BOPs: Groundwork being laid today for the needs of tomorrow

Despite challenging market, manufacturers are keeping their focus on meeting requirements of drilling in deeper waters, upcoming regulations

By Stephen Whitfield, Associate Editor

As drillers and operators push into deeper waters, the demand for systems that can handle high-pressure, high-temperature drilling is greater than ever. This means that – even with the COVID-19 pandemic putting unprecedented strains on the drilling business, including both drilling contractors and OEMs – innovations for this critical piece of equipment has not slowed down.

“Our BOP technology is focused on the core concept of helping our customers meet the changing requirements of the industry,” said Matthew Givens, Business Development Manager for Cameron Pressure Control Equipment at Schlumberger.

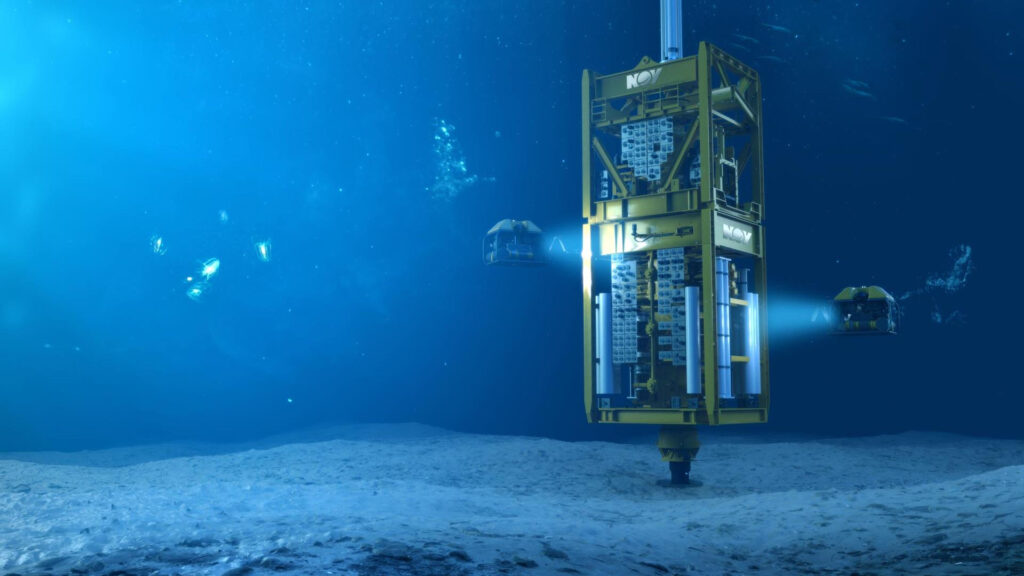

One frontier in BOP development that has been under discussion for years is the 20,000-psi (20K) rated BOP. Some momentum was built around 20K BOPs last year when National Oilwell Varco (NOV) sold two stacks to Transocean for use on a newbuild ultra-deepwater drillship contracted to Chevron in the US Gulf of Mexico. The rig, which is scheduled for delivery next year, will be the first ultra-deepwater floater rated for 20,000-psi operations.

However, that momentum has been slowed this year with the pandemic and subsequent oil price downturn, signaling that the push for 20K may take a backseat in the near future even though manufacturers say they will continue to push for development.

“The oil price and COVID have certainly affected the interest we’ve had in the 20K BOPs,” said Bob Cowan, Product Technical Director – Offshore at NOV. “As the price of oil comes back, we believe we can work our way back. We know there are both operators and contractors looking into these systems.”

Building 20K BOPs

NOV’s 20K BOP is a ram-type model with a drill-through diameter of 18 ¾ in., capable of operating in a maximum water depth of 12,000 ft. It is controlled by NOV’s RCX multiplex control pods, which take in hydraulic supply, electrical power and control data from the rig and distribute pressure through a network of valves to individual stack-mounted functions. The RCX pods are the company’s next generation of control systems and were developed internally, Mr Cowan said. Compared with previous control systems on 15K BOPs, these new pods have a simpler architecture that make them more user friendly. A simplified interface design makes these pods easier to modify during an operation.

Like with previous control systems, the RCX monitors cycle, flow, runtime and time-in-service data from equipment components, and the subsea equipment undergoes constant analysis to detect latent failures. An improvement is also being planned for the new pod design so that, if a failure occurs, it can be retrieved and replaced without pulling a stack.

“Nobody wants stack pulls, so we did everything we could from a design and development perspective to make our equipment as reliable as possible,” Mr Cowan said. While this retrievable feature was not included in the first two stacks built for Transocean, it is something NOV hopes to develop for future orders.

Mr Cowan also noted that the design considerations required for a 20K system were massive compared with previous systems. Because multiple components had to be designed specifically for the 20K system – including a 20K wellhead connector, subsea valve, choke and kill connectors, shear rams, multi rams, pipe rams, riser seals, and choke and kill lines – the company took a holistic perspective to the design philosophy. He described the design approach as something done “on a system level.”

“A 20K BOP is just bigger,” Mr Cowan said. “The wall thickness and inner workings are substantially greater. You’re dealing with heavier bits. There’s always a tradeoff when you’re trying to optimize the weight with your design. A 20K ram is almost double the weight of a 15K ram and 50% bigger in size. This makes for substantially different criteria in the design of a 20K system.”

The company estimated that, to handle a 20K BOP, a rig would likely need a lifting system capable of hoisting 1,500 tons, according to an NOV paper presented at the 2020 IADC/SPE International Drilling Conference. NOV has developed cylinder and single-layer winch hoisting systems capable of lifting 2,000 tons.

Although NOV has been continuing discussions with operators and contractors for the 20K BOP, Mr Cowan acknowledged that market for new orders is quite challenging in the current market. “We are active in pursuing projects with some operators, but we recognize that budgets have been capped and most companies are buckling down and surviving. We expect demand to come back with some additional opportunities in one to three years,” he said.

Improving Shear Rams

At Schlumberger, the primary focus of Cameron’s BOP development has been on designing new parts to fit into its existing product inventory, such as shear rams and pipe rams. Regulatory requirements have been a key driver: As part of its 2016 well control rule, the US Bureau of Safety and Environmental Enforcement (BSEE) banned the use of alternative cutting devices capable of shearing any electric-, wire- or slick-line before closing the BOP.

The rule, which will come into effect on 29 April 2021, requires operators to use shear rams in their surface stacks to shear electric-, wire- and slick-lines under the maximum anticipated surface pressure and seal the wellbore.

In addition, by 1 May 2023, subsea BOPs must also have a mechanism coupled with each shear ram to position the entire pipe within the area of the shearing blade, ensuring that shearing will occur any time the shear rams are activated. This mechanism cannot be another ram BOP or annular preventer, although those can be used during a planned shear.

In advance of the new regulations taking effect, Cameron has been working to validate the capabilities of its Broadshear off-center tool joint shear ram, which was launched in 2016. It is a heavy tubular shear ram designed to shear off-center tool joints, but it was not intended to shear smaller wires, cables and electrical lines. In June, six successful wireline shear tests were conducted on smaller wires with an unnamed drilling contractor and its affiliated operators, according to Cameron.

“We worked with our drilling contractor customers and a number of operators to determine the worst-case cables that they’re going to be using in drilling and completions work, build that list together and validate that these rams – which were never intended to shear these small lines – are actually capable of shearing them,” Mr Givens said.

In addition, last year Cameron commercialized its 13 5/8-in., 10,000-psi dual string interlocking (DSI) shear and seal ram. This technology was also developed in response to the BSEE well control rule; it can shear wirelines, electric lines and slick lines when used around a tubular. Mr Givens noted that the DSI can replace Cameron’s blind shearing rams and interlocking shear rams, adding that it requires 40% less shearing force than the interlocking shear rams.

“One of the limitations on a BOP stack is the amount of force you can provide with a control system,” Mr Givens said. “Effectively, you have a finite amount of mechanical energy that’s derived from the control system to provide the force that pushes the rams together and cuts the pipe. If you can reduce the amount of force needed, then you can make your systems more efficient and more optimized.”

The DSI’s interlocking feature allows for the shearing of wireline and braided cable with zero tension in the line. Further, because they do not use a fold-over shoulder, they can also shear larger-diameter pipe and casing.

The DSI’s performance improvement over the interlocking shear rams was enabled largely by the tweaks Cameron made to the geometry of the ram’s blade. The angles of the blade’s edges were adjusted to increase the contact points of the ram to the pipe.

Cameron modeled the DSI through an internal computer program, which is based on what Mr Givens called an advanced form of finite element analysis, to effectively simulate a physical shearing test. This “virtual shearing” method reduces the time, costs and labor that would’ve been involved in transporting a full-sized BOP to a laboratory. Additionally, the program allowed multiple simulations of the same BOP system to be run and adjustments to be made to the shear ram’s designs to improve efficiency, before running a physical test.

While this virtual shearing model will not replace physical full-sized shear testing, it could allow companies to run more simulations in a shorter time frame, and at lower costs, to improve BOP design, Mr Givens said. He added that while the model is currently only used internally by Cameron to improve equipment design, it could be offered as a service in the future if there is customer demand.

Reconfiguring Control Systems

In July, Baker Hughes completed verification of an updated version of its SeaPrime BOP control system, which was first introduced in 2016. Originally designed for potential use in a 20K BOP stack, the system was recently reconfigured to fit with 15K stacks and existing rigs, which meant reducing its footprint.

“When we first designed SeaPrime, 20K BOPs looked like something companies were going to pursue, so we didn’t necessarily look at what we would need to do to shrink it or fit it on existing stacks. It wasn’t one of our design requirements,” said Bob Judge, Director of Drilling Products at Baker Hughes. “But as the opportunities effectively moved, we had time to ask whether we could make this compatible with existing rigs and future 15K stacks, while still accommodating 20K stacks in the future.”

To reconfigure the control system, the company went back to a blank slate, centering most of its efforts on designing smaller components for the system.

However, Baker Hughes also adopted an “inside-out” design philosophy that differed from the original prototype, where the electrical components were available from the outside of the system, according to Matt Boerlage, Product Director of Control Systems at Baker Hughes. This allowed for greater ease of access for repairs, minimizing the risk of collateral damage to additional components, as well as the need for stack pulls.

This is a key reason why the company has estimated a 40% drop in the total cost of ownership over the lifecycle of the system, compared with the original design.

“In our analysis of the control system, we found that most failure modes are from collateral damage,” Mr Boerlage said. “For any kind of control system from any kind of OEM, you have to remove other components to get access to the components you want to service, and this can be extremely damaging.”

SeaPrime is the first BOP subsea control system to include a re-routable smart redundancy feature that allows drilling to continue if components within a pod fail, according to Baker Hughes. This was achieved by isolating and re-routing hydraulics within the pod.

In June, the Baker Hughes team completed a five-year reliability campaign on SeaPrime using a custom-designed extreme event hydraulic flow loop in Houston. The company collected more than 300 years of field equivalent data, which it said was sufficient to prove the design requirement to exceed 99% availability of the control system.

With the updated control system now available for commercial use, the company has started engaging in conversations about its own 20K BOP design, which Mr Judge said is effectively complete and has passed independent third-party verification. The BOP has an 18 ¾-in. bore diameter and is rated up to 350°F; it comes with six rams and two annular stacks, an approximately 20 ft x 15 ft footprint.

This 20K design has been around since 2012, and there is a prototype available for production. However, market conditions have made it difficult for the company to commercialize the technology. While Mr Judge said he’s optimistic about the long-term future of 20K BOPs, he acknowledged that customer demand for 20K has been a “world of stop and start” in recent years.

“I feel like we’re finally starting to get some traction,” Mr Judge said. “To me, the question is what will global oil demand look like when everything returns back to normal post-COVID? It’s as opaque as I’ve ever seen it. If the demand for oil and gas picks back up to where it was, I think 20K has a really good chance.”

All-Electric BOP

While the major service companies have focused on making improvements to their existing BOPs, one private Norway-based company has been working on a concept that it believes can have a significant impact on drilling operations, should it come to fruition.

Since its establishment in 2012, Electrical Subsea & Drilling (ESD) has been developing a lightweight BOP concept that removes hydraulic equipment from the BOP, replacing it with electrical-mechanical actuators integrated with well barrier utilities and a control system.

The electric BOP system is based on the same topside electronic controls infrastructure, communication systems and back-up controls as existing BOP systems. However, the main differences are that the actuator is run by an electric motor, and subsea batteries take the place of hydraulic accumulators. Eliminating the hydraulic accumulators and hydraulic controls will lead to a significant weight reduction. For a dry BOP, ESD estimates a saving of around 62 tons.

This concept could allow drillers and operators to use rigs built for mid-water operations in deeper waters without significant modifications, according to John Dale, Chief Executive of ESD.

While the concept was initially conceived for subsea BOPs, Mr Dale said land drilling could also see significant savings with this technology. “By taking away the accumulators, the hard piping and the flexible pipes, even for land drilling, you can save up to three truckloads of equipment every time you do a rig move,” Mr Dale said.

ESD has tested prototypes of the key actuator technology for the electrical BOP concept, and the next step is to build a complete prototype of the electrical BOP. The company has already had contact with many operators and drilling companies about developing the system, and it has also submitted four pending quotations for surface BOPs. While discussions have been halted this year due to the COVID-19 pandemic and the oil price crash in recent months, Mr Dale said he remains confident in the industry’s long-term interest in the electrical BOP concept.

He hopes to test the technology on a land rig or at surface on an offshore production platform before moving to subsea testing. DC