Optimism rising for jackup outlook as utilization, dayrates both improve

Non-harsh environment floater market is relatively weaker, but positive signs can be found in new contracts signed in 2019

By Linda Hsieh, Editor & Publisher

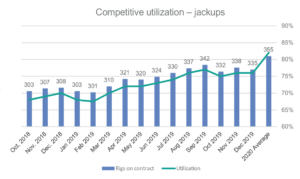

You can’t quite say the outlook for the offshore drilling market is rosy just yet, but some of the gloom is definitely letting up, according to David Carter Shinn, Partner and Head of Bassoe Analytics at Bassoe Offshore. Particularly in the jackup segment, 2020 should be a step above recent years, he said. “We’re much more optimistic than we were a year ago. With respect to jackups, we’re seeing strong growth in the number of rigs on contract and demand.”

Bassoe Analytics, an open-source collaborative rig database, shows that there were around 340 working jackups as of September 2019 – up by 42 units compared with the 298 jackups working in September 2018.

“That doesn’t account for several recent awards in places like Mexico, Qatar, Saudi Arabia and the UAE where the rigs haven’t started their contracts yet. We should move up into the 360s by the end of next year,” Mr Shinn said. By 2021, he added, that number will likely approach 400.

Dayrates for jackups have also risen significantly this year – in some cases, by 50% or more, he added. “A year ago, you would expect to see contract fixtures in the $40,000 to $50,000 range. Now we’re seeing most of the awards coming in around $80,000, up to $100,000. The growth in dayrates is definitely happening and expected to continue. We will probably see dayrates in the $110,000 to $120,000 range by late next year or early 2021.”

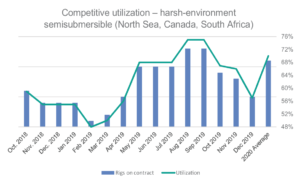

In the floater segment, the harsh-environment sector continues to lead the recovery. Demand in Norway remains strong, and dayrates there have moved beyond $300,000 for the highest-spec rigs. “We expect North Sea as a whole to maintain solid fundamentals in 2020. As the number of rigs on contract increases, availability will decrease, and we’ll see dayrates continue to move up.”

Mr Shinn pointed to the uptake of the newbuild CS60 harsh-environment semis by companies like Northern Drilling, Odfjell Drilling and Transocean – and Awilco Drilling with their two newbuild orders – as positive signs. Earlier this year, Odfjell also announced a management agreement for some of the GM4-D rigs. The Beacon Atlantic, for example, has been contracted to drill six firm wells on the Norwegian Continental Shelf for Neptune Energy Norge beginning in Q4 this year.

Base dayrates for these harsh-environment floaters are likely to be limited to around $325,000 in the near term, he said, but could move into the $350,000 range by 2021. There are approximately 125 working floaters worldwide, 33 of which are harsh-environment semis, according to Bassoe.

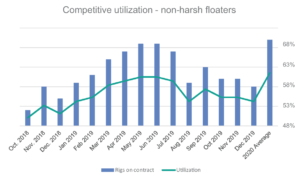

The outlook is less bullish for the rest of the floating rigs, however. “It’s still the weakest part of the market, but I think the fundamentals are better than what they were previously,” he said. “Drillship utilization had been moving up pretty nicely. It got up to nearly 70% in the middle of this year, but then it’s kind of pulled back.”

There are still positive signs for activity. Petrobras, for example, appears to be ramping up its rig count again. In March, Transocean announced it had won 629-day and 550-day contracts for the Ocean Rig Corcovado and Ocean Mykonos ultra-deepwater drillships, respectively. The rigs, which were acquired as part of Transocean’s Ocean Rig transaction in 2018, are expected to commence work in Brazil in November 2019.

In July, Petrobras awarded two-year contracts each to Constellation’s Laguna Star ultra-deepwater drillship and its Alpha Star, Gold Star and Lone Star ultra-deepwater semisubmersibles. This was soon followed by another two-year contract award to Ocyan’s Norbe VI semisubmersible, which can operate in water depths up to 2,400 m.

“The growth in (jackup) dayrates is definitely happening and expected to continue. We will probably see dayrates in the $110,000 to $120,000 range by late next year or early 2021.”

– David Carter Shinn, Bassoe Offshore

On top of these contracts out of Brazil, there have also been a number of short-term contracts awarded in West Africa and the US Gulf of Mexico, Mr Shinn added, noting that he expects non-harsh environment floaters to reach 70% average utilization in 2020.

“We’re beginning to see dayrates moving up, too. Last year, we would expect to see dayrates in the $150,000 to $175,000 range, but now the most recent fixtures have been coming in around $200,000,” he said.

For longer-lead time work, like Diamond Offshore’s contracts with Woodside in Senegal that aren’t scheduled to begin until either late 2020 or even 2022, Mr Shinn estimates the fixtures to be closer to $300,000. “These rates aren’t high enough to say they’re awesome, but they’re definitely moving in the right direction.”

Staying competitive

Although there are still 120 older jackups that are on contract today, Mr Shinn said that operators’ preference for newer units is clear. “Bassoe Analytics shows that 167 years of backlog were secured this year by jackups built after 1999. That compares with 50 years of backlog for rigs built before 2000. So you’ve got three times the amount of backlog for newer rigs.”

The older rigs, built before 2000, will still retain a place in the market, especially if the drilling contractor can provide a high quality of operations. “Being competitive isn’t necessarily the rig that you have – more often it’s about the rig manager and how they minimize downtime, keep efficiency high, keep costs low and ensure safe and environmentally responsible operations,” Mr Shinn said.

Another key part of drilling contractors’ differentiation strategies, he said, is innovating with digital and environmentally focused solutions. In May, Maersk Drilling announced that the Maersk Intrepid would undergo a series of upgrades to convert it to a hybrid rig with low levels of NOx emissions and to add data intelligence to further reduce energy consumption and CO2 emissions.

In August, Diamond announced a new real-time monitoring, data visualization and advanced analytics platform to identify trends and detect anomalies in BOP performance across its rig fleet.

And most recently, Transocean announced the deployment of a hybrid energy storage system onboard the Transocean Spitsbergen, which will reduce CO2 and NOx emissions.

“Innovative solutions to reduce the carbon footprint in offshore drilling, gain efficiency and ensure safer operations will keep coming,” Mr Shinn said, “and they will likely offer the most significant ways for players to differentiate in the industry.” DC

This article includes reporting by DC Contributor Emily Lincke.