Local deepwater rig supplies tighten in US Gulf, Brazil as dayrates inch up

Recovery is slow, but positive momentum is building in key deepwater markets

By Leslie Cook, Wood Mackenzie

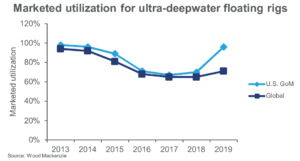

Floating rig backlog grew by over 21 years in Q3 2019, while global utilization finally crossed the 70% line. After four years of aggressive cost cutting and razor-thin returns, it finally appears that drillers are starting to come out of the woods. But despite rising utilization and backlog, pricing remains stubbornly low, most notably in key deepwater regions such as the US Gulf of Mexico (GOM) and Brazil.

The aim of this article is to shed light on these two important deepwater regions and discuss what that can mean for drilling contractors seeking work and operators seeking rigs in 2020.

Local supply tightens in US Gulf of Mexico

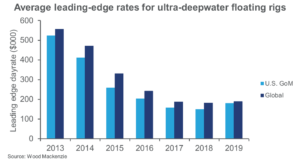

Local idle supply is gone from the US GOM. One year ago, there were nine floating rigs idling along the US shelf, waiting for work to come. Leading-edge dayrates for some of the highest-spec rigs in the world had plummeted to below cash breakeven.

Were it not for the dozen legacy contracts still earning rates above $400,000/day, it’s hard to imagine large drillers such as Transocean, Seadrill and Diamond Offshore sustaining in the region.

What a difference a year makes. In just 12 months, all but one of the idle rigs have gone back to work or been moved out of country. Today, local marketed utilization in the US GOM is nearing 100%. For drilling contractors, this shift in local availability should present opportunities for greater pricing power. And rates have gone up, a little.

Dayrates have come up on recent fixtures by approximately 15% but still remain under $200,000/day, not accounting for any integrated services or enhanced equipment. Examples include: Murphy Oil’s contract for the Deepwater Asgard at $185,000/day, Chevron’s extension of the Pacific Sharav at $175,000/day, and the Equinor and Total contracts for the Pacific Khamsin at $175,000/day and $185,000/day. Other notable contracts with undisclosed rates include two rigs for Kosmos, the Valaris 8503 and the Seadrill West Capricorn. Rates for those two contracts are estimated to be in the mid-$160,000s. Next year, BP will be picking up two of Diamond’s premier ships, the Ocean BlackHornet and the Ocean BlackLion, also at undisclosed rates.

In 2020, six of the 11 rigs that have been operating under high dayrates of more than $400,000 will be rolling off their legacy contracts. Three of those rigs, Diamond Blackships, have already secured follow-on work for half the amount at which they were previously working.

One thing operators and drillers agree on is the importance of keeping hot or operating rigs working. Rigs in the US GOM are the highest-spec non-harsh environment rigs in the world. They maintain some of the best crews and have achieved multiple gains in operating and drilling efficiency. Declines in well demand, coupled with efficiency gains from higher-spec rigs, have resulted in fewer rigs needed. Term contracts have been largely replaced by well-to-well fixtures, resulting in high turnover of operating rigs.

Among the 21 rigs currently operating, half are on short-term well-to-well assignments, so rigs are consistently becoming available, alleviating the need to pull a rig out of warm stack.

Scarcity looms in Brazil rig market

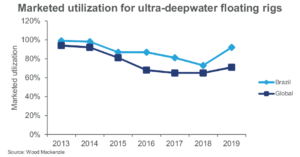

In the blink of an eye, the availability of the ultra-deepwater rig supply in Brazil has disappeared with the July announcement from Petrobras that they have contracted six ultra-deepwater rigs on two-year terms. All six awards went to local drillers who aggressively bid to stay alive. Local utilization skyrocketed from the low 70% to above 90%.

For the local drilling contractors Constellation, Ocyan and PetroServ, multi-rig deals like the Petrobras awards are extremely valuable. With limited experience or presence outside of Brazil, these top three local players struggle to expand beyond their traditional constituency (Petrobras-Brazil).

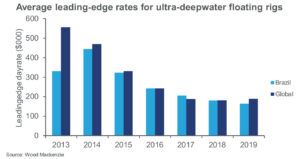

Fortunately for them, they don’t have to just yet. But the domination of Petrobras and desperation of the local players come at the expense of rate. Petrobras secured all six rigs below current ultra-deepwater average rates. After agreeing to bring in two Transocean rigs earlier in the year at rates in the $200,000 range, the local giant was able to get these six rigs at rates ranging from $130,000/day to $160,000/day.

With such scarcity in local supply, IOCs looking to secure rigs at low rates face fewer choices in country than in the US GOM. Operators seeking to pick up rigs in 2020 for short-term well programs will not be faring as well on price.

There are only three rigs coming available in the next 12 months in Brazil: Ocyan’s Delba III, Seadrill’s West Tellus and Constellation’s Amaralina Star. These contractors are in an enviable position to negotiate with operators who are looking to pick up a rig next year without added mobilization costs.

So far this year, multiple contracts for floating rigs have been secured under long-term agreements in Brazil. To date, the consensus has been that drillers are not willing to let rigs go for rates under $200,000/day under long-term agreements, and operators have been content with contracting well to well. But in 2019, Brazil has bucked that trend. Over 70% of the fixtures secured in 2019 were for terms longer than 1.5 years at average dayrates between $200,000 to $215,000. There are indications that Brazil is reaching an inflection point on term versus spot for ultra-deepwater rigs.

Conclusion

In summary, there is some positive momentum building in the deepwater rig sector. Rates are edging up slightly in the US GOM, and term contracts are coming back in Brazil. But nothing worth having comes easy. This recovery is slow and imperfect. Operators are still exercising strong capital discipline while requiring the most highly efficient drilling operations. Demand in 2020 is expected to be flat, and many rigs idle today will remain idle through next year. Drillers are not out of the woods yet, but with the right compass and gear they can stay on the trail…at least another year. DC