Positive rig demand steers 2013 outlook

Analysts optimistic of natural gas rebound as deepwater sustains offshore boom

By Joanne Liou, editorial coordinator

Although the US land rig count has steadily dropped throughout the year since Q1 and US natural gas prices have remained disappointingly weak, analysts are voicing optimism about a recovery in 2013 – looking to upticks in both rig demand and natural gas pricing. The offshore market is providing more signs for a positive outlook as well, powered by the deepwater Golden Triangle and a robust jackup market.

Onshore, the disparity between oil and natural gas prices persisted in 2012, from averages hovering around $96/bbl for oil to $2.50/Mcf for natural gas, according to Guggenheim Securities. “The last 12 months has been about transition,” Michael LaMotte, managing director, head of energy, Guggenheim Securities, said. “In terms of rig count mix, there has been a radical shift away from dry gas into gas liquids and oil.” Rig counts in gassier basins, such as the Haynesville, Marcellus and Barnett, have recorded sharp drops, whereas wetter areas like the Eagle Ford and the Permian Basin have come up significantly.

Offshore, the Golden Triangle – Brazil, the US Gulf of Mexico (GOM) and West Africa – continues to illuminate the deepwater scene, with additional discoveries in East Africa building opportunities for more activity in the coming year. “Five years ago, we didn’t think there was any hydrocarbons of commercial accumulations in East Africa,” James Wicklund, managing director at Credit Suisse, explained. “Anadarko and others have made some significant discoveries in East Africa, which has opened up that area as a brand-new play.”

On the equipment side, improved features in safety, efficiency and capability have ignited a phasing out of older rigs as contractors continue to invest in a fleet of modern newbuilds. “If you take the jackup market, for example, the market has tightened with increased utilization, but nonetheless, we’ve seen more scraping this year than before,” Sven Ziegler, head of offshore research, RS Platou, stated. “One doesn’t really scrap or remove units in an improving market unless the units are very much subcondition.”

Moving into the new year, some analysts believe operators will continue to plan their activities given the disparity between higher oil prices and lower natural gas prices in the US. “Operators will probably be budgeting their drilling programs assuming oil prices will be about $80 and gas prices will be around $3,” John Spears, president, Spears and Associates, said. “They will be very conservative in their price estimates for both those commodities, which will mean that their drilling budgets for the coming year will be very little changed from what they’ll be spending this year.”

Commodity prices

For operators, a main driver of the drilling business is the income of the asset, which in 2012 has been leading them to shift drilling programs across the US away from gas toward oil. Although natural gas prices in 2012 are expected to be down 30% year-over-year – from $4.03/Mcf in 2011 to $2.82/Mcf in 2012 – Guggenheim Securities is considerably more positive on gas prices for 2013, which the firm believes will be north of $5/Mcf at the end of next year with an average of $4.42/Mcf – an increase of 57%.

Mr Spears believes natural gas prices in the US will rise because of the high chances of a more normal winter. The 2011 to 2012 winter was unseasonably warm in much of the US, leading to a lack of demand for natural gas to keep homes and businesses warm. “If we have a normal winter, there will be normal amounts of gas in storage that won’t be depressant on the market like it has been this year,” Mr Spears explained.

“Since rig activity has fallen so far in the number of new gas wells being drilled – it’s fewer than 10,000 wells right now – that puts some constraints on the supply of gas, so we think there will be some increase, small increase, in gas use next year.” The combination of low levels of natural gas drilling activity with the potential increase of gas use is establishing conditions for gas prices to recover some.

While natural gas prices experienced a steady decrease throughout the year, oil prices have fluctuated, going as high as $106/bbl in May to as low as $77.70/bbl in June. “They’ve ranged a lot, but we think they will end up averaging $94.50 this year, which is almost no change from the price we saw last year for spot oil prices,” Mr Spears said. Although prices might continue to fluctuate in the coming year, he expects the average to stay around $95 in 2013. “That kind of volatility is a fact of life in the commodity market,” he stated. “We just have to hold on for the ride.”

The disparity between gas and oil prices recorded in the US also applies to the global market. Crude oil sits around $18 per million Btu, about $108/bbl, while natural gas prices are down between $8.50 and $12 per million Btu ($51 and $72/bbl), according to George Littell, partner at Groppe, Long & Littell. “For the US, the odds are pretty good that the disparity will narrow quite a bit during 2013, but it won’t disappear. Gas prices have been so depressed; they’re liable to come up substantially.” Likewise, more normal weather and stable to declining gas production will help gas prices increase. “Production has been flat in 2012, and we see between a 1% to 2% decline for 2013,” he added.

Rig counts

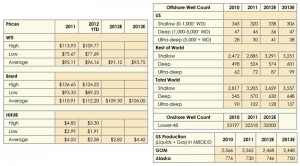

When crude oil prices started declining in early May, the oil rig count in the US started to decline fairly significantly as well, Mr Wicklund of Credit Suisse described. Drilling activity in oil-prone areas onshore US has continued to improve along with oil prices. In Q4 2011, Spears and Associates recorded 1,130 rigs drilling for oil and 880 rigs drilling for gas in the US, whereas they project Q4 2012 to finish with 1,451 rigs for oil and 441 rigs for gas. The overall US rig count for 2012 will be slightly up by 4% from 2011, according to both Credit Suisse and Spears and Associates.

At the end of September, the US land rig count stood at 1,808, down from 1,946 one year ago, according to Baker Hughes’ rotary rig count. The US rig count, including both land and offshore, peaked in Q1 with 2,008 in January and has been falling since then.

While Mr Wicklund expects the US land rig count to be fairly close to flat this year, footage for US land rigs is up 25%, a positive indication for revenue of service companies and drilling contractors. The number of rigs working is not increasing by much, he said, but the jump in total footage shows that rigs are staying on location longer with fewer moves. “We expect the rig count to be flat to down through the rest of this year and to make its usual seasonal drop for the first three or so months into 2013 before we start getting some clarity on commodity prices. (Once) we get more confidence in the outlook in the economy, we’re actually looking at the rig count to rebound in the last eight months of next year.”

In 2013, Spears and Associates expect an average 1,950 land rig count in the US, with about 1,500 dedicated to oil and 450 for gas.

Mr Littell shared similar sentiments in the US rig count outlook. He forecasts gas-directed drilling in 2013 will be down to 300 rigs, while the oil rig count will fall between 1,600 and 1,700 rigs. “My 300 gas-directed rig count assumes there is some recovery in prices,” he said.

The distribution of land rigs drilling for gas versus oil reflects lower gas prices and healthier oil prices. In Q4 2011, the Marcellus rig count was 155, while the Permian rig count was 455; the projected rig count for Q4 2012 is down to 100 in the Marcellus and up to 480 in the Permian, according to Guggenheim Securities.

Globally, the total rig count outside the US is also expected to slightly increase. Mr Wicklund projects a 2.3% increase to about 1,193 rigs, excluding Iraq, in 2012, which falls in line with the 20-year average. “We’re looking at 1% growth in the rig count in 2013, with virtually all that growth being in the offshore, primarily deepwater market,” he said.

Natural gas production

Currently, gas drilling accounts for 25% of rig activity in the US, while it accounted for 32% in 2011 and 70% in 2009. “There has been a huge shift from gas drilling in the US to oil drilling,” Mr Wicklund explained, “starting about three years ago when the shale oil development started moving and gas prices started to drop.

“We have grown oil production by several hundred thousand barrels in each of the last couple of years. It is expected that we will continue to increase our oil production at a faster rate than any other country in the world and continue to do so over the next several years,” he continued. The possibility to reach US energy independence may not be 100%, but going forward, dependence on crude oil is expected to become less and less, he explained.

Pinpointing areas of growth, almost all of the gain in US oil production is from shale oil. North Dakota’s Bakken Shale is leading in the most gains, Mr Spears stated, while liquid from other shales in the mid-continent area and in West Texas are also contributing to the gains in production. On the other hand, results from the Utica Shale in the Ohio and Pennsylvania areas have not been as productive, but “that’s probably a couple of years down the road before we see any material increase in shale oil production from that neck of the woods.”

Despite low natural gas prices, as well as declining gas rig counts, Mr Spears expects US gas production to be up about 4% from 2011. “We’ve seen gas production increase, but next year, we’ll see gas production flatten and expect no change from 2012,” he stated.

Offshore markets

Drilling activity in the GOM continues to improve as the pace of permitting picks up after the 2010 moratorium. For this year, the average rig count offshore will fall around 47 rigs, according to Spears and Associates. Next year’s rig count is projected to grow to 53, a 12% increase. “From a percentage standpoint it looks pretty good, but it’s just a handful of rigs. That’s movement in the right direction,” Mr Spears stated.

The increase in rigs is expected to stem heavily from the deepwater market, as the shallow-water market in the GOM is primarily driven by gas prices. Credit Suisse’s forecast is even more promising for the GOM, as their analyst expects eight to 15 deepwater additions in the next 18 months.

Outside the GOM, the global offshore market continues its ramp-up as well, as reflected in rig counts and newbuild constructions. In 2010, there were approximately 50 drillships worldwide. By the end of 2012, the rig count is expected to more than double to 110, Mr Wicklund said. Further, he expects a sizeable increase in the number of highly capable sixth-generation semisubmersibles from 185 to 220 in 2013. “On a percentage basis, the increase in the number of ultra-deepwater rigs has dwarfed the growth in any other segment of business,” he noted. The bulk of deepwater rigs are set to drill in the Golden Triangle, but East Africa and other parts of South America, such as Suriname, are presenting new prospects for deepwater drilling as well.

Worldwide, utilization rates, as well as dayrates, have been moving in one direction – up. Modern units are being fully utilized, and the utilization rate for jackups is currently at 95%, Mr Ziegler of RS Platou said. “When it comes to floaters, it’s basically the same story – a very high utilization rate, but that’s backed up by a solid backlog. If you take ultra-deepwater dayrates, they moved up around 50%, since they bottomed in 2011,” he stated.

The difference between modern and older assets is becoming more visible. The distinction has always existed; however, the phasing-out of the older jackups has not occurred until this year, Mr Ziegler explained.

With a total fleet of 477 jackups, nearly 300 units were built before 1984, according to RS Platou. “We’re starting to see a removal trend become more and more prevalent,” Mr Ziegler said. “Inevitably the older assets have to be removed. The requirements to drill offshore wells are becoming increasingly complex. That means oil and gas companies need modern, high-specification assets, which are capable of that.”

The uncertainty and less-than-ideal capital markets have made financing difficult and pose an unfavorable environment for speculative rig orders. In September, RS Platou recorded 15 jackups ordered so far in 2012, while 2011 had a total of 45 jackups ordered. In 2013, 46 jackups are expected to be delivered, Mr Ziegler noted.

Considering that the historical growth rate of global jackup demand is close to 2% a year and the market is expecting 10% jackup fleet growth before scrapping and removals in 2013, Mr Ziegler believes either the market will decline and/or quite a few units will be removed.

“This uncertainty combined with lack of financing has really stopped the ordering activity,” he said. “The uncertainty has to be removed before the rigs start to be ordered again. It’s difficult because you have a market right now that is very strong and that should really lead to more orders.”

In 2011, 35 drillships and six semisubmersibles were ordered while 36 drillships and 13 semisubmersibles have been ordered this year, Mr Ziegler said. Of this year’s orders and last year’s, 26 drillships and seven semis will be going to Petrobras’ domestic program, with deliveries scheduled between 2016 and 2019.

Petrobras’ fleet and activity will crowd out international units while creating a competitive international industry of their own, Mr Ziegler said. “They’re the dominant player in Brazil, and the question is whether they can manage the situation for the growth.”

Demand for jackups has been rising and will most likely continue to rise from the Southeast Asia and Middle East regions, Mr Ziegler noted.

Mr LaMotte of Guggenheim Securities is very bullish on deepwater activity in 2013 and 2014. For instance, in the GOM, he believes exploration and development spending will double between 2012 and 2014, due to a near tripling of exploration expenditures. By the end of 2014, Mr LaMotte expects the deepwater (3,000 ft or more) rig count to be at 56, up from the current working count of 30.

Exploration successes in the presalt horizons offshore Angola and the east coast of Africa are also expected to stimulate demand for floating rigs. “From a technical standpoint, the industry is dealing with the dual challenges of extreme drilling depths and extreme water depths in many of the emerging provinces,” Mr LaMotte noted. “However, the combination of high oil and LNG prices and the size of the resources discovered make for very competitive economics.”

Beyond deepwater, “the number of hot spots for ultra-deepwater is increasing globally,” Mr Ziegler stated. “Also, there’s fragmentation of the number of oil and gas companies, not only the majors, but there’s also fragmentation on the rig owner side.”

Shale plays outside the US

The unconventional resource potential has been identified but has not been investigated thoroughly in many places, such as China, Argentina, Poland, Australia and Saudi Arabia, which are considered the top five non-North American resource spaces, according to Mr LaMotte. “Over the long term, we are bullish on the shale markets of Saudi Arabia, Argentina and China, as these countries have tremendous needs for domestically sourced gas; however, development is likely to be much slower than it was in the US, as none of these countries have the ecosystem of the US to foster rapid exploitation – private landownership, a large and pre-existing oil services industry and open capital markets.”

Over the last few years, natural gas has become a far more important commodity internationally, due to robust demand, strong prices and accessibility, and it is a key theme in the coming year for the Middle East and Asia Pacific regions. From an oil services standpoint, Saudi Arabia and Australia are the key markets to watch, Mr LaMotte told Drilling Contractor. As Saudi Aramco tenders for more rigs as part of its strategy to spend $9 billion between 2011 and 2016 to add 50 Tcf of new, non-associated gas reserves and 5 Bcf/day of production, the ramp-up in tight- and shale-gas activity is comparable to the early days of the crude capacity experienced in 2004 to 2009, he stated in a September report about Saudi Arabia.

About half of the projected production has been identified and will come from the Karan, Arabiyah and Habsah fields. According to Guggenheim Securities’ report, Mr LaMotte expects the other half to come from the tight reservoirs of the deep Khuff, from the South Rub al Khali tight-gas discovery near the Shaybah field, and shale gas in the northwest province. Saudi Aramco had five rigs exploring for shale gas at the start of 2012 and has increased activity to about 12 rigs. The report states that the company is in the process of tendering for 20 rigs for 2013 and is considering an additional 20 rigs. By early 2014, total rig count in Saudi Arabia could reach 170, up from about 130 rigs presently working.

As Australia’s offshore LNG projects ramp up in the next few years, Mr LaMotte expects the demand for floaters to increase from 11 in 2012 to 25 in 2014. He also noted that the coal bed methane to liquefied natural gas projects in Queensland, Australia, will require at least 100 more rigs; however, the shallow nature of these wells suggest that the demand should be met by local contractors. “These are simple wells,” Mr LaMotte said. “It is truly post-hole drilling, so the technological differentiation offered by Western contractors is not a source of competitive advantage.”

The Vaca Muerta shale in Argentina presents a large amount of potential in a working environment without the typical challenges other regions face. “Surface rights issues are not really a problem, and they have an existing services infrastructure,” Mr LaMotte stated. “However, supply chain issues – many of which are exacerbated by government policy – are likely to be Argentina’s greatest impediment to the development of the Vaca Muerta.” In places such as Europe, where governments control the mineral rights and property owners control surface rights, he expects little progress to be made in the coming year.

In China, Shell expects to start its first commercial shale gas development program in a couple of years, according to Mr Spears of Spears and Associates. The company’s joint venture (JV) with China National Petroleum Corp (CNPC) has initiated exploration and appraisal drilling and in two year expects to start development drilling, he said. Hess also has announced a JV with CNPC for shale exploration. “The shale gas side of things is moving right along, and China has a prospect for being an shale oil area as well,” Mr Spears said.

Across the board, markets outside North America still lack the service industry and infrastructure necessary for large-scale unconventional development. “Rigs and pressure-pumping equipment are probably the biggest two items that, from a supply standpoint, seem to be lacking,” Mr Spears said.

Another key ingredient to move forward is the market price for gas. Oftentimes, whether the government will allow operators to realize a market price for the gas they produce is negotiated between an operator and the government, Mr Spears explained.

Since most unconventional shale drilling is in the exploration and appraisal stage, Mr Spears does not expect major progress to be made until operators understand the technical characteristics of the field and can use that to then consider commercial development, perhaps by the end of 2013.

E&P spending

US operators will spend close to $150 billion this year to drill and complete wells onshore US, and next year the amount will be around $147 billion, Mr Spears said. He believes spending will be less as a result of projected lower well costs.

Many analysts agree that deepwater exploration will continue to attract the most E&P dollars. Now that companies are breaking ground in Africa and Latin America, exploration has really become worldwide, Mr Littell said.

Mr LaMotte believes deepwater exploration will drive the bulk of spending growth next year and will increase to 30% in 2013. “Deepwater development is not far behind, with an 18% to 20% increase,” he said. He expects spending on unconventionals in the US to be modestly down next year, as a result of lower average rig counts and the deflationary effects of lower frac cost and lower rig rates. However, productivity gains suggests that completions volumes could be relatively flat. “The total number of completions is likely to be flat to down within 3%,” he said.

Well costs

Onshore well costs are falling, with fracturing costs in particular helping to keep prices down. The average cost of drilling a well has fallen about 5%, and the cost of drilling is expected to continue to decline for about four more quarters before possibly stabilizing, Mr Spears said. “Much of that decrease in well cost has come about because of the lower cost of fracking a well. For the next three to four quarters, we’ll probably see land rig rates get softer,” he said, adding that it would not come as a surprise if rig rates were down about 4% in 2013.

“Frac costs were rising right up until January, and since then, they’ve dropped sharply. As a whole, we’ll see frac cost down about 15%, but there are instances we heard about where frac costs have fallen as much as 30%,” Mr Spears stated. Further down the road, Mr Spears believes it will be 2014 before the market is in a decent shape to support any increase in costs.

Conclusion

Analysts foresee companies taking caution in 2013. Mr Spears forecasts most of the capital spending by drilling contractors will be toward maintenance and replacement-type purposes until 2014 or beyond.

Mr LaMotte believes more consolidation is needed in the onshore US services market, moving from a phase that addressed a capacity shortage in services through the construction of rigs.

“We’ve been through the period of ‘shock and awe,’ during which the industry tossed hundreds of billions of dollars at the near-simultaneous identification and early development of the largest unconventional gas and liquids plays in the Lower 48; however, with more than 70% of the nation’s resource potential in a more mature ‘standardization’ phase, we believe E&P companies will become increasingly focused on the productivity of their spending as opposed to just spending more,” Mr LaMotte explained. “It will require the industry to focus on reducing the cost of services delivery, on efficiency and on developing technologies that improve the recovery factors.”

Lessons learned along the way and the changing scene of the industry is raising expectations. “Operating offshore isn’t just about building the equipment and showing up either; success is now about demonstrating operational excellence through the training and retention of personnel, health, safety and environmental practices, and globalizing best practices. It’s going to require – quite simply – working smarter.”