Oil & Gas Markets

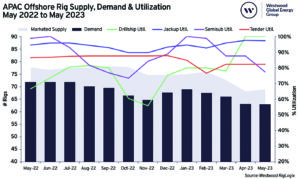

Westwood analysis show rig supply is shrinking in Asia Pacific while dayrates continue to rise

Offshore rigs continue to leave the Asia Pacific (APAC) for other markets, according to recent analysis by Westwood Energy’s Senior Rig Analyst Paul Ezekiel. A total of 14 units have left the region in the past year, although there is one more semi in APAC now compared with the same period last year. In Singapore, only six jackups remain, but they’re all bound for the Persian Gulf.

At the same time, Mr Ezekiel pointed out that utilization and dayrates have increased significantly even though Brent prices dropped by approximately 25% between May 2022 and May 2023.

The lower supply, especially in the jackup and drillship segments, has aided utilization recovery across most rig types over the year. The jackup segment is now close to sold out at 97%, while drillships are fully utilized. Tender-assist utilization dropped by 5% year-on-year, while increased supply and lower demand in the semi segment has resulted in decreased utilization of around 22% compared with a year earlier.

Dayrates are trending upwards, with rigs typically being secured at higher rates than their previous commitments. Jackups have been fixed at as much as $67,000/day more than their previous or current deals, while one drillship was fixed at $240,000/day more than its previous contract. Semis have also witnessed the same trend, with new fixtures being secured at up to $113,000/day more than prior deals.

Meanwhile, between May 2022 and May 2023, Westwood recorded a 10% increase in average rolling jackup dayrates, 28% increase in drillship dayrates and a 7% increase in tender-assist rig dayrates.

Another indicator that market dynamics have changed is reduced contract award activity. Between January 2022 and May 2022, there were 34 contract awards in the APAC region for all rig types. For the same period in 2023, there were only 13 awards. This reduced pace naturally occurs when there is less availability and operators want to lock in rigs on longer deals before prices rise further.

Westwood’s RigLogix currently holds 21 requirements in Southeast Asia or Australia already at a tender stage, totalling over 14 years of potential demand. Of this total, 73% is for jackup campaigns and the remaining tenders are for semis.

Westwood expects current utilization levels to hold steady or rise further in the next 12 months. Dayrates have not plateaued yet, according to Mr Ezekiel, but the pushback on rates from operators will continue. In this environment, operators will be considering further rig-sharing campaigns and more direct negotiations.

Latin America’s natural gas deficit forecast to grow, lead to need for more imports

Wood Mackenzie is forecasting that the gas supply in Latin America will be unable to keep up with demand in the next decade due to challenges with gas development. This will drive the need for expanded imports.

Over the next 10 years, natural gas demand in the region is expected to rise by an average of 1.4% per year, stabilizing at approximately 25 billion cu ft/day. Within the same time frame, gas supply is expected to decline at a rate of 5.6%.

“There are significant challenges with infrastructure restrictions and unfavorable exploration incentives. The likely result will be a steady increase of imports in the region,” said Adrian Lara, Principal Research Analyst, Latin America Upstream Oil and Gas for Wood Mackenzie.

Imports could range between 7 to 12 bcfd by 2035 to meet demand. In 2022, net imports were 4.9 billion cu ft/day, and Wood Mackenzie’s 2023 forecast projects 5.2 billion cu ft/day.

Countries in the mid-continent will be most challenged with gas integration, while countries like Argentina, with its strong reserves, may find opportunities to supply neighboring countries.

“Colombia’s gas production needs to offset declines of at least 300 million cubic feet per day by 2030, or else it will require a higher level of gas imports,” Mr Lara said. “Venezuela has a significant amount of undeveloped gas resources in the Mariscal Sucre offshore assets, estimated at 13.6 trillion cu ft, and some of which could be jointly developed with Trinidad and Tobago. Peru also has discovered undeveloped resources in the Camisea region, accounting for approximately 3.7 trillion cu ft. The question remains which of these resources can become more attractive to operators and whether the infrastructure and market restrictions can be overcome in a timely manner.”

“As many countries shift away from oil and coal in favor of gas to support the energy transition, demand will continue to grow in the next decade,” Mr Lara said. “For Latin America countries, the challenge will be meeting this demand while their own production declines.”

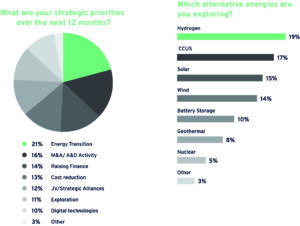

Energy Council’s 2023 Global Industry Survey finds energy transition at top of strategic priorities list

The energy transition topped the list of strategic priorities for the next year, according to an Energy Council survey of more than 500 people. M&A, financing and cost reduction followed as the next priorities in the 2023 Global Industry Survey.

More than 40% of participants in the survey were from oil and gas companies, while other participants came from a mix of consultancy/law firms, non-financial service providers, investors, power/utility companies, and government/NOC.

One question the survey asked was whether participants were expecting any revenue from green initiatives in 2023. Nearly 50% said no, while approximately 35% said less than half of their revenue will come from green initiatives and 10% said they expect more half will be from green initiatives.

When it comes to growth inhibitors for their organizations, the biggest percentage of participants (25%) said it was lack of access to capital, while the next-largest percentage (21%) said regulatory change. Additionally, 15% of people cited talent as an inhibiting factor.

Oil and gas companies were also asked where they were most likely to get their financing from in 2023, and 31% said private equity. The next top answers were debt financing and institutional lenders.

When it comes to exploration, the survey also found that approximately 65% of respondents believe exploration will play a key role in their businesses. That’s an increase of 13% compared with the 2021 survey and up 6% compared with 2022. For the third year in a row, West Africa and South America were the top spots where respondents saw the biggest E&P opportunities.

Looking at the future of oil prices, the biggest percentage of respondents (nearly 60%) said they expect pricing to stay between $75-100, up from about 50% last year. Fewer people this year (13%) said they believe prices will exceed $100, compared with nearly 25% last year.

Europe may need 55 bcm cut in gas demand to avoid risks from supply reductions

Failure to immediately reduce gas demand by 55 billion cu m (bcm) could put Europe at substantial risk from a rebound in Asian demand or reductions in Russian imports, according to McKinsey & Co. A total cessation of Russian imports could reduce Europe’s supply by 25 bcm, and renewed Asian LNG demand could soak up 35 bcm of supply while a colder winter in 2023 could boost demand by 15 bcm.

The research indicates that 57% of EU manufacturers would not be able to further reduce gas consumption while maintaining output over the next two years, indicating that further gas rationing measures could substantially impact the economy. Even if Europe meets targets to reduce gas consumption, volatile gas prices and potential supply disruptions still pose a risk to many economic sectors. McKinsey projects that Europe may need to delay the phase-out of coal, extend the lifetime of nuclear plants and accelerate the expansion of renewable energy sources to reduce reliance on gas as a baseload.

“Our analysis shows there is little bandwidth to further reduce Europe’s gas demand without substantial economic damage,” said Namit Sharma, McKinsey Senior Partner. “The many variables at play will produce significant uncertainty, and Europe’s businesses may need to prepare to mitigate these risks. This may require businesses to consider diversifying their energy sourcing and managing demand, investing in natural gas substitutes or storage, and closely monitoring movements in the energy market.”

Texas Petro Index down amid weak oil and gas pricing, falling value of production

The Texas Petro Index (TPI) declined for the third straight month in April, retreating to 176.9 for the month. This is down from 177.8 in March, but up by 12.3% compared with the April 2022 TPI of 157.6.

Weak pricing for crude oil and natural gas are largely responsible for the decline, with downward pressure on the index coming from prices themselves, as well as the falling value of crude oil and natural gas production. Drilling permits also registered year-over-year negatives for April.

Nominal (unadjusted for inflation) crude oil prices averaged $75.22 for the month. This is down 23% compared with year-ago levels. In real (inflation-adjusted) terms, the April crude oil average is down by nearly 27% year-over-year. Nominal natural gas prices are down a sharp 71% in April compared with year-ago levels, and in real terms were off by close to 73%. That means that, even though production continues to climb, the real value of that production is down by over 20% for crude oil and nearly 60% for natural gas through the first four months of the year.

“Declining prices, followed by a decline in drilling permits, suggests that the rig count will weaken in the coming months,” said Karr Ingham, creator of the TPI analysis. “At some point, employment will follow suit. We can hope that the economy shrugs off a recession and that growing domestic and global demand will begin to stabilize prices and return some optimism to the oil patch in 2023.”