Opportunities, hurdles line industry’s path to making subsea equipment smarter

Limited sensor selection, lack of formal standards among critical challenges

By Andrew Jaffrey, Cameron Drilling Systems

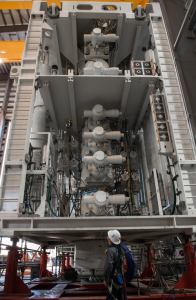

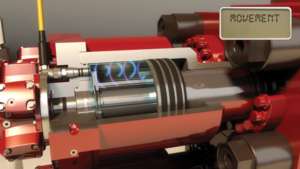

To support increases in safety, reliability and operational economics, equipment used in the oil and gas industry must be made smarter. How is this going to be achieved, e.g. how will original equipment manufacturers (OEM) instrument both old and new equipment? Where are the new sensors going to come from? Condition-based monitoring (CBM) and predictive maintenance systems such as Cameron’s Cognition utilize new sensors fitted to subsea systems. However, the current availability of suitable sensors is extremely limited at a time when increasing instrumentation is being demanded.

What are the challenges and opportunities of developing new sensors and gaining acceptance by end users? What can be done to bring standardization to the process of increasing instrumentation? Design choices will vary by manufacturer, but the industry will benefit from a more coordinated approach, just as it will benefit from a common interface to, and a means of processing and interpreting, the large new stores of data that will result. How is this going to be harnessed to best effect?

The publication of the draft well control rule, “Department of the Interior, Bureau of Safety and Environmental Enforcement, 30 CFR Part 250, Oil and Gas and Sulphur Operations in the Outer Continental Shelf – Blowout Preventer Systems and Well Control; Proposed Rule” confirmed what was already self-evident. Critical subsea equipment, such as blowout preventers (BOP), needs to be made smarter. While the final version of the well control rule (WCR) is still awaited, it is highly unlikely such provisions will be dropped and that there will finally be a formal requirement for the industry to address this issue.

It is an understandable surprise to people outside the industry how few sensors are typically installed on subsea equipment, let alone safety-critical equipment. Lack of feedback in control loops is a reality that would not be acceptable in fields such as aerospace but has been accepted as the norm in subsea oil and gas for far too long.

In part, the present situation is probably a consequence of several factors, including cost, lack of regulatory requirements and lack of industry standard requirements. This situation has to change, and, in particular, the WCR proposes a number of requirements that will necessitate the introduction of sensors to equipment that has essentially been invisible to operators while it is subsea in terms of its performance and health.

Two examples from the draft WCR are: “BSEE should consider promulgating regulations that would require real-time, remote capture of drilling data and BOP function data” and “BSEE should require improvement of the instrumentation on BOP systems so that the functionality and condition of the BOP can be monitored continuously.” There is much more to meeting these goals than simply fitting sensors, but having data sources is clearly the foundation of the overall objectives and will be considered here first.

There are two major tasks to be considered by equipment suppliers when addressing such requirements. There is an opportunity to design fresh solutions for future newbuild deliveries. This is an ideal scenario whereby sensing capabilities can be designed-in from the start and become entirely integral to the equipment.

There is also, however, the challenge of addressing existing equipment. All manufacturers have an installed base of equipment that will need to be upgraded to comply with the new requirements. These two sets of changes, however, may have very different constraints that require two separate solutions, which will, therefore, increase costs. The scope for fitting sensors to existing designs is almost certainly going to be limited by multiple constraints, such as the geometry of the component or subsystem, the placement and accessibility (or otherwise) of the component in the overall system assembly and crucially, the availability of infrastructure to provide a power and communications network for the new data. Overcoming such challenges is a significant task that should not be underestimated.

When considering how to meet new regulatory requirements and, beyond those, the needs of customers for reduced nonproductive time, system reliability is an important consideration. Ironically, when considering the need to install sensors into existing equipment, this can reduce the reliability of the equipment – or lead to a perception that this is the case. New leak paths, new stress points and having to disturb systems by dismantling them to fit sensors are all factors that are expressed as concerns by end users. Cameron has seen this problem first-hand with reluctance from customers to adopt sensors that will provide real-time data. Strategies are needed for handling user perceptions relating to equipment changes. Conducting extensive testing and being transparent with the results of such tests is one approach to addressing client concerns.

The sensors themselves are only one part of the overall situation. Decisions also need to be taken regarding both the cables and the connectors used to link the sensors and their processing networks. The costs of connectors that meet API 16D, by way of example, are typically higher than non-API 16D ones. Many people will correctly argue that API 16D does not apply to an instrumentation network, but clarity in the guidelines for sensors would remove ambiguity over what might be required if monitoring data are regarded as critical to the safe operation of a system. Similarly, should sensor cables be of the PBOF (pressure-balanced oil filled) type or not? Without an agreed approach to such issues, the costs of meeting the new requirements are going to vary significantly between suppliers and potentially lead to disputes over whether a delivered system is acceptable or not.

Some of the challenges of engineering appropriate sensor solutions include: new penetrations (will there be leaks, will the structure be weakened, where can the sensor physically be fitted), high pressures (both hydrostatic and operating), maximizing the data from the minimum number of sensors (creating multifunction sensors that report multiple parameters from a single unit) and certification (how much requalification will be needed after the changes). All of these factors add complication and cost to the task of making equipment smarter.

A fundamental issue at present is that there are relatively few sensor suppliers in the subsea field. While topside equipment manufacturers are reasonably well provided for by the sensing industry, the same cannot be said for the subsea arena. There is a need, therefore, for sensors to be developed to meet the particular demands of the harsh deepwater environment. Such developments take time, can cost significant sums and, if pursued without regard to the benefits of standardization, will lead to multiple solutions of different sizes, using different connectors and implementing different protocols and thereby lead to a lack of interchangeability. This last point is especially true if equipment manufacturers decide to develop sensing solutions in-house, or in exclusive cooperation with third parties. Such an outcome will miss an opportunity to bring beneficial commonality and associated economies of scale to what will, in essence, be commodity items used by the industry.

OEMs have to consider the pros and cons when deciding to develop in-house or seek to buy-in sensor solutions from third parties. A few of the questions that have to be considered when thinking about designing and making sensors include: What standards should be used for accuracy, reliability, repeatability and environmental capability? Similarly, what testing should sensors be subjected to? The same questions will need to be addressed by third-party developers. What happens if everybody arrives at different answers?

A case could be made for a joint industry project (JIP) to look at developing sensors for the industry. All parties will need them, so consolidating the industry’s requirements and developing a set of agreed specifications for a suite of sensors would be a pragmatic way of spreading the risk and costs associated with such an undertaking.

Determining what to instrument, i.e., where to fit sensors, is fundamental to successful monitoring. It might not be necessary, nor possible, to instrument every component or subsystem of interest. Establishing the interdependencies between components to identify which are significant and which can be excluded from monitoring is an important task that is closely tied to the need to consider systems holistically, not simply as subsystems in isolation from each other. In some situations, the condition or performance of one subsystem or component may be inferred from measurements made on an interdependent one. Such opportunities to maximize monitoring value while minimizing monitoring cost are clearly of interest and worth pursuing.

From a cost perspective, many factors need to be accounted for when making systems smarter. These include the sensors themselves, the downtime needed to install and commission sensing systems, the labor to execute the installation and commissioning tasks, machining and other modifications needed on existing equipment, testing and, as necessary, recertifying the upgraded equipment, sustaining engineering, documentation and project management. Exactly where in the supply chain such costs will be borne is going to be a topic of considerable interest to OEMs, drilling contractors and operators, but minimizing the myriad costs associated with these changes is going to be an important common goal and could be assisted by standardization.

The lack of formal standards in this area means that each OEM could implement a bespoke solution for gathering data. The means of transmission, protocol and format by which data are sent from subsea equipment to onshore facilities could, therefore, be many and varied. Once data have been captured, questions then arise as to how they are to be stored, processed, interpreted, shared and regarded. While the first objective is to be able to provide monitoring data to authorities on request, a longer-term goal for OEMs could be leveraging the data to provide predictive maintenance services. For the maximum benefit in developing and tuning predictive maintenance algorithms, data must be stored in a central repository, not distributed across multiple clients and assets. Each OEM should hold a database that is fed with data from all of that OEM’s systems, regardless of client. It is imperative that all data are gathered in one place in order that data from the same components and subsystems (used as common parts of multiple systems) can be compared.

As with any system of this nature, only the OEM will see all the data. Customers would see only information relating to their own systems.

Many companies and interested parties are working on the development of processing tools, such as predictive algorithms. Just as with the sensors, however, a commonly accepted way of doing this is not available, so parallel paths are being followed, and quite different statistical techniques are being applied to the problem of trying to predict when a component failure is likely to occur. A valuable piece of that particular jigsaw puzzle is knowing the baseline behavior of the equipment before it went into service. This is information that is expensive and time-consuming to obtain, however. Other advanced techniques that can monitor and learn the behavior of equipment over time may offer an alternative approach. Such systems are much more concerned with trends than absolute values and, by monitoring the behavior of equipment over time, are able to generate warnings for operators and recommend that investigations be conducted of particular components or subsystems. Such directed maintenance activity is more efficient and cost-effective than relying on time-based schedules, since how equipment has been used is the critical factor, not just how often it has been used (as would be seen from a simple cycle count value). Clearly, 1,000 “easy” cycles does not have the same impact on equipment condition as 1,000 “hard” cycles.

While the need for additional data relating to the performance and health of critical (ideally, all) subsea equipment is not in question, for now it seems that there are many more questions than answers on how best to make equipment smarter. Collaboration, common sense and consultation are going to be required to achieve the most beneficial outcomes.

Cognition is a trademarked term of Cameron.

This article is based on a presentation at the 2015 IADC Advanced Rig Technology Conference, 13-14 October, Amsterdam.