Offshore rig utilization continues upward trend, but not all regions seeing bumps in dayrates yet

Westwood: Global marketed utilization could reach as high as 85% in 2022 if rig attrition continues

By Terry Childs and Alex Middleton, Westwood Global Energy Group

The global offshore rig market has experienced somewhat of a recovery – at least in utilization – in many regions. The price of Brent crude seems to have risen and stabilized at more than $70 over the past several months. Additionally, oil companies and rig owners have mostly managed to navigate through many of the logistical hurdles posed by the COVID-19 pandemic. Drilling programs that had been postponed have now begun or are back on schedule.

As a result, the number of contracted rigs has rebounded, and fleet utilization (jackups, semisubmersibles and drillships) is nearing March 2020 pre-pandemic levels. Dayrates for some rig types in certain regions, such as for US Gulf of Mexico drillships, have risen dramatically. Conversely, dayrates for rigs in other regions have remained stagnant or only risen modestly, as is the case for Southeast Asia jackups.

Drilling contractor consolidation has taken place, and more of that is a given. We even saw Seadrill assigning its Seadrill Partners’ (now called Aquadrill) rig management contracts to four rival companies – a move rarely, if ever, seen in the industry.

On the supply side, attrition is down from 2020, despite rig owners’ (and just about everyone else’s) calls for the pace of retirements to be stepped up. Several stranded newbuild rigs in various Chinese yards have found work, some for drilling and a few others converted to wind installation or other non-drilling modes, but most delivery dates continue to be pushed to the right.

More and more rig owners are modifying rigs with hybrid battery power systems and other equipment and capabilities that will reduce carbon emissions. While the “green” movement is moving forward, where it ultimately ends up is still a bit of an unknown. Most acknowledge that oil and gas will continue as the primary source for global energy needs for the foreseeable future.

This article will look at the current global jackup and floating rig fleets, as well as what we believe 2022 might look like. In addition, we will detail a few key regions for both fleets and provide a global supply, demand and utilization outlook.

The jackup market

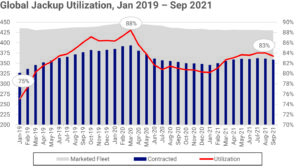

As of September, global marketed jackup utilization stood at 83%, with 359 units contracted/committed out of 430 total units. Utilization has increased by about 4% since the beginning of 2021 and is on its way to rallying back up to the March 2020 pre-pandemic level of 88%. As seen in Figure 1, the marketed jackup supply has declined by 14 units since January 2020, but that has been offset by a 24-rig drop in demand. While every region in the world was – and, in some cases, continues to be – impacted by the COVID-19 pandemic, maintaining utilization in the 80-85% range has been a considerable accomplishment.

As of September, 10 jackups have been removed from the fleet, five fewer than the 15 retired through August in each of the past two years. In a market where rig owners (and others) continue to trumpet the need for large-scale rig attrition, and with 64 cold-stacked units currently in the fleet, there are certainly plenty of retirement candidates.

New jackup deliveries, on the other hand, have been far less eventful in 2021, and the rest of the year will not be any different. Through mid-September, just four new units were delivered, well below the 10 deliveries for the same period in 2020. Construction on the remaining units is largely completed, with estimates being that it will take anywhere from three to six months to get a rig ready.

While 83% utilization is very good in this market, the general rule of thumb is that it takes a rate of 85-90% before a meaningful increase in dayrates will occur. For the current market to reach that level, the number of contracted units would need to increase by between six to 28 units. It could be accomplished solely by a drop in supply, but the more likely scenario is a combination of both increasing demand and decreasing supply.

So far in 2021, 124 new jackup fixtures have resulted in 150 rig years of contract backlog. Of the total, 44 of the deals have been for one year or more, with many of those in the three- to five-year range. In 2020, there were just 52 new fixtures, which totaled 37 rig years of contract backlog, and only five of the 52 fell in the three- to five-year term.

The most notable areas of jackup operations presently are the Middle East (Arabian/Persian Gulf and Red Sea/Gulf of Suez), which is far and away the most active region, with 165 jackups, or 33% of the global fleet. Saudi Aramco and ADNOC Offshore are the dominant operators, with those two having 80 contracted units between them. Marketed utilization in the region is over 88%, with 131 of 148 units working or under contract.

Mexico is another very busy area. In addition to state-run Pemex, a few international operators have also been active in the jackup market here, including Eni, Fieldwood Energy and Hokchi Energy. As of mid-September, there were 49 jackups in the region, 41 of which were marketed. Utilization stood at 85%, with 35 of the 41 under contract.

The number of contracted/committed jackups in Southeast Asia has been interesting to watch since March 2020. Marketed utilization was over 81% in that month but fell to 63% by October 2020. In the past year, however, the number has climbed back up to 78%, and the demand outlook is improving, with a large number of rig requirements on the books. However, with 10 warm-stacked and seven cold-stacked units in the region, dayrates have little chance to improve by any meaningful degree.

The floating rig market

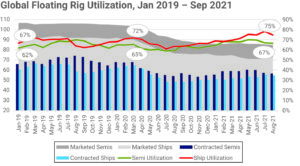

The current floating rig fleet comprises 106 semisubmersibles (85 marketed) and 95 drillships (73 marketed). Marketed fleet utilization as of September was around 71%, with 112 of 158 units working or under contract. Drillship utilization was substantially higher than semis, at 75% versus 67%. Figure 2 shows that drillship utilization fell to 61% in July 2020, but the 14% increase since then represents the largest gain of any rig type.

Twelve floating rigs have been taken out of the fleet to date in 2021 – eight semisubmersibles and four drillships. During the same period in 2020, 18 units were retired. Looking at the cold-stacked rigs, 12 of the 22 drillships are under 10 years of age. Although this does not guarantee a rig’s survival, two recent contract awards for previously cold-stacked units could be making rig owners hesitate on attrition decisions. For semisubmersibles, nine of the 21 cold-stacked units are less than 11 years old, but there are also five units 33 years or older. We believe there will definitely be fewer of those in existence within the next year.

The 85 floating rig fixtures this year have totaled 67 rig years of contract backlog. That number is below the 2020 total of 84.4 backlog years, but it took 116 contract fixtures to reach that. In fact, there have been 26 new deals (39% of the total) for one year or longer signed in 2021. There was the same number for all of 2020 (22% of the total), evidence of the more long-term nature of the market this year.

At present, drillship dayrates for new fixtures in a few regions have increased significantly versus 2020. One of the better-performing regions in 2021 has been the US Gulf of Mexico, especially for drillships. Currently only one of the 18 total units is available, and there are rumors that it will have a long-term contract in place shortly. There are two rigs that will exit the region in the coming months, and there likely will not be any spare inventory to speak of until the first half of 2022.

The range of new dayrates has increased substantially versus 2020. Last year, fixtures ranged from $178,000-$240,000, with just one fixture over $200,000. However, for the first eight months of 2021, the range has been $190,000-$335,000 (excluding 20K BOP fixtures). Outside of one sub-$200,000 and one rate over $300,000, rates were in the $215,000 to $285,000 range.

South America, including Brazil and Guyana/Suriname, is another highly watched region, and for good reason. Marketed rig utilization currently stands at 100%, with all 32 units in the region either contracted or committed for work. In addition, there are currently 10 programs in Brazil with either outstanding tenders or some form of rig inquiry. Rigs located outside Brazil have been bid in several recent tenders, and we expect the fleet there to grow in the next year.

Meanwhile, the 10 working floaters offshore Guyana and Suriname represent a 100% increase since early 2020, when there were only five units. Looking at the current fleet status, it is likely that June 2022 will be the earliest there might be an available rig, but with 14 rig requirements not yet having a rig, there will not be a fleet reduction for the foreseeable future.

Drillship rates in this region have greatly improved, especially on the upper end of the range. In 2020, new fixtures ranged from $170,000-225,000, but that has increased to $170,000-334,000 so far this year.

Another region that has garnered a lot of attention on the floating rig side is Africa. Recent reports note that the west coast, far and away the most mature side of the continent, has seen three major deepwater oil discoveries offshore Namibia, Angola and Cote d’Ivoire. However, the area is also a major stacking locale, with eight cold-stacked floaters sitting in Las Palmas.

Combined marketed drillship and semisubmersible utilization stood at 94% as of mid-September, with 18 of 19 units contracted or committed for work. However, there are a couple of units scheduled to roll off contract later this year, so that would be a hit to the market should they not find other work. At present, there are 14 drilling programs where a rig inquiry or tender has been made, but only two of those have 2021 start dates attached to them. Nevertheless, that amount of work will provide plenty of backlog for the existing fleet. Two units are likely to leave the region and possibly more if any attrition takes place.

Global offshore rig outlook

Looking ahead at potential rig requirements in 2022, RigLogix has over 300 tenders, prospects and expressions of interest estimated to start next year. Asia Pacific represents 33% of potential 2022 drilling demand, followed by Northwest Europe at 22% and Africa at 17%. Prospects are subject to drilling schedules, field development final investment decision dates and so forth.

It is also important to consider that although the firm rig tenders released to the market will require a rig, it may not necessarily result in incremental demand since many future tenders will be fulfilled by rigs already under contract today. In terms of the preferred rig types required to cover next year’s anticipated drilling tenders, 46% of demand is represented by jackups, 29% semisubmersibles and 25% drillships.

As of September, Westwood’s Wildcat database predicts that approximately 67 high-impact (HI) wells have been completed or are being drilled globally. In addition, there is potential for an additional 30 HI wells to be spud in the final quarter of 2021, though many of these will likely be pushed into 2022. As for next year, we currently estimate that 86 HI wells will be drilled. However, this number is expected to increase closer to 100 as more programs are finalized and/or if the wells mentioned above are pushed from this year into next. Focus will remain on the Americas, with North America expected to account for 35% of the 2022 total, followed closely by South America at 28%. Westwood also anticipates a return to deepwater Africa, with the region representing 12% of planned HI wells in 2022.

RigLogix has identified around 85 jackups that we view as potential retirement candidates. We expect close to this number will ultimately be removed from the fleet, but the question is over what time frame. We believe that an additional three to five units will be retired during the remainder of 2021.

For 2022, if we assume a 20% attrition scenario, this would indicate that around 17 jackups will be retired next year. We believe this is a reasonable number, possibly even a bit conservative, given that there were 43 retirements in 2019 and 2020 combined. However, most of this attrition will come from the current cold-stacked inventory, which will not reduce marketed supply. Nevertheless, we do anticipate that as many as five of the 20 projected retirements will come from the marketed fleet.

At present, of the 32 newbuild jackups sitting undelivered in various shipyards, seven have 2021 delivery dates. While it is possible that one or two may make their way into the fleet this year, most will see delivery dates pushed into next year or beyond. In 2022, some deliveries will doubtlessly be made, but we believe it will be limited to five or fewer.

According to our estimates, the average number of contracted jackups in 2022 will increase by around 23 from 2021. Combined with our supply forecast, the result will be a marketed utilization of around 85%, representing a 5% increase from the 80% expected for all of 2021.

Overall, we expect the next year to improve for floating rigs. The number of contracted semis and drillships worldwide will increase, which will result in higher utilization. However, marketed supply will likely increase through a combination of rigs coming out of cold stack and newbuild units that are delivered. Earlier, we referenced the two previously cold-stacked drillships that were recently awarded long-term contracts in the US Gulf of Mexico. While there likely will be more of this, we do not think it will be very many.

Regarding new deliveries, only three of 25 units classed as under construction have contracts in place and definite delivery dates. There are four units, which – if and when they are finished – will go to work for Petrobras. However, those delivery dates continue to be delayed. Otherwise, no newbuild rigs will enter the fleet without a signed contract, so we do not anticipate more than three to five of these coming into service by the end of 2022. As for attrition, we believe that most, if not all, of the retired units will come from the current cold-stacked inventory, which will not impact marketed utilization.

As a result, we believe demand in 2022 will see an average base case increase of 10-15 contracted units, while the best case scenario would see the contracted number go up by 20-25 units. This would result in an increased demand of 122-137 units. That will be offset some by a five- to eight-rig increase in marketed supply. All these numbers combined would result in 2022 marketed utilization ranging from as low as 76% to as high as 85%, the latter representing quite a jump from the current 71%.

As noted in our regional analysis, we believe the areas to watch for drillships will be the Golden Triangle, that being the US Gulf of Mexico, South America and Africa (including south and east coasts). For semisubmersibles, demand in South America will continue, as it will in the North Sea, Southeast Asia and Australia. DC

High-impact (HI) wells are defined as any well with a pre-drill recoverable resource of more than 100 million bbl of oil and/or 1 tcf of gas and post-drill recoverable resource greater than 100 million bbl of oil and/or 1 tcf of gas, as well as any frontier play well.