Adoption of data infrastructure, data-centric disciplines empowers OEM in digital transformation

Digital journey focuses on developing applications that drive tangible impacts on financial performance

By Gilbert Chahine, National Oilwell Varco

The performance of original equipment manufacturers (OEMs), service companies, drilling contractors and operators alike will be bolstered through adoption of digitization and data-driven technologies, provided that adoption focuses more on the financial outcome rather than the technological outcome. Such adoption, in fact, is rapidly accelerating, with a large pool of open-source technologies and service providers readily accessible to those looking to make a change.

“Digital” must not be a buzzword, though, but rather a meaningful way of impacting cost structures and using data to improve bottom-line – and potentially top-line – financial performance.

What is digital and why now?

National Oilwell Varco (NOV) has undertaken a “digital journey” to implement data-centric disciplines and data infrastructure into the organization, which will empower the company to create and utilize data-driven applications and products that focus on the end result for the customer.

Positive outcomes for customers include reduced total cost of ownership for capital equipment and other assets; drilling performance optimization; and continuous improvement of products and services through an iterative cycle. Many companies spend time defining digital and following the novel technology route. In fact, several key technologies enabling digital have been around for decades: Machine learning and artificial intelligence have existed since the 1950s, early Big Data concepts have been around since the 1940s, and sensors have been around since the late 1800s. Even the Internet of Things has existed since 1999.

Rise and stall of enabling technologies

There has been an almost exponential increase in the types of “enabling” technologies that are driving the digital shift, causing the marketplace to become more and more crowded. This dramatic increase in technology development and innovation led to several years of significant change that has since stalled.

Early backers of technology- and data-focused companies are now asking the hard questions about how such projects will reach financial maturity and begin paying dividends. In many cases, there isn’t an easy answer. This ambiguity has led to an effective stall in the continued development of enabling technologies, which in turn provided an opportunity for NOV, in the oil and gas space, to become an OEM drilling technology enabler.

Although not typical, NOV’s digital journey makes logical sense, as an OEM will understand the equipment and the processes necessary for optimization – and can provide direct integration of the technology.

The real questions

The real questions that oil and gas companies must now ask concern the actual impact of the digital on financials. It has been mentioned that 75% of digital projects fail, but in fact 75% of all startups fail to return the investment to their early investors. The low survival rate is not singular to digital; it is universal.

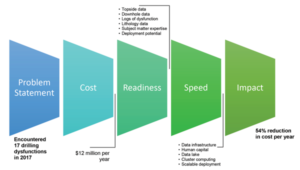

The same logic applies to digital in oil and gas: The value should drive the technology and the novelty, not the other way around. First, a problem statement must be developed, with the company willing to objectively delineate the problems they are experiencing. Cost must then be examined in the context of those problems, followed by the company’s readiness and ability to address them. The company must then ask how quickly a solution can be determined and implemented and, after implementing the solution, assess its impact on the actual enterprise.

By following this thought process, a company can ultimately save capital while compiling lessons learned for future use. It should be noted, however, that the process is not without some complexity, particularly in the third and fourth phases. A real-world example of how a scenario might play out following this logic is presented in Figure 1. Note the amount of data necessary to establish readiness in this scenario, as well as the various factors impacting the speed of implementation. This is not to say that these variables will be the same for every scenario but rather to illustrate what must be taken into consideration and why, as noted, financials must be assessed over a pure technology integration approach.

The enabling OEM

NOV has developed several digital solutions that address distinct customer pains, with “digital” as an operative word defining how the technology enables value creation. It has offered a direct integration of the digital solutions on the equipment, sensors, controls and applications level.

For example, a subsea flexible pipe monitoring solution embeds fiber optics into the construction of the pipes to allow direct sensing of temperature and strain throughout the asset, providing insight into its condition. By understanding the true intra-layer condition of the pipe, customers will be able to defer the need for an ROV inspection service from annually to once every three years or more.

In this scenario, the digital aspect – the data-collecting fiber optics – isn’t the benefit but rather the expedient. Predictive analytics, developed after analysis of data collected from the fiber-optics system, allow the customer to foresee movement in the buoyance modules attached to the pipe; water breach into the outer layers; disturbances in trenching areas; and accumulation of fatigue damage on the pipe’s most critical areas. This is the actual impact and value of “digital” with this technology – a potential 75% reduction in the risk for plugged pipe, and saving approximately $5 million by deferring an inspection. That’s tangible, and something that the industry will understand, appreciate and evolve around.

Another digital technology that’s driving real-world value is the company’s process-automation system. The system has two primary functions: to automate repetitive drilling processes and to act as a platform for the deployment of drilling applications. Process automation addresses the discrepancy between crews’ performance, or at a micro level, the performance of individual drillers, allowing them to perform more consistently and reliably regardless of their experience level. There is both short-term and long-term value in the implementation of a digital solution like this.

Beyond scalability and fleet performance improvements, the system also changes the role of the driller, making him/her less of a button pusher and more of a process manager. This will not only make rigs safer but also will prepare the industry for a shift in talent as younger employees with little or no experience begin to work in the field. Additionally, NOV provides a software development kit that allows developers to create their own applications that can be run within the operating system. Major oil companies, drilling contractors and even universities are already developing custom applications to deploy using the system.

Process automation is only one aspect of being an enabling OEM; the other is an industrial data platform. The platform collects data from any source, including land and offshore rigs, production wells, service equipment and manufacturing facilities. Decades of historical data can be reviewed, and data science can be applied to real-time data streams to identify meaningful patterns and enable intelligent decision making on the state of equipment.

A suite of related technologies complements the data platform, including “edge” devices and a customer-facing data visualization portal. The data platform is cloud-based, acting as the historian component of the system by aggregating the collected data for analysis by data scientists. “Edge” refers to the field device that is connected to the actual equipment or sensor network, collecting operational data, forwarding it to the cloud infrastructure and running edge analytics. The portal allows customers to access real-time, customizable dashboards that provide visual detail on the data streams coming from field equipment.

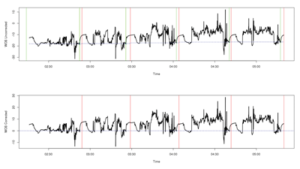

As an enabling OEM, NOV also makes its own applications, such as a stick/slip prevention software that uses automated vibration dampening to mitigate torsional vibration and reduce stick/slip oscillations during drilling operations, to take advantage of digital capabilities. Virtual downhole sensors connect topside data acquired at surface and link it to downhole data, assessing potential scenarios once a decision point is reached and determining a path to the best possible outcome using analytics. Auto-tarring uses data-driven pattern recognition and automatic data transformation to enable real-time weight-on-bit (WOB) correction (Figure 3), reducing the need for a meticulous, time-intensive and manual process.

For equipment dysfunction mitigation, predictive frameworks across several equipment types, including blowout preventers (BOP), top drives, drawworks and mud pumps, enable condition-based maintenance instead of usage-based maintenance. In this scenario, NOV effectively predicts when and where a component will fail before it actually happens, advising on more realistic maintenance schedules and, in extreme cases, preventing significant events, like a subsea BOP stack pull.

Conclusion

As an OEM, NOV has the subject matter expertise and infrastructure to quantify and address equipment-centric problems. On the other hand, drilling contractors and operators will have a strong focus on operational problems, such as drilling dysfunctions, operational equipment failure, and issues arising from challenging lithologies. When the drilling industry attempts to address quantifiable challenges, collaboration becomes a prerequisite, allowing a holistic and effective approach. The notion of “follow the money,” not the “technology,” will lead to a focused and result-oriented industry, which will change the old vendor/client business model to more of a partnership – one where uptime rewards and vertical integration of IT infrastructure, software and operations becomes the new standard. DC

This article is based on a presentation at IADC World Drilling 2018, 19-20 June, Copenhagen, Denmark.