Drilling & Completion News

ADES expands Middle East, North Africa rig fleet

ADES International Holding has signed a definitive agreement to acquire 31 onshore drilling rigs from Weatherford, as well as associated onshore drilling operations, for $287.5 million. Expected to close in the second half of 2018, the acquisition includes 12 rigs in Kuwait, 11 rigs in Saudi Arabia, six rigs in Algeria and two rigs in southern Iraq. Weatherford’s onshore drilling operations include associated assets, contracts, management systems and approximately 2,300 employees and contract personnel across Algeria, Kuwait and Saudi Arabia. The transaction brings the number of ADES’ onshore rigs in the Middle East and North Africa to 34.

In related news, on 12 June ADES closed its acquisition of three jackup rigs based in Saudi Arabia from subsidiaries of Nabors Industries for a total purchase price of $83 million. The acquisition is expected to add approximately $60 million annually to ADES’ revenue. The acquired rigs have been renamed to Admarine 655, Admarine 656 and Admarine 657. Admarine 655 is undergoing recertification, while Admarine 656 and Admarine 657 will generate revenue immediately, with their material impact expected to be weighted toward 2H 2018 earnings.

Transocean announces new rig contracts for work in Australia, UK North Sea

Transocean’s ultra-deepwater semisubmersible GSF Development Driller I has been awarded an 11-well contract, approximately 955 days, commencing offshore Australia in the first half of 2019 with Chevron Australia. The estimated firm contract backlog is approximately $158 million. The contract includes four one-well options.

Additionally, the company’s midwater semisubmersible Transocean 712 has been awarded a 13-well contract, approximately 580 days, commencing in March 2019 in the UK North Sea with ConocoPhillips. The estimated firm contract backlog is approximately $75 million. The contract includes a one-well option.

In separate news, Transocean has also purchased a 33.3% interest in the West Rigel, a newbuild harsh-environment semisubmersible, for $500 million. The rig, renamed the Transocean Norge, is a Moss Maritime CS60 design rig. Delivery is expected in Q4 2018, and the rig is expected to become available for charter in Q1 2019.

BP to acquire BHP shale acreage for $10.5 billion

BP has agreed to acquire from BHP Billiton 470,000 net acres of licenses, including a new position in the liquids-rich Permian-Delaware basin and two premium positions in the Eagle Ford and Haynesville basins, for $10.5 billion. The assets have combined current production of 190,000 BOE/day, approximately 45% of which is liquid hydrocarbons, and 4.6 billion BOE resources.

The acquisition will significantly increase the liquid hydrocarbon proportion of BP’s production and resources in the onshore US to approximately 27% of production and 29% of resources from the current 14% and 17%, respectively. BP’s existing US onshore business produces around 315,000 BOE/day from operations across seven oil and gas basins in five states, with resources of 8.1 billion BOE.

BSP extends contract for Maersk Convincer

Maersk Drilling has been awarded a contract extension for the Maersk Convincer jackup by Brunei Shell Petroleum (BSP). The contractor has worked with BSP continuously since 2007 with the Maersk Completer and the Maersk Convincer, respectively. The current contract for the Maersk Convincer has been extended for a firm 912 days, with up to three years of options. The contract extension will commence in November 2018, in continuation of the current contract.

The BSP contract extension follows a number of new contracts and contract extensions for Maersk Drilling over the past six months. Maersk Drilling has added 1,200 days and $116 million to the backlog.

OGA launches 31st Uk offshore licensing round

The Oil and Gas Authority (OGA) has launched the 31st Offshore Licensing Round, which offers blocks in frontier areas of the UK Continental Shelf. A total of 1,766 blocks, encompassing 370,000 sq km of open acreage, is available across the West of Scotland, the East Shetland Platform, the Mid North Sea High, southwest Britain and parts of the English Channel. The blocks are covered by more than 80,000 km of seismic data generated through government seismic programs. Companies have until 7 November 2018 to apply for blocks; decisions are expected to be made in the first half of 2019.

Kosmos enters Gulf of Mexico with acquisition

Kosmos Energy will enter the Gulf of Mexico with its $1.225 billion acquisition of Deep Gulf Energy. Expected to close in Q3 2018, the deal will add approximately 25,000 BOE/day of production and estimated 2P reserves of approximately 80 million BOE to Kosmos’ portfolio, boosting its production to approximately 70,000 BOE/day and its 2P reserves to approximately 280 million BOE.

Lundin raises Edvard Grieg field resource estimate

Lundin Petroleum has completed the development drilling program, consisting of 14 development wells, at the Edvard Grieg field on the Utsira High in the Norwegian North Sea. Overall reservoir results have exceeded pre-drill expectations, with the best estimate gross ultimate recovery for the Edvard Grieg field increasing by 47%. Current gross production from Edvard Grieg is approximately 95 million BOE/day, which reflects the facilities’ capacity allocation with the Ivar Aasen field.

The reserves upgrade has led to the field production plateau being extended by two years to the end of 2019. An infill development drilling program is being planned for 2020, which has the potential to further extend the production plateau. The 14-well drilling program was completed by the Rowan Viking jackup.

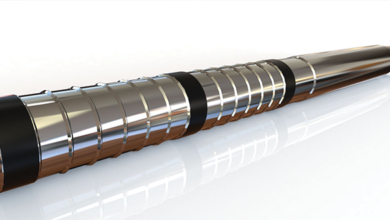

Precision newbuild rig wins 5-year contract in Kuwait

Precision Drilling has been awarded a five-year take-or-pay contract with an optional one-year extension for one of its newbuild ST-3000 drilling rigs in Kuwait. Precision has five active rigs in Kuwait on long-term contracts and expects the sixth rig to commence operations in Q3 2019.

All six rigs have standardized rig design features and specifications delivered within the last five years. The rig addition allows Precision to leverage its existing scale in country, with no additional overhead required to support the expanded fleet. Capital cost for the newbuild is approximately $60 million.

Eon acquires lease in Wyoming’s Powder River Basin

Eon NRG has acquired its first lease in the Powder River Basin (PRB), Wyo., as part of the company’s exploration and development strategy. The lease covers an area of 640 acres in Converse County, Wyo. This is expected to be the first of several lease acreage acquisitions as part of the future development strategy. Eon currently operates two fields in Wyoming – Silvertip and Borie.

The PRB has a long history of oil and gas production from more than 4,000 ft of stacked pay. It has seen a significant increase in exploration and production in recent years from horizontal laterals in the unconventional rocks of the Niobrara and Mowry Shale. Operators are also testing horizontal laterals in the conventional sandstones of the Parkman, Sussex, Shannon and Turner, with excellent results.

New technologies in drilling and completions have brought the breakeven to $30-$50/bbl in several of the formations. The PRB has attracted multiple large E&P companies, including Anadarko, Chesapeake Energy, EOG Resources and Devon Energy.

Shelf Drilling acquires Diamond Offshore jackup

Shelf Drilling has entered into a definitive agreement with subsidiaries of Diamond Offshore Drilling to purchase the Ocean Scepter jackup. The total cost for the rig, including the purchase price, expected costs for the planned reactivation, and mobilization of the rig for its intended purpose, is expected to be approximately $90 million.

Upon delivery – expected in Q3 2018 – the rig will be mobilized from the US Gulf of Mexico to the Middle East. Shelf’s total shallow-water rig count will increase from 39 rigs to 40 rigs at that point. Shelf Drilling will finance the acquisition with proceeds from the initial public offering completed earlier in June and cash on hand.

Wintershall awards Nova Drilling work to West Mira

Wintershall Norge has awarded a contract to Seadrill Norway Operations for the West Mira semi. The rig will drill six subsea wells on the Nova field in the northeastern North Sea starting in the first half of 2020. Wintershall has options to use the rig for up to 10 additional wells on its other operated assets or for exploration activities. Seadrill will operate the rig on behalf of Northern Drilling.

Rowan jackups win Saudi Aramco contracts

ARO Drilling has been awarded six three-year contracts by Saudi Aramco for Rowan Companies jackups operating in Saudi Arabia. These new contracts will commence upon completion of the rigs’ existing contracts later this year.

The Rowan Middletown, Charles Rowan and Arch Rowan are expected to be leased to ARO in September, and the Rowan Mississippi is expected to be leased to ARO in December to fulfill these new drilling contracts. The Scooter Yeargain and Hank Boswell, which will be sold to ARO in October, will commence their new drilling contracts upon the rig ownership transfer to the joint venture.

Earlier this year, Rowan’s Super Gorilla XL Class jackup Bob Palmer was leased to ARO to fulfill a three-year contract that ARO has been awarded by Saudi Aramco.

Keppel FELS delivers second jackup to Borr

Keppel FELS has delivered the SKALD jackup to Borr Drilling. It is the second jackup Keppel has delivered to Borr following delivery of the SAGA earlier this year. An additional eight rigs are on order.

Built to Keppel’s KFELS Super B Class design, SKALD can operate in 400 ft of water and drill to 35,000 ft.

The rig is equipped with cantilever skid-off capabilities, with a maximum combined cantilever load of 3,700 kips, and high-capacity hookloads of 2 million lb.