US Steel Tubular Products to open Innovation & Technology Center for industry customers

By Joanne Liou, editorial coordinator

U.S. Steel Tubular Products (USS) will open the Innovation & Technology Center at its Houston offices on 28 March. The 10,000-sq-ft facility will serve as a training and education facility for customers, stakeholders and the community; it will be open to host events, such as lunch-and-learn sessions, industry association meetings and employee training. The center features six areas of interest devoted to research and development innovations; services and connections; manufacturing; inspection and testing; raw materials; and an overview area showcasing the company’s history.

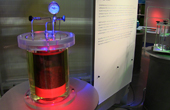

The six areas reflect the company’s integrated supply chain and vision. “We started this vision of customer-driven tubular focus within our tubular segment,” Douglas R. Matthews, senior vice president – tubular operations of USS, said at a media event last week. “We need to be a stronger supporter – supporting technology developments that help our customers do their job easier, faster, better, cheaper.” The display of artificial iron ore, coke and limestone show the process of selecting and mining the materials. In the manufacturing exhibit, visitors can learn about the process and how materials are refined.

USS’ technologies and services are featured in the products, services and connections area of the center. Some of the company’s latest advances, such as the USS Buttress Thread, are showcased in the R&D innovations area. The interactive inspection and testing exhibit allows guests to test the performance capacity of various products through a touch-screen virtual testing system. Throughout the center, videos, posters and simulations give visitors an in-depth look and understanding of different technologies and process involved within the steel and tube-making process.

“We’re excited about this step in the evolutionary process of being tubular focus and customer driven,” Mr Matthews said. “We’re making sure our customers are at the forefront and identifying what their needs are and being responsive and proactive to supporting those needs, and we feel that this grand opening of our innovation and technology center is a step in that direction.”

Image Gallery

Click any image to zoom

Where in Houston is this facility located?