Despite energy security focus, market to be defined by need for low-cost, low-emissions barrels

Near- and longer-term outlooks still tip toward energy transition strategies as operators remain cautious on oil and gas spending

By Stephen Whitfield, Associate Editor

The E&P industry is likely to remain in a transitional period in the coming year, according to Rystad Energy. E&P companies will continue to exercise significant caution when it comes to spending, even while they are shifting strategies to target more profitable regions that are better understood from a geological perspective. That caution and investment pattern is likely to define the energy sector in 2024.

“We’ve seen some stability, and we don’t expect any major fluctuations in the market, but what we’ve seen over the past couple of years has really brought us to this point where we’re reflecting on what we’ve been doing in this industry,” said Reza Kazmi, Senior Analyst and Product Manager – Supply Chain Research at Rystad, at the 2023 IADC Advanced Rig Technology Conference in Amsterdam on 15 September. “If you look back to the downturn, everyone was cutting down activity and cutting down investments. Now we’re seeing the impact of that.”

Compounding the effects of those reductions in drilling and spending is an increased global focus on energy security, spawned largely by the Russia-Ukraine war. After Russia’s invasion of Ukraine in February 2022, upstream investments in fossil fuels grew by $140 billion over the following year above previously expected levels. Before the war, Rystad had estimated total combined investment in 2022 and 2023 would reach $955 billion, but as the war sparked natural gas shortages and high energy prices, spending over those two years jumped to almost $1.1 trillion. Global upstream oil and gas investment reached $581 billion in 2023, $100 billion more than Rystad’s pre-war estimates.

However, while geopolitical volatility is highlighting the importance of energy security and re-directing governments’ focus to meeting short-term demand, there remains significant uncertainty about the long-term future of fossil fuel demand. Operators still largely remain cautious with investments into oil and gas, with the energy transition still a key driver of their future strategies.

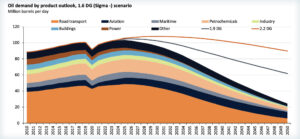

In its “fast transition” scenario, where global warming is limited to 1.6°C in accordance with the 2015 Paris agreement, Rystad forecasts that peak oil will occur around 2026. This fast scenario has become more “realistic,” according to Rystad. There are a couple of reasons for this. First, electric vehicle (EV) adoption is tracking on an exponential adoption curve as barriers like charging infrastructure are being resolved. Rystad estimates that EV sales will continue to accelerate and reach 44% of new passenger vehicles sold globally by 2030 and 83% by 2040.

Second, petrochemical and plastic recycling is estimated to reach 90% by 2050, and green hydrogen – or hydrogen created through renewable electricity – will account for around 70% of feedstock for plastics.

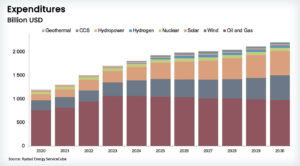

At the same time, investments in renewables will continue to be strengthened by government policies around the world, like the US Inflation Reduction Act and the European Union’s Critical Raw Mineral and Technology Acts. The solar, wind, carbon capture, hydrogen and battery storage markets all stand to benefit from these policies aimed at accelerating low-carbon deployment. This shift in investment will be felt in the hydrocarbon space: Mr Kazmi said that oil and gas will make up 50% of total energy investments by 2030, down from 80% in 2020.

“If you look at the commitments from the E&P majors, about 30% of their budgets are expected to go into low-carbon investments by 2030,” Mr Kazmi said. “There are variations if you look at US-based majors versus European majors – the priorities may shift between companies – but the overall ambition is to gradually increase the share of low-carbon investments toward 2025 and beyond. There’s no lack of clarity about that. Net-zero emissions are on the table, and they’re a key priority for all energy majors playing in the E&P space.”

This uncertainty and caution from E&Ps does not mean the industry is in a bad spot, however. While the Brent crude price has dropped off from the triple-digit figures reached in summer 2022, it has still traded well above the low points seen during the worst of the downturn, and no drastic collapses are anticipated. Rystad forecasts Brent crude price will remain in the high $80s to low $90s in 2024: $89 in Q1 and Q2, $91 in Q3 and $87 in Q4.

This is because, despite the push toward net zero, oil and gas will still remain a necessary part of the energy mix, Aditya Ravi, Senior VP of Upstream Research at Rystad, said at the 2023 IADC Well Control Conference of the Americas in New Orleans, La., on 23 August. He estimated that, in order to meet energy demand in 2030, E&Ps will need to produce 56 million bbl of oil and 2.66 billion cu m of gas from wells that have not been spud as of Q4 2023, according to Rystad’s base case scenario.

So, even though E&Ps are exercising caution, they will continue to spend. Conventional exploration CAPEX is expected to top $56 billion next year. While that is well below the $80 billion in exploration CAPEX seen prior to the 2015 oil price downturn, it does represent the highest total since 2019.

“Drilling is still extremely important,” Mr Ravi said. “The fact that the wells that are out there now will eventually go in decline, while we still need more oil and gas, clearly demonstrates that. We’ll see a significant amount of drilling that’s required, and the supply that comes out of that drilling is going to be critical from a global perspective.”

Still, it’s important for drillers to keep in mind that E&Ps will prioritize capital discipline and sustainability when deciding where their spending goes in the coming years. Mr Ravi noted that operators will likely choose to pursue only “advantaged barrels,” or barrels with a breakeven price below $40 and an emissions intensity of 15 kgCO2e or less.

This focus will not necessarily favor the offshore or onshore sector, he added. However, offshore is well positioned to benefit from the search for advantaged barrels, and Guyana is one example. That country has become a global heavyweight in oil and gas production, with an average breakeven of $28/bbl across all projects and less than $20/bbl for producing projects. By comparison, Mr Ravi said the weighted average breakeven price for the world’s top 20 onshore plays by undeveloped oil reserves is around $40/bbl.

Both Guyana and its neighbor Brazil also feature production with low emissions intensities, around 9 kgCO2e/BOE. US shale’s CO2 emissions intensity is around 12 kgCO2e/BOE.

Rystad said it expects offshore activity to account for 68% of all sanctioned conventional hydrocarbon exploration in 2023 and 2024, up from 40% between 2015-2018 (the last measured period before the pandemic). Offshore development will make up almost half of all sanctioned projects this year and next, compared with 29% from 2015-2018. These investments will be a boon for the offshore services market, with supply chain spending set to grow by $21 billion year-on-year from 2023 to 2024. That would be the highest year-on-year increase seen in a decade.

“Conventional onshore exploration is relatively mature. The sheer number of wells and facilities are higher in comparison to offshore. There’s more flaring, and you typically use diesel to fire up your facilities. All of these things add up to your overall carbon intensity and make it more carbon intensive compared to offshore,” Mr Ravi said. “With offshore, and particularly with deepwater, you’re getting a lot of production out of fewer wells. Your gas is used for fuel or re-injection, if not sold. That’s one of the key reasons why offshore barrels have become the advantaged barrel right now.” DC