The great migration to wet plays

Liquids-rich US shales shine as industry sweet spot

By Katie Mazerov, contributing editor

The paradigm has shifted. US land rigs that just two years ago were at work in prolific shale gas plays are on the move, delivering an oil and liquids boom that has yet to be fully quantified. Whatever trends are occurring globally, US shales are the big story for 2012, driven by new play discoveries, technology advances and favorable pricing. Drilling contractors are seeing steady and rising dayrates and high utilization as operators shift their focus from the dry gas basins and set their sights on liquids-rich regions, such as the Bakken, Eagle Ford and the Niobrara, along with emerging plays believed to hold huge reserves.

“There’s a boom going on,” said professor Jeremy Boak, director of the Center for Oil Shale Technology and Research and chair of the Oil Shale Committee’s Energy Minerals Division at the Colorado School of Mines. “There are three or four significant oil-producing plays in the US today and a huge amount of excitement, with companies moving rigs as fast as they can. While gas is much easier to get out of impermeable rock, the technology in multi-stage fracturing has advanced to the point that we can now produce oil and wet gas in these areas. In many regions, such as the Bakken, the best-producing horizons are in silty rocks, siltstones and dolomites that are interbedded in the shale.”

Since the industry cracked the shale oil code in the Bakken in 1999, production in the play has increased 55% per year, a phenomenal growth rate for a new resource, Dr Boak noted. “Potential for the Bakken is predicted to reach one million bbls per day by 2019, just 20 years after production started. It took the US 65 years to reach that number in conventional oil production and 40 years for the Canadian oil sands to achieve that.”

Meanwhile, there is a debate among some geologists over what to call the oil produced from shale. As the Bakken play developed, the industry called it shale oil, a term used since the early 1900s to refer to organic-rich shale that requires heating to produce oil. However, Dr Boak prefers to call shale containing liquid hydrocarbons “oil-bearing shale,” and the product, “shale-hosted oil.”

Aside from increased production in the Eagle Ford and Niobrara plays, operators such as Chesapeake Energy are ramping up activity in the newer hot plays, including the Utica, underlying much of eastern Ohio, and the Mississippi Lime, or Mississippi Chat, spanning across northern Oklahoma and southern Kansas. The Tuscaloosa Marine play, a deep (10,000 to 15,000 ft) formation in central Louisiana and southwest Mississippi is believed to hold seven billion bbls of recoverable oil, an estimate made as far back as 1997, Dr Boak noted.

Despite concerns about hydrogen sulfide (sour gas) and high levels of produced water, particularly in the Tuscaloosa, there are no signs of a slowdown, he said. “Oil prices right now are high enough that an operator can spend a good deal of money going after the oil.”

Rates Steady and Rising

Nomac Drilling, an affiliate of Chesapeake Energy, has 113 marketable rigs with 110 active in the Eagle Ford, the Mid-Continent (including the Granite Wash, Cleveland, Tonkawa and Mississippi Lime), the Barnett, the Haynesville, the Bakken, the Marcellus and the Utica. In the Utica, Chesapeake plans to increase the rig count to 20 by year-end and to 30 by year-end 2014.

“Like most contractors, we are experiencing migration from dry gas plays to wet plays,” said Jay Minmier, Nomac president. “Fortunately, due to our relationship with Chesapeake, these changes do not impact Nomac’s utilization, only its deployments.”

Mr Minmier reports that rig rates have remained favorably steady since Q3 2011 and currently range from $18,500 in the Barnett to $29,750 in the Bakken. “Nomac’s rates are market-based so we aren’t immune to price fluctuations. We do believe that, to the extent wet plays can absorb the capacity leaving the dry plays, overall pricing will remain stable, although weakness is expected in certain areas like the Barnett and Haynesville.”

All of Nomac’s marketable rigs are either working or undergoing upgrades for upcoming jobs. “Our utilization has historically stayed between 95% and 100%, and we will be fully employed again once the upgrades are fielded,” Mr Minmier said. Twelve new rigs are slated for delivery through April 2013, with two 1,500-hp rigs for oil drilling in the Powder River, Wyo., region and 10 1,200-hp rigs for the Utica. Dual-fuel systems are being added to the majority of its fleet to allow the rigs to run on compressed natural gas or liquefied natural gas, as well as diesel.

“Many of our existing rigs and all our newbuilds have walking systems to facilitate efficient, slot-to-slot moves on a single pad,” Mr Minmier said. “Our newest rigs also include certain innovations to reduce location-to-location move times. We are focusing heavily on mobilization times as this portion of the well manufacturing process has become much more visible due to faster drilling times.”

From a technology perspective, the company has not been limited on lateral lengths. “To the extent that some laterals are shorter than preferred, it is almost always a leasing issue,” he added.

Nomac is implementing an accelerated development program for drillers, directional drillers and rig managers aimed at reducing the time required to train competent rig leaders by 60% over traditional methods, Mr Minmier noted. The program is targeted to young, motivated professionals with no industry experience.

Big E Drilling has shifted its fleet from the Haynesville to the Eagle Ford play, a move president and CEO Lyle Eastham said was justified given the current pricing environment. “We decided to go where the liquids are,” Mr Eastham said. “There could conservatively be 10 to 15 years of drilling in the Eagle Ford. When we moved into the play three years ago, there were only 30 rigs. Now there are nearly 240 operating.”

Today, the company’s five rigs are all operating in the Eagle Ford, including one the company built 18 months ago.

“We have added a lot of automation equipment, including top drives, catwalks, blowout preventer lifts and rig walking systems, to our rigs, which have enhanced safety and efficiency and aided in the contracts we’ve been awarded,” Mr Eastham continued. The fleet is designed for horizontal and directional drilling at depths from 15,000 to 25,000 ft, with dayrates in the mid-$20,000s.

But he also gives considerable credit to the company’s stable work force. “All our pushers have a minimum 20 years of experience, and we have a lot of 30-year employees with little turnover. We keep our rigs busy, and run a safe, efficient operation.”

Walking the Walk

Newbuild activity is also healthy in North America, with many of the major companies ramping up their fleets with efficient, highly mobile rigs suited for shale wells and pad drilling. Calgary-based Precision Drilling delivered 18 new rigs in 2011 and has contracts on 33 more to be delivered by the end of 2012 in North America.

“These are state-of-the-art, tier one rigs that are equipped with pipe-handling systems and integrated top drives, and all run range three (45-ft) tubulars. They are designed with a small footprint in mind,” said Doug Evasiuk, senior vice president of sales and marketing, North America for Precision.

“Pad drilling continues to be attractive to operators wanting to minimize the environmental footprint, limit truck traffic and reduce move times,” he said. “All the major companies are building rigs that have the capability to walk from wellbore to wellbore to eliminate trucks. With our Canadian roots, we understand how to do that, especially for cold-weather environments. All our rigs going forward will have walking systems or the capability to accommodate them.”

Precision’s newbuilds for the US market include seven 1,200-hp rigs and 17 1,500-hp models. All are AC Super Triple rigs. For Canada, where wells are generally shallower, the bulk of the rigs are the Precision Super Single design. The Super Single rigs also run range three tubulars and have fully automated pipe-handling systems.

“In Canada, because we have a compressed drilling season and have to be very efficient, we’ve always been focused on highly mobile rigs,” Mr Evasiuk continued. “Over the years, technology has enabled operators to drill considerably faster. Wells now are taking far less time than they did in the past, meaning we’re moving a lot more than we once did. When we’re moving, we’re not drilling the well, and that translates to nonproductive time, which is costly for our customers.”

Dayrates have been solid, particularly in the liquid plays. Precision began shifting from the dry gas plays to the liquids last year, a trend that will continue, Mr Evasiuk said. The company’s large presence in the Haynesville has shrunk from the peak level of 26 rigs to just three. “There has been enough activity in the liquids plays to absorb rigs coming out of the dry gas markets.”

US utilization is above the industry average. Of the company’s 150 US rigs, 104 are operating in all the major plays, including the Bakken, Eagle Ford, West Texas, Mississippi Lime and Tuscaloosa. Precision has yet to enter the Utica but has been approached by operators in that region.

As the largest drilling contractor in Canada, Precision has operations in every major basin, notably the Cardium, Viking, Duvernay, Canadian Bakken, oil sands and heavy oil. Utilization in February was around 85% but has recently declined due to the spring “break-up,” which occurs late in Q1 and can carry into Q2. The thawing makes transporting equipment difficult. Traditionally, 35% to 40% of drilling activity in Canada occurs in the winter months.

From a technology standpoint, Mr Evasiuk believes the push for longer laterals will be achieved by further development of completion designs. “The industry has the capability to go out a lot farther, but it really becomes an economic decision by the operator to determine what the length of the horizontal section should be.”

Outside North America, Precision has two rigs operating in Villahermosa, Mexico, and three in Saudi Arabia. All are 3,000-hp rigs for deeper wells.

Increasing Automation

Nabors Drilling has seen an uptick in US land rig utilization, primarily in the 1,000- to 1,500-hp size being deployed in most of the shale plays, said Denny Smith, director of corporate development. “Overall, US land rig utilization is around 80%, but utilization is virtually 100% for our rigs in the highest demand window.” He sees dayrates averaging in the mid-$20,000s.

Commodity pricing is the key driver for the shifting market, a trend that began back in 2010. The weak gas price phenomenon is isolated to North America.

Nabors initially shifted several rigs from the Haynesville to the Eagle Ford. Two years ago, 58 Nabors rigs were working in the Haynesville; today there are 26. Along with a significant presence in the Eagle Ford and the Permian Basin, the company has several rigs in the Mississippi Lime, with plans to move two more from the Haynesville. The company also plans to move one or two additional 1,500- to 2,000-hp rigs into the deep Tuscaloosa play to go after gas liquids and oil, Mr Smith said.

Additionally, Nabors remains the biggest drilling contractor in the Bakken. By the end of 2012, the company will have 76 rigs, including several newbuilds, in the play.

“The market will continue to be this way for awhile. Gas continues to be oversupplied, in part because of the associated gas that is being produced with the liquids and oil,” he continued. “There is a broad range of pricing right now. I think there is a lot of latitude for prices to even moderate some and still keep a pretty robust market. Our customers have indicated they would continue drilling if oil prices get as low as $75 to $80 in the Bakken and $60 to $65 in the Permian.”

Mr Smith said shale production, particularly horizontal drilling, has benefitted from an increase in pad drilling and major advances in downhole logging and real-time technologies. “I think there is going to be a trend toward more automation and remote control of the drilling processes that will spark further improvement in the next two to five years in rig efficiency, with increasing numbers of AC rigs featuring digital controls and automatic drillers.”

Through its wholly owned subsidiary, Canrig Drilling Technology, Nabors manufactures top drives and other rig systems and intelligent software technologies. At year-end 2011, the company had 119 AC rigs in the US, with 31 newbuilds planned this year. Most of the contracts are for the US market, but at least two have been designated for Canada and three for other markets. Outside the US, the market is recovering, with Nabors’ land rig count expected to increase from 116 at year-end 2011 to 130 by the end of 2012. The company saw peak activity during the seasonal Canadian market, with close to 50 rigs operating in the oil-rich Montney, Duvernay and Cardium plays, Saskatchewan, and the Horn River gas basin.

There is more gas drilling in the Middle East, particularly Saudi Arabia. “We do the majority of the gas drilling in Saudi Arabia with very high-spec, 2,000-hp rigs with multiple blowout preventer stacks for the high-pressure wells,” Mr Smith said. Nabors also has 15 rigs in the Llanos Basin of Colombia and is drilling oil for two major operators in Russia.

An Anticipated Bonanza

But there is one area of the globe where drilling activity is at a near standstill. Despite favorable market conditions, a lack of service infrastructure is retarding progress.

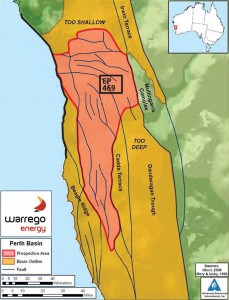

Dayrates in Western Australia are at least 48% higher than US rates, despite gas prices that are $8-$10 (and rising) per gigajoule, considerably higher than North American prices, with acre lease costs of $500 or less, said Dennis Donald, a partner at Warrego Energy.

The company holds an unconditional permit to develop an 86-sq-mile block in the North Perth Basin, which is estimated to hold the fifth-largest reserve of shale gas in the world. The block contains the West Erregulla tight-gas field, which underlies the Kockatea shale play recently mapped by the US Energy Information Administration. The company plans to do seismic testing this year and begin drilling in early 2013.

Mr Donald cites lack of service infrastructure as the primary reason for the low unconventional production in the vast region, in part a function of the cannibalization of rigs being used for the vigorous coal seam gas activity in the eastern sector the country, thousands of miles away. “But with the government’s push for gas to replace diesel in Western Australia, operators have been given permission to utilize hydraulic fracturing to open up the gas shales,” Mr Donald said. “There eventually will come a tipping point, and when production does open up, this will be a massive market, and we will see a bonanza for rigs and fracturing.”