Tax increase hits UK North Sea sector hard

$10 billion-plus in capital spending on hold; for rest of European drilling, it’s business as usual

By Jeremy Cresswell, contributing editor

Warp back to the first few weeks of 2011 and it looked as if Northwest Europe was set for a vintage year, so long as oil prices remained robust and there were no “left-of-field balls” to contend with.

But that’s exactly what did happen, at least in the UK sector, thanks to a budget decision in March by the British Treasury to increase its North Sea tax take by a further 12%, with no concessions offered to gas, even though prices for this commodity were then and remain relatively depressed.

The impact has been dramatic, with more than $10 billion of capital projects put on hold thus far and operational programmes cut, including chopping step-out wells targeting pockets of hydrocarbons suddenly rendered subeconomic; and the decommissioning of some elderly infrastructure brought forward, including the Murchison platform operated by CNR.

However, elsewhere on the Northwest Europe Continental Shelf, it has been business as usual, with no nasty fiscal surprises dealt out by other governments garnering revenues from maritime hydrocarbons production. In that regard, the news outside the UK sector seems almost prosaic and certainly routine by comparison.

Among the best when it comes to building a forward picture of Northwest European offshore prospects is Andrew Vinall of North Sea drilling analysts Hannon Westwood, who particularly specialize in UKCS and Norwegian sector activities covering exploration, appraisal and development drilling.

Notwithstanding the potential damage that the 2011 UK budget has already and/or may inflict in the near to medium-term, Mr Vinall is optimistic about the outlook for drilling in the British sector of the North Sea.

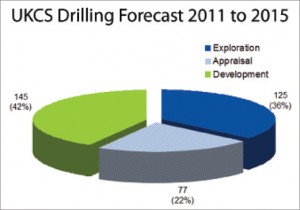

“We’re forecasting nearly 350 wells on the UKCS over the next few years … that’s E, A & D, of which around 145 are development. These are wells that are placed on our database when we know that they’re likely to be on the cards. We regularly have 200 E&A wells in our database, some of which drop away because people can’t get funding for them,” Mr Vinall said. “But those that are JV (consortium)-funded tend to go ahead.”

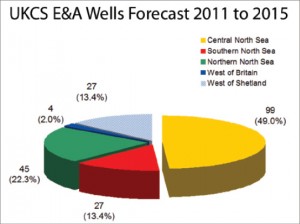

The approximately 200 UK E&A wells currently forecast by Hannon Westwood is mainly for the Central North Sea, but with a growing proportion in West of Shetland. The Northern and Southern sectors of the North Sea are attracting much less interest, whereas West of England (Irish Sea) drilling is sporadic at best.

While the Central North Sea has grown in popularity over the past decade, what is the West of Shetland attraction, given how traditionally slow it has tended to be as an exploration province?

“Historically it used to be around 8% to 10% of the total population (of wells drilled annually). But we’re now seeing a higher percentage of wells being planned for WoS … up 3% to 4% on the prior norm. That’s significant,” Mr Vinall said.

Fueling the interest is the recent run of apparently reasonable-sized gas and oil discoveries, though the long-running Lagavulin well has just been abandoned by Chevron as a dud – one that cost an estimated $270 million-plus to drill, which is a near-record for UK waters.

As for the Southern North Sea, where the Breagh and Cygnus gas discoveries now under development are of material value to the UK, the downside is commodity prices.

“The gas price has depressed most of the drilling in the Southern North Sea, and only those wells that need to be drilled are going ahead,” Mr Vinall said.

“In fact, we have on our database the same number of planned exploration and appraisal wells in the Southern North Sea as West of Shetland.”

Turning to the Northern North Sea, Mr Vinall reports that this area is currently enjoying a resurgence with about double the number of wells planned than for West of Shetland or Southern North Sea.

“That’s about 45 E&A wells for the Northern sector over the period 2011 through 2015. Then you can double that again (to 90) for the Central North Sea over the same period. Central has lately accounted for around 50% of the E&A total.”

IRELAND

Brief reference was made earlier to the sporadic activity West of England; however, further south in what is known as the Celtic Sea, a number of wells are planned, with Irish company Providence Resources setting the pace.

“There’s a bunch of wells being drilled in the Celtic Sea in a bid to bring on some of the discoveries made in recent years, with one or more rigs scheduled for this year,” Mr Vinall said.

“And there were going to be some West of Ireland wells, but I believe most have been deferred out to 2012, partly because of the Eni assets sale and partly because Serica with RWE need to farm-out before drilling follow-up wells to existing discoveries.”

Eni’s early 2011 announcement that it was offering its entire Ireland exploration portfolio (preferably as a package) for sale could be interpreted as a set-back for a country where it has taken decades to achieve barely a handful of commercial oil and/or gas discoveries.

In particular, an interested operator or joint venture will have to assume the commitment of drilling a well on each of the Dunquin and Fiachra prospects. The former is regarded as one of the largest gas prospects ever identified on the Northwest Europe Continental Shelf.

Mr Vinall believes the Eni decision to get out of Ireland is not as negative as could be interpreted.

“It’s going to pick up out there because they’ve just had 15 companies apply for licenses. So I think we’ll see a burst of activity West of Ireland over the next two or three years and so perhaps further drilling.”

NORWAY

Turning to Norway, Mr Vinall said it is very much business as usual – long-term and underpinned by clearly articulated governmental strategy and fiscal stability.

Interestingly, last year and this, activity levels in the Norwegian sector are running higher than for the UK, and it looks as if that will continue. However, in terms of keeping an overall measure of that activity, the Hannon Westwood database count is showing 17 wells only … but these are just fully confirmed wells.

“There is quite a lot of farm-out activity going on at the moment, and this will lead to wells being drilled. And bear in mind, under the Norwegian fiscal system, one gets 80% of the tax back on the drilling of an exploration/appraisal well. There is no such incentive in the UK, other than for companies that already have production that they can offset the tax against.

ROWAN

Glenn White, general manager of Rowan Drilling UK and current chairman of the IADC North Sea Chapter, is just as positive about the Europe offshore scene as Mr Vinall. Not only that, the industry is armed with perhaps the best rigs that have ever been mustered in the North Sea as various newbuilds arrive. Those new tonnage investors include Rowan.

“We’re doubling in size in the UK in 2011,” Mr White said. We have three high-spec drilling units here and before the end of the year we will have doubled that to six. Our competitors are doing the same thing, and it means that the North Sea is going to have a lot of newer rigs and the older units will head elsewhere.

“The new units will meet today’s tougher safety standards, and the drive to replace rigs is coming from the industry itself, though cooperating closely with bodies such as Oil & Gas UK, IADC itself, together will the regulators and governments.”

Of course, if you’re an operator, the problem with high-grading the North Sea fleet is that rig owners will need higher dayrates. It might grate with some oil companies, but such investment is necessary and, ultimately, generally welcomed as the new rigs are bigger, better-equipped and safer.

According to Mr White, the CAPEX soaked up by the build, fitting out and commissioning of Rowan’s new North Sea trio is well over $1 billion.

“A dayrate of maybe $300,000 per day is needed just to cover the cost of a new unit over 10 to 12 years. We already had high-spec rigs in the North Sea, and we had pretty good term contracts.

“The rigs we use are relatively new … 12 years or younger and well-suited to drilling demanding wells such as HPHT. This has positioned Rowan in a good spot. Good times or bad, over the past 30 years we’ve never stopped building rigs at Rowan.

“We had the luxury of owning a rig builder that we just recently sold. Overall, we have seven new rigs coming out in 2011. Two of the three for Europe are already here; the other one will be here in September. They are the Rowan Viking, Rowan Stavanger and Rowan Norway.”

Does this mean that older, less able rigs no longer have a place in the North Sea?

“There sure is, especially for jackups in the Southern part of the North Sea. They might be 20 to 25 years old, but there’s still a place for them,” Mr White said.

But it’s not solely about drilling power in the North Sea. Big, high-spec jackups are also in demand to support the upgrading of existing platforms, development of new fields and to drill/produce them. The heavy crude Bentley field is an example.

It means that more beds are needed.

“Older rigs carry between 70 and 100 POB (persons on board); higher-spec ones can accommodate 120 to 150 and are easily upgradable to 180 to 200. You have to get a Gorilla-type rig or a CJ70 or an N-class. And we happen to own almost 50% of them,” Mr White added.

As for the long-running concern regarding rigs not yet having the freedom to cross between the UK and Norwegian sectors, his view is that while a common regulatory regime may never be possible, efforts continue to at least simplify the process.

“As drilling contractors, we of course want governments in Europe to work together and have a common level playing field where rigs have to comply with shared standards; that would benefit everyone,” Mr White said.

So does that mean everyone is inching towards a common agreement?

“I wouldn’t want to speculate on that. However, things are improving, signifi bodies such as Oil & Gas UK, IADC itself, together will the regulators and governments.”

Of course, if you’re an operator, the problem with high-grading the North Sea fleet is that rig owners will need higher dayrates. It might grate with some oil companies, but such investment is necessary and, ultimately, generally welcomed as the new rigs are bigger, better-equipped and safer.

According to Mr White, the CAPEX soaked up by the build, fitting out and commissioning of Rowan’s new North Sea trio is well over $1 billion.

“A dayrate of maybe $300,000 per day is needed just to cover the cost of a new unit over 10 to 12 years. We already had high-spec rigs in the North Sea, and we had pretty good term contracts.

“The rigs we use are relatively new … 12 years or younger and well-suited to drilling demanding wells such as HPHT. This has positioned Rowan in a good spot. Good times or bad, over the past 30 years we’ve never stopped building rigs at Rowan.

“We had the luxury of owning a rig builder that we just recently sold. Overall, we have seven new rigs coming out in 2011. Two of the three for Europe are already here; the other one will be here in September. They are the Rowan Viking, Rowan Stavanger and Rowan Norway.”

Does this mean that older, less able rigs no longer have a place in the North Sea?

“There sure is, especially for jackups in the Southern part of the North Sea. They might be 20 to 25 years old, but there’s still a place for them,” Mr White said.

But it’s not solely about drilling power in the North Sea. Big, high-spec jackups are also in demand to support the upgrading of existing platforms, development of new fields and to drill/produce them. The heavy crude Bentley field is an example.

It means that more beds are needed.

“Older rigs carry between 70 and 100 POB (persons on board); higher-spec ones can accommodate 120 to 150 and are easily upgradable to 180 to 200. You have to get a Gorilla-type rig or a CJ70 or an N-class. And we happen to own almost 50% of them,” Mr White added.

As for the long-running concern regarding rigs not yet having the freedom to cross between the UK and Norwegian sectors, his view is that while a common regulatory regime may never be possible, efforts continue to at least simplify the process.

“As drilling contractors, we of course want governments in Europe to work together and have a common level playing field where rigs have to comply with shared standards; that would benefit everyone,” Mr White said.

So does that mean everyone is inching towards a common agreement?

“I wouldn’t want to speculate on that. However, things are improving, signifi cantly and will continue to. It’s important to keep communicating … keep talking.”

KCA DEUTAG

KCA DEUTAG has been in the North Sea for decades and is a first-division platform drilling specialist in the Norwegian and UK sectors.

“Across those two sectors we’re currently managing drilling operations on 20 platform rigs; seven-ish in Norway and 13-ish in the UK,” said chief operating officer Brian Taylor. Basically that means about a third of each market.

However, in the UK, platform-based drilling is a rather go-stop-pause business, while the approach in Norway is sustained … a pretty much continuous business for the Aberdeen-headquartered group’s drilling teams.

“In the UK, though we have the potential for 13 platform rigs, platform-based drilling on the UKCS is at more mature phase than Norway. At the moment the number of platform rigs currently working with our crews is around the five or six mark.”

Mr Taylor too is bullish about the market, describing it as “stable or better”; in other words, it still offers the potential to grow the business, despite the region’s growing maturity, albeit the aging process is less advanced in the Norwegian sector.

“Of course, Norway is dominated by one operator (Statoil) though others are clearly active there. In the UK, the shorter-term view plus greater maturity of the province means that operators have to prioritize their capital commitments, something that we at KCA DEUTAG understand.

“There is another aspect. We’re not just involved in drilling but also the refurbishing of many platform rigs. By example, in the UK sector, we’ve carried out extensive rig renewals on ExxonMobil’s Beryl Alpha and Bravo platforms.

“This sort of work’s becoming a feature of the North Sea, and we’re well positioned to do that. We have our own drilling facilities engineering division … RDS … and so we’re very keen to be involved in the upgrade and renewal of rigs.”

Mr Taylor currently sees the potential for renewing the drilling packages aboard another five or six UKCS platforms, but this depends on operators being willing to invest. Bearing in mind the latest UKCS tax rise, there is less incentive to spend in the North Sea; favored markets being expanding provinces like West Africa.

“There is competition for their CAPEX, and we fully understand that.”

So how many development wells was KCA DEUTAG responsible for in the North Sea in 2010?

“Around 35-40 … drilling or renewal of 35 to 40 wells on the UKCS compared with around 20 for the NCS,” Mr Taylor said.

“We expect about the same for the NCS this year too. On the UKCS the position has become less clear following the recent tax increase. However, it’s quite difficult to be sure that any reduction in the number of wells is the result of decisions around the UK fiscal regime.”

European drilling by the numbers

- $10 billion-plus in capital projects have been put on hold since a 12% increase in the UK’s North Sea tax take was put in place.

- Nearly 350 exploration, appraisal and development wells are currently forecast for the UKCS over the next few years, of which 145 are development.

- 45 E&A wells are currently forecast for the Northern North Sea for 2011 through 2015.

- 49% of UKCS E&A wells forecast for 2011 to 2015 are for the Central North Sea.