Post-downturn offshore upcycle shows stability heading into next year

Growth in activity set to level off, but utilization will remain healthy as drilling contractors refrain from adding new rigs to market

By Stephen Whitfield, Senior Editor

Heading into 2025, not only does the global offshore rig market remain in an upcycle, but the upcycle may prove to be sustainable since operators are holding firm to capital discipline and drilling contractors are not adding new supply to the market.

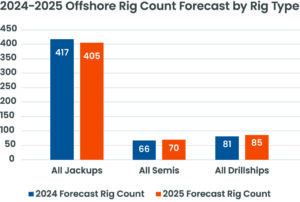

There will be a leveling off of the growth in activity, however. Globally, Westwood Global Energy Group forecasts 417 jackups, 66 semis and 81 drillships by the end of 2024. The jackup count will drop to 405 by the end of 2025, shifting utilization from 94% to 89%. The semi count will go up to 70, with utilization moving from 86% to 89%, due to a combination of cold stacking, rig retirements and a slight rise in demand. The number of working drillships will go up to 85, shifting utilization just slightly upwards from 92% to 94%.

Across each segment, the stagnation in rig count is indicative of an industry that’s hesitant to flood the market with new supply. Cinnamon Edralin, Americas Research Director at Westwood Global Energy Group, noted that this hesitance is likely to continue in the near future: “Demand is still high, and utilization is still high. The market is still strong enough to support continued demand for these projects and fields to be profitable. That’s what makes this upcycle different. There’s a pretty strict limit on adding new supply. The market has so far been very disciplined.”

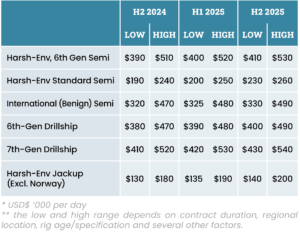

Westwood’s dayrate projections fall within a low and high range depending on contract duration, regional location and rig age/specification. The firm expects dayrates for harsh-environment, sixth-generation semis to range between $390,000-$510,000 in the second half of 2024. That range will rise slightly over the course of 2025 – in the first half of next year, it will be between $400,000-$520,000, and in the second half it will range between $410,000-$530,000. For harsh-environment standard semis, dayrates will average between $190,000-$240,000 in H2 2024, $200,000-$250,000 in H1 2025, and $230,000-$260,000 in H2 2025.

On the drillship side, Westwood forecasts dayrates for sixth-generation drillships will range between $380,000-$470,000 in H2 2024, $390,000-$480,000 in H1 2025 and $400,000-$490,000 in H2 2025. Seventh-generation drillships will range from $410,000-$520,000 in H2 2024, $420,000-$530,000 in H1 2025, and $430,000-$540,000 in H2 2025.

Harsh-environment jackups will average between $130,000-$180,000 in H2 2024, $135,000-$190,000 in H1 2025, and $140,000-$200,000 in H2 2025.

“While we are seeing a softening in the jackup market, our outlook there is still very positive,” said Teresa Wilkie, Director – RigLogix at Westwood Global Energy Group. “This is not a story of doom and gloom. Really, across the three main segments – jackups, semis and drillships – we’ve seen a really steep incline in demand, utilization and dayrates since the downturn ended in 2021. But this year is really the first year where we’ve seen something of a plateau in these three segments. The recovery from the downturn was just a very steep incline, and now in several markets, you’re seeing things level off.”

US Gulf of Mexico

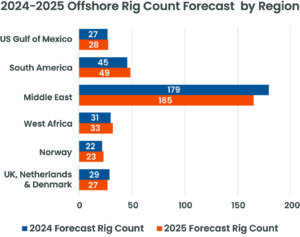

The US Gulf of Mexico (GOM) is about as stable of a region as one could have in the current market. Rig count in this market is expected to remain mostly flat from 2024 to 2025, with Westwood forecasting 27 rigs this year and 28 rigs next year. Utilization will go from 89% in 2024 to 91% in 2025.

Ms Edralin described the GOM as a “very balanced market with a limited number of players.” And with a lack of E&Ps entering the market, that means any potential growth in rig count moving forward will be limited.

“With all the M&A among the operators that we’ve seen in recent years, all we have left are a few supermajors who already have several rigs each, and then a very small handful of smaller independents who really can’t take on more than a couple of rigs apiece due to their size. If everyone’s maxed out, and there’s no more rigs they can take, and there’s no one waiting in the wings to step in and take more rigs, that’s how you reach this balance in the Gulf,” Ms Edralin said.

High-spec drillships continue to be the rig of choice for operators in the region. The GOM continues to be the only region with rigs utilizing 20,000-psi (20k) BOP stacks. Two 20k drillships – Transocean’s Deepwater Titan and Deepwater Atlas – are currently working there, and a third, Stena Evolution, is set to be upgraded to 20k capability in 2026.

The demand for 20k drillships will not grow much over the next couple of years, Ms Edralin said, primarily due to a limited number of fields that need them and the expense of building or upgrading a rig to 20k capabilities. However, operators will favor rigs that have invested in upgrades such as offline standbuilding and advanced automation systems. Rigs with these types of upgrades will generally fetch dayrates at the high end of Westwood’s projection for 2025 – Ms Edralin said dayrates for higher-spec drillships could reach the mid-$500,000s next year. Lower-spec drillships will likely see dayrates in the mid-$400,000s range.

“The higher capabilities that come with these upgrades are generally safety related, things that make the rig safer and make drilling faster. Those are the things operators are looking for, and a lot of that can be done as a retrofit,” she said.

South America

South America is expected to see a slight increase in its offshore rig count over the next year, moving from 45 in 2024 to 49 in 2025. Like in the US GOM, most of the rigs working in South America are floaters – Ms Edralin anticipates an average of only five jackups in the region both this year and next. Utilization will move from 91% this year to 90% next year.

The areas of interest in the region are of no surprise, with Brazil remaining the primary driver of activity. Four rigs are slated to arrive in the country in Q4 2024 to begin drilling campaigns by the end of this year or early next year, and there are tenders out for as many as seven rigs to start work in 2025 or 2026. While most of these tenders will likely go to local contractors, there’s a possibility for non-Brazilian companies to make headway.

“You have more of an advantage when you’re local out there. You don’t have as much of a mobilization fee, and Petrobras typically has a lot of requirements that you have to add on in order to work for them,” Ms Edralin said. “So if you’ve already made those modifications, you’re more competitive. But you’ve got some rig owners putting pressure on their management teams to get some rigs working, especially the companies that have offices there, so there’s a potential to see some increased interest.”

Guyana and Suriname comprise another area of note. Much of the activity in the basin over the past few years has centered on the Guyana side, particularly the Stabroek Block, where ExxonMobil has made more than 30 discoveries since 2015. However, the Suriname side of the basin has also seen some major discoveries this year, and a pickup in activity is likely to proceed over the next few years.

In May, Petronas announced its third successful discovery in Block 52, at the Fusaea-1 exploration well, and it is evaluating results from that well to determine the potential for a tie-in with the Sloanea-1 (discovered in 2020) and Roystonea-1 wells (discovered in 2023). Chevron, which is partnering with QatarEnergy and Suriname NOC Staatsolie in Block 5, will likely begin exploration drilling in the block next year.

Additionally, TotalEnergies plans to start development drilling in Q4 2026 in Block 58. The operator and its partner, APA Corp, is running studies for the Sapakara South and Krabdagu projects, where exploration work confirmed combined recoverable resources close to 700 million barrels. The drilling campaign would include 16 production wells, 14 water injection wells and two gas injection wells.

“Suriname has a lot of potential,” Ms Edralin said. “Some of the attention has been taken by Guyana, but I think we’re starting to see a little bit of a lookback at Suriname. We’ve got at least a few operators that are in some form of discussion to drill several exploratory wells next year,” Ms Edralin said.

Middle East

Outside of the Americas, the Middle East was an area of great interest for the industry heading into 2024, particularly on the jackup side. However, the situation has evolved significantly over the past year, primarily due to things happening in Saudi Arabia.

In January 2024, the Saudi government ordered Saudi Aramco to halt its oil expansion plan and to target a maximum sustained production capacity of 12 million bbl/day, 1 million below the target announced back in 2020. It was initially unclear if that order would lead to a drop in offshore rig capacity, but in early April drilling contractors in the area began confirming various contract suspensions. As of 10 September, Westwood has recorded 28 jackups across eight contractors whose contracts have been suspended.

With the resulting downward trend in activity in Saudi Arabia, Westwood is forecasting the Middle East’s total offshore rig count will reach 179 at year-end 2024 before falling to 165 by year-end 2025. Utilization will also drop from 97% in 2024 to 90% in 2025.

“Saudi Aramco had set that target (of 13 million bbl/day), and they just swallowed up all the extra jackup supply over the course of two years,” Ms Wilkie said. “The jackup market was super tight, and they were one of the major contributors to the recovery in that market coming out of the 2020 downturn. But now they’re just trying to get rid of the capacity they already had because of the change in production target. They can control the global market by letting go of so many rigs.”

The full terms and conditions of each suspension have not been disclosed, but Ms Wilkie said the majority will be for up to one year at either a zero dayrate or a mutually agreed standby rate. The original term of the suspended contracts will automatically be extended for a period equal to the suspension period for each rig, but during the suspension drilling contractors can market their rigs for other work.

This re-contracting has already begun and should continue into 2025. Drilling contractors have also expressed confidence that they can secure work for their suspended rigs in other regions, she added.

“We’re seeing now that the drilling contractors are trying to move their rigs out of the Middle East, and there are these pockets of demand in other parts of the world that are starting to soak these rigs up,” Ms Wilkie said.

India, Latin America, Southeast Asia and West Africa appear to be the prime areas for absorbing excess supply from the Middle East over the next year. However, Ms Wilkie did not rule out the possibility that some operators in these regions may cancel current opportunities at a tender stage and re-tender with the potential of lower dayrates from this new additional supply.

West Africa

Westwood is projecting a slight increase in rig count in West Africa heading into next year – the region will end at 31 rigs in 2024 and go up to 33 rigs in 2025. While that increase is small, when combined with rigs also moving out of the region, utilization is actually anticipated to increase slightly from 85% in 2024 to 87% in 2025. The bulk of demand will come from traditional areas such as Nigeria and Angola.

However, Ms Wilkie said Namibia will be a country to look out for in the near-term future – in particular, the Orange Basin. Off the back of several giant discoveries made there over the past three years, the outlook is promising.

Several operators are expected to take short exploration campaigns from Q4 2024 to Q3 2025, including Chevron (which owns an 80% stake in PEL 82), Galp (which concluded the first phase of exploration in the Mopane field earlier this year), BW Energy (which acquired an interest in PEL 73 in July) and Rhino Resources.

Beyond that, Shell and TotalEnergies have been very active in contracting rigs in Namibia, securing 80% of the firm rig time for Namibian operations since Q3 2021. TotalEnergies is expected to begin exploration and appraisal drilling in its acreage by Q1 2025. It plans to drill the Kokerboom prospect in the PEL-56 exploration license, although no rig has been selected for that program. The operator currently has Vantage Drilling’s Tungsten Explorer drillship booked on a 10-year deal, as well as Odfjell Drilling’s Deepsea Mira drillship on hire until at least January 2025. Both rigs are currently working offshore the Congo but have previously drilled in Namibian waters.

TotalEnergies is also expected to make a final investment decision on Venus in 2025, which will require further drilling of subsea wells to be tied back to an FPSO.

“Once we see TotalEnergies make FID on Venus, and they have their development concept in place, that’s when we’re going to see the real demand moving into the Namibian market,” Ms Wilkie said. “At that point, you’re looking at a huge development with likely dozens of wells, so that means at least one rig working there for multiple years and maybe a couple of other rigs working in parallel depending on what they decide to do. And that’s just one of the fields that’s been discovered.”

Shell has taken a hiatus from its drilling activities in PEL-39 and has not announced any further exploration or appraisal plans – Ms Wilkie said the operator is in the process of “assessing what they’ve found already rather than going in with more drilling.” Even so, there is still significant activity planned for the Orange Basin in the coming year.

In Q4 2024, Chevron will undertake a one-well exploration campaign in PEL-90 with the Odfjell Drilling semisubmersible Deepsea Bollsta, a rig that Shell had previously used in Namibia from December 2022 to April 2024. Rhino Resources will also start a two-well campaign in Q4 2024 with the Noble Venturer drillship. Next year, BW Energy intends to drill two firm wells within the PL003 license. Galp Energia also plans to drill up to four wells around the Mopane Complex.

“There’s been a lot of comparisons of the potential in the Orange Basin with what we’ve seen in Guyana and Suriname,” Ms Wilkie said. “I don’t know if that’s exactly what we’re going to see, but the potential is there because of the size of the discoveries they keep making. Namibia is the area where everyone wants to be. Most of the acreage that was available for licensing is taken now.”

North Sea

The outlook for the UK North Sea is more uncertain in the coming year. While Westwood does not have UK-specific rig count forecasts, it expects rig count in the UK, Netherlands and Denmark will drop from 29 rigs in 2024 to 27 rigs in 2025, shifting utilization from 93% to 89%.

In July the UK elected the Labour government, which has indicated that they aim to ramp up renewable power development and move the country away from oil and gas. This could create an unfavorable environment for E&P activity.

That same month, the Labour government announced it would increase the Energy Profits Levy (EPL) for companies operating in the UK North Sea from 35% to 38% starting 1 November. When added to the 30% corporation tax on profits and a supplementary 10% tax rate, this move would bring the headline rate of tax on oil and gas activities to 78%, among the highest in the world. The EPL increase would last at least through March 2030. The changes would also include scrapping the EPL’s 29% investment allowance, which currently allows companies to offset tax from capital that is re-invested.

The tax increase has, not surprisingly, drawn criticism from industry. In a report released on 2 September, Offshore Energies UK (OEUK) estimated that the move would lead to a reduction in capital investment on the UK Continental Shelf (UKCS) from £14.1 billion in 2025 to £2.3 billion by 2029. Further, 63% of additional oil and gas production that could be sanctioned under the current tax regime would be uneconomic under the new regime, according to the report.

The uncertainty of the new tax regime will likely lead an already declining basin to continue the downward trend in rig activity.

“People don’t want to invest in an area where they don’t know what it’s going to look like a year from now,” Ms Wilkie said. “When you’re planning a new development or an exploration well, you want to know what it’s going to cost. You want clarity on your returns. Because things have been changing so quickly and the Labour government has been suggesting not-so-positive things for the industry, operators are wary of investing in the country. There’s a change in landscape and, at the moment, it’s quite difficult to know whether that landscape’s going to be supportive or not.”

Westwood is also not forecasting much growth in rig count for Norway next year. One rig may be added to push the rig count to 23 in 2025, while utilization will remain full (99% in 2024, potentially 100% in 2025). In fact, Ms Wilkie pointed out that the region had only one rig requirement active (at a pre-tender or tender) as of 9 September – Equinor has a requirement for a semisubmersible to start work in either 2025 or 2026.

She also noted that operators working in Norway have leaned toward contracting higher-spec, sixth-generation semis for longer terms in order to keep them from moving to other markets. This has put upwards pressure on dayrates, with the majority of new contracts awarded in 2024 going for at least $440,000/day and with one as high as $517,000/day, Ms Wilkie said.

“What we’re seeing in Norway is that operators are paying more for assets that they really want to keep,” she said. “Some of these contracts are going out to 2030, or they have options for 2030 and beyond, because they don’t want those rigs leaving for work in other regions. Because many of those rigs are so efficient, they know they can save money in the long term even with higher dayrates.” DC