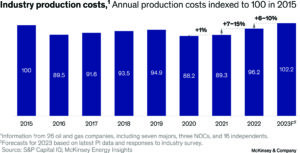

McKinsey warns labor, raw materials may drive more cost spikes this year

After rising by 7-15% in 2022, oil and gas industry costs could increase by an additional 6-10% this year due to labor uncertainties and raw-materials inflation, according to new analysis from McKinsey & Co.

Primary operational tasks, such as regular inspections and maintenance, are becoming more expensive as labor rates grow upwards of 9% and costs for steel casings and tubing rise at 5%. Marine and aviation logistics have been particularly impacted, with fuel costing 20% more on an annual basis. Another contributing factor is food costs – food prices on offshore installations have risen by approximately 10%.

At the same time, lead times continue to stretch out and impact project deliveries. This means that organizations taking measures to secure their supply chain are seeing less inflationary pressures; McKinsey estimates those organizations are saving about 15% on costs. Steps companies can take include revising the organization’s approval gating process or enabling earlier budget approvals, as well as improving the risk-reward ratio in major contracts to incentivize performance and consolidate contract volumes.

White-hot GCC market set to give major boost to land rig demand, supply

Onshore rig demand remained particularly strong in the Gulf Cooperation Council (GCC) countries in Q1 2023, with average rig utilization above 70%, according to a recent analysis by Westwood Global Energy Group. That number compares with a global average of around 50%.

Westwood says it is forecasting utilization to continue growing in the GCC and reach nearly 80% by 2027 – even despite the production cuts announced by OPEC+ in early April. “Growing demand in GCC countries is ultimately driving demand for high-specification drilling rigs, which is expected to lead to a major uplift in rig supply,” the analysis stated. The firms forecasts GCC rig supply will increase by 11% between 2023 and 2027.

Saudi Aramco and ADNOC have each committed to significant rig fleet expansions through Saudi Aramco Nabors Drilling and ADNOC Drilling. In its 2022 financial results, ADNOC Drilling said it expects to increase its rig fleet from 115 now to 142 by the end of 2024. In early March, ADNOC Drilling also announced a contract with China Petroleum Technology & Development Corp to provide 10 newbuild 1,500-hp hybrid power land rigs, with the first to be delivered in Q4 2023.

GOM sale pulls in $264 million in high bids

The US Bureau of Ocean Energy Management held Gulf of Mexico Lease Sale 259 on 29 March, generating $263,801,783 in high bids for 313 tracts covering 1.6 million acres in federal waters of the Gulf of Mexico. A total of 32 companies participated. Compared with total lease sale spend in 2021, this sale saw $72 million more in high bids, and the number of deepwater blocks receiving bids increased by 30%.

“The majors participated in a big way at the lease sale, bidding on 70% of the 313 blocks, and their high bids were 77% of the total,” said Justin Rostant, Principal Research Analyst at Wood Mackenzie. “We expected to see an uptick in the activity as it has been almost 18 months since the last lease sale.”

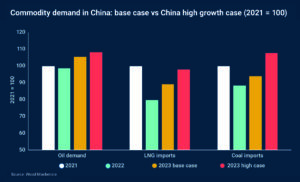

China’s re-opening could reshape short-term commodities supply, pricing significantly

The Chinese economy could grow by as much as 7% in 2023 as the country bounces back from three years of lockdown, according to a new report by Wood Mackenzie. “Faster-than-expected Chinese growth would reshape short-term commodities supply and prices dramatically,” said Massimo Di Odoardo, Vice President, Gas and LNG research.

China’s return to normal mobility is expected to drive a strong recovery in global oil demand, potentially accounting for 1 million bbl/day of the 2.6 million bbl/day gain that Wood Mackenzie expects this year. This could drive Brent crude prices to average $89.40/bbl for 2023. Under its high-case scenario of 7% growth, increased construction activity would drive Chinese oil demand even higher in 2023. In this case, the 1 million bbl/day figure could increase by as much as 400,000 bbl/day and push average oil prices higher by $3-$5/bbl.

focus globally on energy security, with more organizations expecting to boost

investments in oil and gas while slowing growth in areas outside of hydrocarbons.

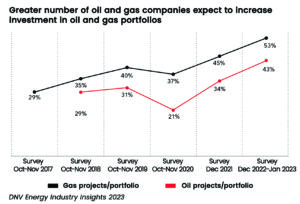

Focus on energy security renews interest in oil and gas investments, DNV survey shows

Energy security concerns outweigh clean and affordable energy on the list of priorities for energy companies globally, as the industry says the energy system will not resolve the energy trilemma in the next decade. The findings come from DNV’s surveys of more than 1,300 senior energy professionals, conducted during December 2022 and January 2023.

Resolving the energy trilemma – delivering secure, clean and affordable energy – is viewed by the energy industry as a long-term goal. Few in the industry (17%) believe the transition will deliver secure, clean and affordable energy in the next decade to all parts of the energy system in their country.

A large group (41%) sees this being achieved in 10-20 years, while another sizable group (32%) believes this outcome of the energy transition will not be realized until well into the 2040s. There is general agreement on this outlook across regions, with only energy professionals in North America being slightly more conservative on the timeline.

Perception is also evolving around profits. In 2022, 52% of oil and gas executives said their organization would make acceptable profits if the oil price averaged $40-50/bbl. For the year ahead, just 39% feel the same. Half of respondents from the oil and gas industry (53%) say that their organization will increase investment in gas in 2023, up 8% year-on-year. Some 43% said they expect to increase investment in oil, up 9%. Oil and gas companies are slowing their shift into areas outside of core hydrocarbons businesses and holding back their focus on decarbonization compared with 2022.

In 2023, more than a third of energy professionals say they expect their organization to increase investment in carbon capture and storage. Six in 10 say their organization is increasing investment in energy efficiency and digitalization, and half the industry is investing in energy storage technologies.

Additionally, three-quarters of the energy industry say that supply chain issues are slowing down the energy transition, while less than half of the industry (44%) say they expect a significant improvement in the availability of goods in 2023. Some 40% of energy companies globally are finding it increasingly difficult to secure reasonably priced finance for projects, although finance is easier to access in North America and Europe.

Analysis: UK windfall tax may intensify drilling rig departures from North Sea

Analysis by Westwood Global Energy Group shows that the outlook for the UK drilling market could change significantly if operators decide their projects are no longer feasible in the current financial climate. The culprit is the UK government’s announcement of a further 10% hike to the UK Energy Profits Levy (EPL) – also known as the windfall tax – which took the headline tax rate for UK oil and gas producers to 75% and delayed the closing date until 2028.

Companies like TotalEnergies, Equinor, Shell and EnQuest have said they plan to reduce UK spending this year, according to an analysis by Teresa Wilkie, Research Director – RigLogix. Some of the planned greenfield projects, such as Ithaca Energy’s West of Shetland Cambo development, may also be in jeopardy of reaching a final investment decision due to the EPL.

There are 5,403 days of UK jackup and semi demand with a 2023 or 2024 start date and already in the tender or pre-tender stage, according to Westwood’s RigLogix. Several of those may be in question now, however, and if canceled could have a knock-on effect on what Westwood says is already anemic North Sea rig demand.

Of the nine warm-stacked rigs in the North Sea, only three have future work in place, and two of those will be outside of the region. Additionally, 15 more rigs could roll off contract by year-end.

Westwood says it has confirmed with several North Sea semi contractors that they are bidding their assets for work in areas such as West Africa, Asia Pacific and the Mediterranean due to paltry demand in region.

In the jackup segment, Ms Wilkie pointed to Valaris’ recent decision to preservation stack the Valaris Viking as a cost-reducing measure. The company said it does not see sufficient work in the region to keep all three of its harsh-environment rigs working due to softening North Sea demand from “the uncertainty created by changes to fiscal policy related to windfall taxes.”

Over the past year, six North Sea jackups have left for work in the Middle East, Mexico and West Africa.