Pad drilling, on-site water treatment help reduce surface impact

Multilaterals, non-aqueous fracturing and longer laterals also on horizon to help improve shale development

By Katie Mazerov, contributing editor

Michael Power is Chevron’s manager of unconventional resources – global drilling & completions.

Michael Power is Chevron’s manager of unconventional resources – global drilling & completions.

How is the need to boost economics in shale development driving new drilling and completions technologies in North America?

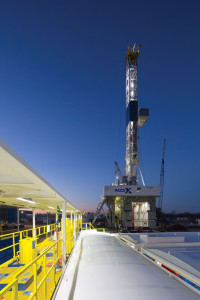

As an industry, to ensure commercial success, we have to use technology and best practices to make production beneficial from a cost perspective, as well as to reduce our environmental footprint. An example is how the industry is using pad drilling. In the Marcellus, Chevron is putting six to eight wells on a pad with longer horizontals, which reduces construction costs on a per-well basis and actual rig time in terms of moving rigs. We also can more efficiently coordinate water transportation and reclamation. Once we finish a pad of six to eight wells, we are using less than two acres of surface land but can produce from more than a square mile by drilling those horizontal wells with longer laterals.

We’re also treating our frac flowback water on-site, which reduces both trucking costs and emissions. On-site treatment means we are transporting cleaner water to the next pad site. We’re also using an innovative water tank design that helps reduce the size of our temporary pads used for drilling and completions. At one time in the Marcellus, we covered 20 acres before going into production mode. With these tanks, we have reduced that footprint to 10 acres. Going forward, we’re looking at multilateral technology, non-aqueous fracturing and drilling longer laterals. Together, these advances add up to significant cost savings, efficiency and less surface impact.

What role does collaboration play in the industry to further advance unconventional development?

Wherever we operate, we engage with local communities, non-governmental organizations (NGOs), industry groups and academia. We understand that communities have certain expectations and concerns, and therefore we engage in frequent and ongoing outreach efforts with the various stakeholders. In the Marcellus, we are trying to build long-term partnerships with stakeholders through open communication, job creation and support of initiatives beneficial to residents to achieve mutual benefits that potentially could last for decades.

How is regulation keeping pace with expanding shale development?

From a regulatory standpoint, in the US, we have state and federal regulations with which to comply, as well as industry-recommended practices and guidance. State agencies have the primary role in regulatory and enforcement activities and can leverage local expertise. This “boots on the ground” philosophy is important because there are unique, regional issues associated with the geology, surface waters and topography that need to be considered to determine the safest way to design and operate a well.

At Chevron, we put a lot of emphasis on robust well design to ensure that we are protecting the groundwater for the life of the well. We believe the states are effectively responding to increased shale and tight resource development and evolving technologies. Pennsylvania, for example, recently enacted updates to its regulatory structure for shale development, including increased setback requirements from buildings, streams and other water sources. The updates also encompass new notice requirements to obtain drilling permits, increased penalties in bonding amounts and greater authority for the regulatory agency. West Virginia and Ohio have enacted similar rules regulating natural gas and oil operations.

How will developing technologies and the shift toward automation impact shale development in North America?

While we don’t see an extraordinary shift toward rig automation in the shale plays, the rig industry in general is becoming more automated. One of the big drivers is safety. Some automation features have increased efficiency, but automation also is resulting in fewer and less-serious injuries, which is even more important.

As an industry, we are in a continuous improvement mode, and technology is a big part of that. But there are some technologies that are true game-

changers that make our assets commercial. Current innovations include closed-looped technologies, directional drilling, drilling fluid and fracturing technologies that result in less water usage. Effectively handling drill cuttings, through devices such as hammer mills and cuttings driers to recapture some of the synthetic-based mud (SBM) is key in helping us manage costs.

The ability to extend farther out from existing pads to minimize pad size and our footprint, as well as efforts to improve penetration rates and reduce costs, also are important. At Chevron, we’ve upsized some of our rigs in terms of top drive, drill pipe and mud pumps, and we’re looking at rotary steerables in specific sizes that fit our needs to further develop these wells and drill longer laterals.

A water-based mud system that would allow us to drill with the same lubricity and reach as SBMs also could reduce costs and provide additional environmental benefits. The use of frac sleeves, instead of plug-and-perf methods, has the potential to reduce the need for wireline and coiled tubing, as well as the amount of water needed for fracturing and the hydraulic horsepower required to pump the fracs. We’re experimenting with that and trying to understand the best fit for our operations.

In Pittsburgh, Chevron is constructing a Decision Support Center, a physical and virtual space that will enable decision-making for optimization in both drilling and completions. Phase One of the center, which will focus on drilling and landing of laterals, will be operational this year. The center will be staffed by subject matter experts (SMEs) who have real-time access to data. We believe data coming directly from the rig, and better data management from previously drilled wells to establish a baseline, will result in better, more timely decisions.

The SMEs in the center will communicate directly with the drill site managers on location to optimize performance. Looking ahead, we hope to use the center for predictive analysis. Having the ability to transmit different drilling parameters from the rig to the center will allow us to actually dial in what we believe will be the best combination of direction, rotary and weight-on-bit, and then make adjustments on lateral drilling in real time.

In light of the pending Big Crew Change, the center also will help in the development of organizational capability.

Nabors PACE X-01 rig is working in the Marcellus for Chevron, where the operator puts six to eight wells on a pad with longer horizontals.

In Europe, what challenges need to be overcome to make shale gas technically recoverable and production commercially viable?

Chevron is in the very early stages of exploration in eastern Europe. We have begun exploratory drilling activities in Poland and some in Lithuania. Seismic is under way in Romania, and we will drill there soon. In Ukraine, we recently signed a production-sharing agreement with the government that will put us on the road to operating there. But understanding the rock and its potential and reducing uncertainty are our primary goals in Europe.

At this early stage of exploration, high performance doesn’t necessarily equate to wells being drilled fast. We have value-based well objectives. A hole that is drilled fast but doesn’t allow for full evaluation because of poor hole conditions is of limited use to us. We’re trying to make sure we can drill wells correctly and get all data we can to understand the rock itself.

In Poland, we’ve drilled four vertical wells using a 1,500-hp rig from Polish rig company Exalo. Our future need for rigs will depend on seismic and geologic data we get from exploration, looking at a variety of parameters, including permeability, porosity, brittleness and total organic content.

How is industry working to build trust in local communities throughout Europe and other regions regarding shale development?

Chevron and the industry are working hard to build trust in emerging markets. We’re very committed to sharing the science of shale development and the practices we have in place in the US that ensure safe and environmentally responsible operations. We try to manage this through a two-way dialogue – listening to residents’ concerns and working to help them understand the benefits of natural gas development. We are also working to raise the bar on industry standards and incorporate robust practices into local and regional regulations. We strive for transparency in our operations and support public disclosure of chemicals in hydraulic fracturing.

What challenges do you face in other emerging global markets, such as Argentina and China?

We see expanding opportunities globally to develop natural gas and tight oil from shale. In Argentina, we are in the early phases of a venture with state-owned Yacimientos Petroliferos Fiscales (YPF). We also are doing exploratory work in the underlying shale of the El Trapial concession, which we’ve had since 1999. We have drilled shale gas wells in China, but we are in the very early stages there, as well, as we focus on understanding the rock.

The US Energy Information Agency has indicated we are about to enter a “golden age” of natural gas, with greater and more diversified supplies and reduced energy costs. We believe we can develop these resources safely and responsibly. There are a lot of challenges globally, and we believe we have the experience, technical expertise, values and integrity to do it right. There is always time to do it right.

Drilling is usually a tough activity and it can be such time-consuming. It’s true that each company competes with another. Companies that use environment-friendly technologies will survive from tight competitions.