Dayrates down, but rig demand remains stable in Middle East

Terrorist activities have brought drilling to standstill in Kurdistan, but development drilling continues strong in majority of the region

By Alex Endress, Editorial Coordinator

While drilling markets remain depressed around the world, the Middle East still stands as a growth market. In this region, demand for drilling rigs appear to be relatively stable and is likely to continue growing in 2017 and beyond. “Few rigs have come off contract without going back to work,” said Niels Espeland, President, International at Grey Wolf Oilfield Services. “The Middle East has been stable throughout the cycles. Due to its unique drivers, there’s always been growth regardless of the global market cycles.”

Indeed, the rig count in the Middle East has averaged 393 from January to August this year. That’s just below the 2014–2015 average of 406 and slightly above the 2013 average of 372, according to the Baker Hughes active rig count.

Dayrates, on the other hand, have not fared as well as rig demand, with both onshore and offshore rig rates seeing downward pressures since 2014. “All operators throughout the Middle East have had the same reaction to their reduced incomes as a result of low oil prices – to squeeze daily rig rates down, varying from 10% to, in some cases, well over 30%,” said Chaher Sakkal, Deputy CEO and Board Member for Dubai-based Sakson Drilling & Oil Services.

Some operators in the Middle East are now calling for “call-out” contracts, Mr Sakkal said. Sakson Drilling is in the process of finalizing such a contract for one of its rigs in Algeria. A call-out contract is a contractual arrangement in which the drilling contractor commits to have, over the course of the contract term, the equipment available whenever it is called for by the operator, taking an agreed notice period into account.

When the rig is operating, the operator pays the contractor for the services provided for in the pre-agreed compensation, which includes a daily rig rate component. While the rig is not working, or stacked, a pre-agreed “daily stacking rate” is paid by the operator to the contractor. The stacking rate covers expenditures such as manpower cost, stack yard rental cost, transportation cost and general overhead like equipment insurance. These are costs the contractor incurs while the rig is on stand-by, waiting to be “called-out” by the operator.

“There is no problem with rebalancing the risks along the drilling chain. However, only a dialogue amongst parties will lead to a sustainable redistribution of risks, to a business concept better adapted to the new dynamics imposed upon our industry by the low oil prices,” Mr Sakkal said.

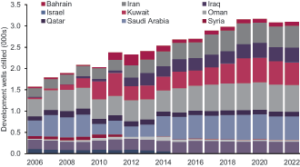

Looking forward to 2017, analysts are forecasting an increase in activity in the Middle East, particularly for development drilling. Douglas-Westwood expects onshore development wells in this region to increase from 2,402 in 2016 to 2,545 in 2017. “The forecasts do not yet take into account effects of an OPEC output cut. We’re holding out for something more concrete before we alter these projections,” Douglas-Westwood Analyst Matt Cook said.

Offshore, the number of development wells in the Middle East is expected to increase from 311 in 2016 to 343 in 2017. “The fields there are big, well-known and quite simple geology to produce from. Many times, development wells are just drilled with no need for exploration drilling due to the high amount of confidence they will produce,” Mr Cook said. On the other hand, exploration wells in the Middle East will be scarce in 2017. “Exploration and appraisal drilling is proportionally low here compared to other regions.”

Effects of OPEC deal uncertain

Despite OPEC’s deal to cut production levels, announced in late September, it is not yet clear how the reductions will be divvied up between the oil cartel’s various members. Thus, it is also unclear how such cuts would affect drilling programs in the Middle East.

“It’s fair to say that countries would need to reduce the scope of their drilling programs in order to meet any sort of production cut, but the extent of how much is all a bit too speculative at the moment,” Mr Cook said. More details about the production cuts are expected to be announced after OPEC’s next meeting on 30 November in Vienna, he said, noting that member countries’ conflicting goals could stand in the way of the production cut agreement.

Regardless of whatever cuts are agreed to, it remains clear that Saudi Arabia will fight to maintain their market share. “At the end of the day, they still have the same objective, which is to eventually get the economy off of total dependence on oil, but in the meantime they are going to need money, so they will need more oil to sell,” said Allen Brooks, Managing Director of investment bank PPHB. “With that in mind, I doubt the deal OPEC has announced will have any sort of meaningful effect on Saudi Arabia’s drilling, one way or the other.”

In fact, the country recently began transitioning some of its power generation from oil to natural gas. “That frees up more oil that they can export to fight for market share,” Mr Brooks said. “This could drive the Saudi rig count up further in the future as the country targets its gas resources. They are actually even targeting some initial exploitation of the shale plays in Saudi Arabia.”

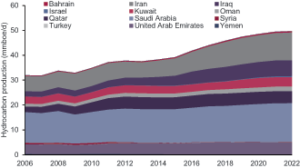

Over in Iran, which appears to be exempt from the OPEC deal, production has risen significantly over the past year – from an average 2.84 million bbl/day in 2015 to 3.65 million bbl/day as of August, according to OPEC’s Monthly Oil Market Report from September. The increase is primarily attributed to international sanctions being lifted in Q1 2016.

Iran’s Ministry of Petroleum recently reported a goal of reaching 4 million bbl/day of production, making a hold on production within OPEC unlikely. “They want to boost production back to where it was prior to the imposition of the sanctions,” Mr Brooks said. Economic sanctions limiting exports of refined petroleum products were imposed on Iran following the 1979 Iranian Revolution and after Iran refused to halt uranium enrichment.

Like Iran and Saudi Arabia, Iraq has also increased its production levels in order to fight for market share, according to Mr Cook. Over the past year, Iraq’s production increased from an average of 3.9 million bbl/day in 2015 to 4.6 million bbl/day as of August, according to the OPEC Secretariat. This indicates that overall production has not been significantly impacted by ISIS activity in the country, likely because most developed fields are located in southern Iraq.

“The main fields that are quite far south around Al Basrah, near the borders with Iran and Kuwait,” Mr Cook said. “There’s been some geographical safeguarding there.”

In the Kurdistan region of Northern Iraq, however, drilling activities have nearly ceased since ISIS gained control over a large portion of the Iraqi territory in 2014. “There are currently fewer than five rigs working in Northern Iraq, down from the 40-50 that were operating in the region during the first half of 2014,” said Erik Houlleberghs, Vice President Corporate Affairs for Sakson Drilling. In August 2014, when ISIS fighters captured the Northern Iraqi city of Mosul, Sakson’s crew members had to make an emergency escape from the rig site, which was operating less than 20 miles from Mosul.

“The rapid advance from ISIS took everybody by surprise,” Mr Houlleberghs said. “One moment the crew was drilling, and the next moment they needed to secure the well, leave all equipment behind and focus on evacuating.

Such evacuation requires very close collaboration with the operator to ensure all personnel are evacuated safely and efficiently. Our emergency response plan came into place and was vitally important in this particular case.”

Mr Sakkal added: “Years of preparations went into this emergency planning, preparing yourselves for the worst and hoping that it’s not going to happen, but if it does, you are prepared.” The rig remains unreachable to this day.

“Given the geopolitical uncertainty, naturally all operators are very hesitant to execute their exploration and/or development programs in the area. So, the demand for drilling rigs in the Kurdistan region of North Iraq is expected to remain sluggish for the foreseeable future,” Mr Houlleberghs said. Before ISIS took control of Mosul, Sakson had five rigs operating in the region. “Currently, Kurdish and federal Iraqi forces, with the support of Western intelligence, are planning a military campaign to push ISIS out of Mosul. When that happens, our rig will become accessible again. The retake of Mosul is an absolute must for the drilling activities to start up again.”

Sakson also has one rig in Egypt, and over the past two years, three of its rigs have been drilling in Algeria. The rigs have been working for Groupement Berkine, a joint venture between Sonatrach and Anadarko Petroleum, and for Groupement Sonatrach-AGIP (GSA), a joint venture between Sonatrach and AGIP, subsidiary of Eni. “Contrary to the Kurdistan region of Northern Iraq, the demand for drilling services in Algeria is stable, even picking up a bit with recent tenders announced by PetroVietnam, Groupement Sonatrach-AGIP, Statoil, Pertamina and Bir el Msana (BMS),” Mr Houlleberghs said. BMS is joint venture between Sonatrach, Petronas and Cepsa.

In addition to operations in Algeria, Sakson has one rig in Turkmenistan working for Dragon Oil. The 2,000-hp land rig is mounted on a platform and is drilling development wells in the Caspian Sea in a water depth of roughly 115 ft. It’s challenging to bring a jackup into the Caspian Sea because they must be disassembled and transported via multiple vehicles, and then be reassembled at the Caspian shoreline.

“To avoid a costly mobilization into the Caspian Sea and to optimize the benefit Dragon Oil’s project could gain from the huge difference in daily rate prices between jackup and land drilling rigs, Dragon Oil and Sakson decided to collaborate on a fairly unusual concept: the fabrication of an offshore platform, on top of which a Sakson land rig was installed,” Mr Houlleberghs explained.

“Oil companies and contractors working closely together lead to creative and innovative solutions – solutions that have a positive impact on the economics of our clients’ projects. A collaborative approach between all players is what the industry needs to get through these difficult times,” Mr Sakkal said.

Thinking far ahead in Middle East

In some parts of the Middle East, onshore drilling operations resemble today’s high-spec offshore environments – with the use of 7,500-psi, high-capacity mud pump capability, 750-ton high-torque top drives, semi-automatic pipe-handling along with 18 ¾-in. 15,000-psi BOPs and associated well control equipment to drill complex high-pressure, high-temperature (HPHT) wells. “You do require long-term contracts for these rigs to make the well construction projects viable for both the contractor and the operator,” said Mr Espeland, who also serves as VP of the IADC International Onshore Division and leads the IADC International Onshore Advisory Panel.

“As a minimum, it takes six to 18 months to get a rig from a stacked position or to deliver a new rig to the market,” he said. “One-well contracts are not viable due to the large capital requirements for equipment and mobilization.” In fact, the large rigs in the Middle East typically drill two to three wells per year.

Grey Wolf Oilfield Services currently has four HPHT rigs in Saudi Arabia. Three are operating on long-term contracts and one was stacked after reaching the end of its contract in 2015. The company also has several rigs working in Kuwait under long-term contracts. In addition, two newbuilds are currently mobilizing to Kuwait after having completed construction and commissioning in Jebel Ali, Dubai. The rigs will commence operations in Q4 2016. “These are large, high-specification, 3,000-hp AC rigs designed for extreme HPHT drilling and similar to the other rigs Grey Wolf operates in Kuwait,” Mr Espeland said.

Further, the company has two HPHT rigs in Kurdistan that were stacked after rolling off contracts at the end of 2015. Political conflict in Northern Iraq left the rigs without additional work. Continued instability in Iraq along with low oil prices has had a negative impact on oil and gas activity in the Kurdistan region, and most operators have reduced or postponed their drilling programs. Grey Wolf is planning to deploy these two rigs elsewhere in the Middle East and North Africa (MENA) region in the near future. Other MENA areas negatively affected by political unrest are Libya, Egypt, Yemen and Syria, Mr Espeland noted.

“Once our idle rigs go back to work, their contracts will be long term, which offers stability,” he said. “Despite the present general reduction in capital spending for field development, there are positive signs for the category of HPHT rigs. The key is to manage costs, planning and foster the drive for continuous improvement in all aspects of operations.”

Factory-style offshore drilling

For offshore rigs, the Middle East drilling market offers slightly more stability than other markets, but competition is still fierce due to a grossly oversupplied market. In many cases, the extreme downward pressure on dayrates is the result of other drilling contractors, rather than E&P operators, driving prices down further, Shelf Drilling CEO David Mullen said. “Competitor companies are offering extremely low dayrates, well below cash breakeven costs, in some cases. You are forced to match it or potentially walk from the deal.”

Typical jackup dayrates in the Middle East ranged between $120,000 and $140,000 in 2014. Since then, rates have fallen by as much as 40%, Mr Mullen said. Still, Shelf Drilling has managed to keep full utilization for its jackups in the Middle East. “The most important thing is to keep your rigs working and to make sure you don’t burn cash whilst working. Working at rates below cash cost is not sustainable.”

The Dubai-based company has a fleet of 36 jackups – 10 of which are under contract in the Middle East. The remainder are located in West Africa, Mediterranean, North Africa, India and Southeast Asia. Shelf Drilling currently has six rigs on five-year development drilling contracts with Saudi Aramco that last into 2018 to 2021. Two other rigs are under three-year development drilling contracts with National Drilling Company in the UAE, and these were brought into the Middle East from Southeast Asia in early 2015. One rig has been working for Maersk Oil in Qatar since December 2013 and will roll off contract by year-end. The rig will then enter a new contract in Bahrain with BAPCO under a six-month contract for development and workover drilling.

To increase operational efficiencies, Shelf Drilling kicked off the “Perfect Execution” concept 18 months ago. The company modeled best practices from its operation in the Gulf of Thailand with the intent to create a performance-based culture that is focused on safe and efficient well delivery.

“In the Gulf of Thailand, we’re able to drill and complete deviated wells to 12,000 ft with three casing strings in less than six days, averaging 5.7 days per well in 2015,” Mr Mullen said. “This is achieved through a combination of batch drilling in a factory style and being able to do a lot of activities offline, such as cementing and wireline logging. However, the key critical element in the success is the collaborative nature in which the E&P operator, drilling contractor and services providers all work together with a common goal of delivering the well safely and in the most efficient way possible.”

The technology enabling offline cementing and wireline operations are equipped below the rig floor. Additionally, the rig is equipped with offline capability above the rig floor that enables the rig to prepare and rack back drill pipe and casing for future operations.

Another example of Perfect Execution applies to workover operations in Saudi Arabia where the rig is equipped with modifications that enable the operator to produce hydrocarbons while working over producing wellheads. In one instance, the operator was able to produce 1.4 million bbl during a workover campaign when traditionally this production would have been shut in, Mr Mullen said. He added that Shelf Drilling’s ultimate goal with the project was to encourage operators to consider more factory-style drilling and performance-based contracts. “We want to move away from traditional dayrate contracts,” he said.

“Factory-style drilling is ideally suited to areas where you have a lot of wells, you have a high degree of repetition and the geology is well understood,” Mr Mullen continued. “The Middle East has many big fields where this should work.”

The company is currently looking for an operator to participate in a pilot study for factory-style offshore drilling in the Middle East. “What really drives the success is the collaborative effort between the E&P operating company, the drilling contractor and the service companies. It’s all about working together to execute exactly in accordance to the plan you’ve mapped out in very fine detail.” DC