Neptune Energy commences Dugong appraisal drilling

Neptune Energy and its partners announced drilling has commenced on the Dugong appraisal well, located in the Norwegian sector of the North Sea. The well is being drilled by the Deepsea Yantai, a new semisubmersible rig owned by CIMC and operated by Odfjell Drilling.

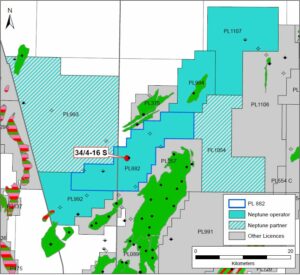

The Neptune-operated Dugong discovery, in Production License 882, was one of the largest discoveries on the Norwegian Continental Shelf in 2020. Neptune estimates recoverable resources to be between 40 million to 120 million barrels of oil equivalent (BOE).

Neptune Energy’s Managing Director in Norway Odin Estensen said: “Thanks to a collaborative approach between Neptune, our license partners and key contractors, we are progressing with the Dugong project at pace and have reached another important milestone.

“This exciting new discovery is located close to existing infrastructure and has the potential to become a new core growth area for Neptune in Norway. The ongoing activity underlines our commitment to investing in the region and to growing our presence in Norway.”

Dugong is located 158 km west of Florø, Norway, in a water depth of 330 m, and is close to the existing production facilities of the Snorre field. The reservoir lies at a depth of 3,250 to 3,400 m.

Neptune Energy’s Director of Subsurface in Norway Steinar Meland said: “The main objective of the appraisal well is to collect the data necessary to help provide certainty related to the reservoir, structure and recoverable resources, so the partnership can optimize the development solution.

“Data from this well will also provide valuable information to help de-risk additional exploration and development opportunities in the license and in the surrounding area.”

Neptune and the Dugong partners plan to drill an exploration well in the license in Q3 2021, targeting the Dugong Tail prospect.

Dugong license partners are Neptune Energy (operator and 45%), Petrolia NOCO (20%), Idemitsu Petroleum Norge (20%) and Concedo (15%).