ConocoPhillips announces $12.5 billion capital budget for 2009

E&P spending

Approximately 82% of the ’09 capital program will be allocated to the Exploration and Production (E&P) segment – approximately $10.3 billion, including capitalized interest of $0.5 billion and about $0.8 billion for the company’s contributions to the upstream business venture with EnCana and loans to affiliates.

In North America, the E&P capital program is expected to be approximately $5.2 billion. In the US Lower 48, this includes ongoing development programs in the Permian, San Juan, Williston and Fort Worth basins and the Lobo Trend in South Texas, as well as the development of projects such as the Rockies Express natural gas pipeline.

Spending in Canada will focus on ongoing development programs in the Western Canada gas basins and progression of oil sands projects, primarily those associated with the EnCana business venture.

Spending in Alaska is expected to be primarily directed toward the continued development of fields within the existing Prudhoe Bay and Kuparuk areas, as well as the development of the Alpine satellites on the Western North Slope.

In Europe, Asia, Africa and the Middle East, the E&P capital program is expected to be about $5.1 billion.

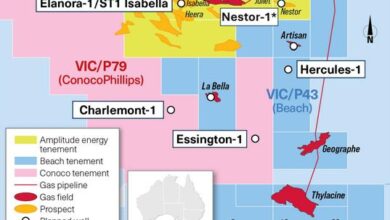

Within the Asia Pacific region, a significant portion of the funds will support the advancement of coalbed methane projects in Australia associated with the Origin Energy joint venture and the continued development of Bohai Bay in China. Funds also will be used for the continued development of the Gumusut field offshore Malaysia, oil and gas reserves in offshore Block B and onshore South Sumatra in Indonesia, and fields offshore Vietnam.

In the North Sea, funding has been allocated for the development of existing and new opportunities in the Greater Ekofisk Area, as well as the continued development of the J-Block fields, Greater Britannia fields, and various Southern North Sea assets.

Spending in the Middle East and Africa is expected to be primarily directed toward the continued development of the Qatargas 3 project in Qatar and the Shah gas field in Abu Dhabi, with the remaining funds supporting several onshore developments in Nigeria, Algeria and Libya.

Spending in the Russia and Caspian Sea region will primarily support the continued development of the Kashagan field in the Caspian Sea.