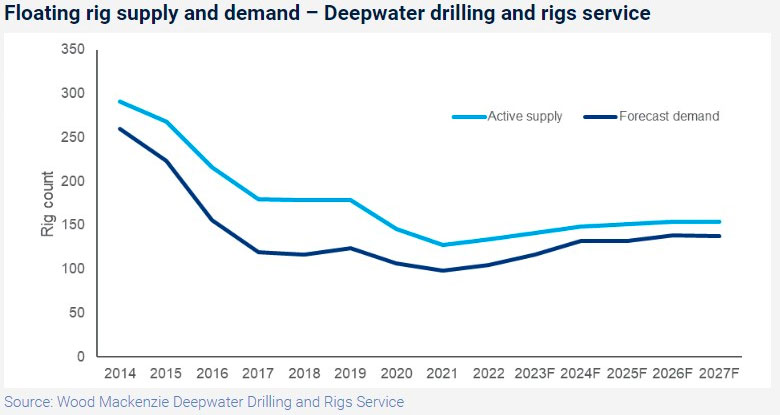

Rig utilization has returned to pre-COVID levels, driving rates up 40% in the past year as demand is forecast to increase an additional 20% from 2024-2025, according to a recent report from Wood Mackenzie.

Active floater utilization has rebounded from a low of 65% in 2018 to over 85% in 2023, the number of contracted ultra-deepwater (UDW) benign rigs has returned to pre-COVID levels, and dayrates for best-in-class floaters have doubled in the past two years.

“Higher oil prices, the focus on energy security and deepwater’s emissions advantages have supported deepwater development and, to some extent, boosted exploration,” said Leslie Cook, Principal Analyst for Wood Mackenzie. “Active supply is now more in line with demand, and rig cash flows are positive. We expect demand to continue to rise.”

Much of this expected growth will come from the “Golden Triangle” of Latin America, North America and Africa, as well as parts of the Mediterranean. Wood Mackenzie projects that these areas will account for 75% of global floating rig demand through 2027.

Rates on the rise

Recent activity has pushed rates up 40% in the past year, and Wood Mackenzie anticipates a further 18% escalation for floater day ates. Before the end of the year, rates of $500,000/day or above may return for highly prized, advantaged ultra-deepwater rigs. Benign ultra-deepwater rigs have averaged $420,000/day in the first half of 2023, with utilization at 90%.

“With increasing demand and rates, we are approaching the tipping point for newbuilds and reactivations,” Ms Cook said. “We haven’t reached it yet, but for newbuilds, it’s not a question of if, but when. The need for decarbonization, technological advancement, more efficiency and, ultimately, fleet replacement will drive a new cycle. If rig economics remain robust and rig companies see contractual risks abate, this could be sooner rather than later.”