Analysis: Dayrate business model not built to drive innovation, value delivery

Well construction projects need clearly defined integrator to take control, steer focus on objectives, not simply on reducing costs

By John P. de Wardt, DE WARDT AND COMPANY

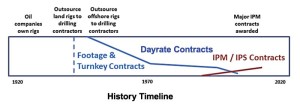

The drilling business model has become the “elephant in the room” as drilling systems automation advances seek an integrator and technology/performance enhancements seek rewards. The dayrate model has been adapted many times over the life of the industry, but none of these adaptations has prevailed.

The business model entails a number of key aspects that drive business behaviors in the supply chain: control, liability, risk and revenue. Some companies have the approach that the operations team drives the contracting of suppliers, while others draw the whole process under supply chain for process control and pricing, often leaving the delivery of value in doubt.

This article describes many of the business model adaptations created over the past 70 years from footage and turnkey through integrated project management (IPM) and production enhancement contracts (PECs). Recently, actions and intentions have surfaced to transpose roles within the drilling supply chain to overcome resistance to change and improve financial performance (vertical integration by operators). This article makes observations on the various contract forms and various roles in the supply chain. The conclusions outline a blueprint for developing a business model that can drive performance and innovation through the supply chain.

Discussing the current business models and opening the industry to development of more appropriate models has extremely high value and impact. The topic is often raised but not debated. If a new business model is broadly adopted, it will change roles, performance, technology application and revenues through the supply chain. Managers and engineers in the drilling business must remain aware of this potential change.

Background

Dichotomies are occurring in the industry on multiple fronts. The dichotomy between multiple, similar land wells on a large scale with pad drilling versus deep offshore wells with complex and uncertain geology is real. A dichotomy also exists between methods to purchase services: Independents in the US take decisions within the operations team, where accountability lies, for supplier performance, but majors have largely dissociated the purchasing process from the operations management process.

This dissociation is causing major ramifications as operations mangers struggle to gain performance alignment to their objectives, suppliers struggle to accrue additional income for additional investment in technology improvements, and supply chain managers achieve performance awards for reducing purchase costs regardless of well delivery performance.

Yet another dichotomy exists where managers of major oil companies view their success on discovering and accessing production of large volumes of hydrocarbon over and above measures of operational efficiency to deliver these reserves.

Conversely, the growth of outsourced multiwell projects (IPMs) and PECs has brought a focus on drilling and completion performance in terms of operational safety, schedule, cost and production, whereby companies need to achieve top-quartile performance to succeed with this business model. Drilling performance becomes not only a profitability driver but also a competitive advantage.

The dayrate model has sustained itself. However, the lack of performance alignment is contributing to a changed business model, demonstrated by independent oil companies developing their own wholly owned drilling contractors, IPM companies partially or wholly owning their drilling rigs and advanced drilling technology developments being created under joint ventures by majors with manufacturing companies.

The demand for faster, lower-cost and more productive wells will drive a change in contracting processes. However, the rate and effect will depend on oil companies’ willingness to adapt a new model and supplier ability to deliver improvements.

Transitions

Some oil companies have chosen to become vertically integrated by developing their own drilling contractor and service company businesses.

Drilling contractors have added services, such as rig trucking, directional drilling and, more recently, fracturing, in order to access new revenue streams.

Many drilling contractors have developed the capacity to design and build their own land drilling rigs. Service companies have also incorporated drilling rigs into their portfolio.

These transitions have generated multiple forms of vertical integration of the drilling contractor within the drilling process.

Offshore, a shift occurred early this century when shipyards started to deliver standard units based on their ship design and the drilling equipment suppliers’ drilling equipment package. This de facto standardization has enabled cost and schedule control. However, some claim it has stifled innovation.

This transformation indicates that the business model prefers standardization to innovation. Standardization provides security for the drilling contractor in cost and schedule of delivery, as well as an understanding of the operating cost and risk reduction through improved reliability. The drilling contractor has simple choices; price per day (plus mobilization and other financial commitments) and firm delivery schedule (investment to revenue period). It’s difficult for the innovator to penetrate this market unless the standard drillship manufacturer chooses to make a large investment in next-generation units to deliver more value to the customer.

The current status is obviously driven by the financial market model: capital cost for a drilling unit, operating cost for the same unit; maintenance and personnel cost against a term dayrate contract. Drilling contractors are strongly judged on their stock price, which is also driven by return on capital employed placing these businesses into a leasing market scenario.

Leasing companies

A concept that has been employed in other industries that require large capital investment in equipment is the leasing business, specifically aircraft leasing. The business model is one of a manufacturer who develops a new model to meet the market needs, then adapts this model with variants for customer selection. The operators are airlines who brand the machine, operate from beginning to end without passengers knowing they do not own the expensive machines. Large financial institutions own the machines and lease them to the airlines for operations.

In the drilling industry, the drilling contractors own their equipment and, as such, play the role of the leasing company. They also operate the equipment so they play a similar role to the airlines. This creates a conflict of interest since the owner prefers to have income over a long period while the operator ought to be differentiating based on performance. Creating a distinction in the business model between the owner of the drilling rig and the operator could change the performance initiative and deliver more value to the oil company.

Liabilities and indemnities

Liabilities and indemnities are core aspects of drilling and service contracts. A fundamental premise adopted by the industry is that of mutual indemnity and retention of liability for own equipment and personnel. In effect, each party to the contract takes care of its own issues and is not liable for events caused to the other parties except in the case of gross negligence. This is agreed to be convenient for the purposes of undertaking work in a relatively high-risk business. Unfortunately, if a party fails to perform, resulting in delays to the drilling operations, there is little recourse except to terminate the contract.

The current situation raises the question: “At what point does mutual indemnity prevent performance and become a negative factor in realizing the goals of a well construction project?” Construction contracts do not contain the same level of indemnities; each party takes responsibility for its part of the project and has liabilities relative to performance of their work. Construction contracts are more specific in defining roles and responsibilities and often leave broader liabilities with the party causing the issue. Damages, in the form of liquidated damages – defined financial consequences – are common in construction contracts as compensation for failure of one party to the contract.

It is difficult to perceive performance responsibility without some penalty for causing negative impacts on the outcome of well construction; inversely, positive impacts ought to receive additional rewards.

Contracting lessons from industrial projects

This section is developed from the benchmarking work that is routinely undertaken across industrial projects. The findings of this work are used as the source of this section.

Benchmarking analyses have assessed alliance contracting arrangements to be disastrous in almost every case. This matches the previously observed trend that alliances have diminished in importance as a method of contracting for well construction. The delay in transitioning from a positive view of alliancing to a neutral view may be related to operability problems that arose after the drilling/completion (construction) operations that was contracted had ended.

A project type called “mixed strategy” was observed to be significantly more successful than other types of contractual arrangements – alliance, engineering procurement construction (EPC) lump sum and EPC reimbursable. Mixed contracting involved reimbursable engineering and procurement followed by lump sum contracts for construction (or fabrication) by construction firms that are independent of the engineering/materials procurement firms.

This observation shows that a separation of engineering/materials procurement and an incentive (lump sum)-based execution delivers the greatest value. The implication is that a contractor who takes both the role of engineer/materials procurement and execution (including subcontracting) faces a significant barrier to deliver performance in terms of operator value. The challenge is to judge how relevant this learning is to well construction and how to transfer these learnings into well construction.

Clear definition of roles and responsibilities are required for successful large/complex projects. Clear definition enables management of interfaces between the parties involved. It appears that severing the link between engineering and construction has advantages: It makes the project more manageable with the respective experts managing each of these phases, and the engineering team focuses on engineering alone without scoping the project for easier delivery. Of course, the interdependence between the engineering and execution function must be fully exploited so that all execution efficiencies have been designed into the engineering; this is a matter of managed interdependency and not single overall control.

The obvious solution is that the operator takes the roles of engineer/materials procurement and fully outsources the execution; this is similar to IPM contracts. The less obvious solution is to follow the Imperial Chemical Industries (ICI) model. ICI is a specialist chemicals company that built its own advanced process plants in the 1960s and ’70s. It developed a model whereby the operator creates a wholly owned subsidiary that performs well construction as a general contractor (GC). This organizational structure dissociates the execution team while retaining alignment of project objectives through common ownership.

General contractor – who takes this role?

In construction contracts, the operator usually outsources the management and control of the project to a GC. This GC takes responsibility to perform the work according to an agreed design and schedule. In well construction dayrate contracts, the industry lacks the obvious role and responsibility of a GC; the GC is well defined in IPM contracts and PECs as these are fully outsourced. Some operators express the desire to have contractors perform to certain levels of performance, yet they are either unwilling to fully outsource to a lead contractor as a GC or to take the formal role of GC themselves. For dayrate contracts, it seems that operators who wish to retain control ought to set themselves up organizationally to be a GC and then formalize their relationships with suppliers on stronger contract management and reciprocity of liability.

The value of creating a distinction between engineering and execution introduces the concept that a GC ought to execute the well construction either as a project or as multiple wells in a manufacturing-style environment. Oil companies often fail to distinguish between engineering and operations, merging them together in a manner that inhibits performance delivery. In the past, drilling engineering and drilling operations were typically separated, creating adversity and often a blame culture. This may lead to the conclusion that integration of the two competencies is a better solution, yet the industry performance discussed so far does not support this.

A solution to this dilemma was executed by ICI, a specialist chemicals company that built its own advanced process plants in the 1960s and ’70s. The company created HAZOPs and was a leader in process innovation. It faced the same issues – design was satisfactory and construction was poor, and projects were late and overspent. As a solution, ICI created a wholly owned subsidiary that took the GC role in its plant construction. This subsidiary was fully empowered to behave as the GC, acting alone, yet the GC ownership drove reason to collaborate.

The GC was involved much earlier than contractors had been previously and liaised with the design team to influence the design to support the construction program – “design to build.” Contractors to the GC were advised of the bill of quantities and asked to bid on percentage increases or decreases on this and variation in rates with causes; tenders were evaluated based on this. Consequently, the actual quantities were quickly priced.

The GC also interfaced with the plant operations team and created a joint plan for pre-commissioning, commissioning and hand-over that matched the user requirements. The result of this change in focus and responsibility was that complex chemicals plants were delivered on schedule, on budget and operated according to specification.

These insights provide lessons for well construction:

• Separate engineering and execution;

• Assign total control for execution, whether to a contractor or to an internal entity, that is sufficiently separated from the business such that it will truly operate as a GC; and

• Ensure that the GC interfaces fully with the design team and with the production team such that the input and output of the execution process operates in the most favorable manner for the oil company.

Key performance indicators

Too often discussions of the “learning curve” do not focus on performance at the start of the learning curve or the gradient of the learning curve through comparing what was achieved to what was possible.

There are two locations in the drilling world where exceptional performance has been achieved on a routine basis; one offshore and one onshore. These locations routinely drill deviated wells at greater than 2,000 ft/day overall. If these two locations can achieve this performance routinely, with various drilling contractors and operators, why does the rest of the drilling world lag behind?

Some operators are sharing drilling performance data in a structured manner, yet this benchmarking methodology does not appear to have become a driver for performance. Performance reviews are often an analysis and justification of performance improvement from internal levels with little regard to what could have been achieved through benchmarking against peers. Learning curves are often displayed as evidence of improvement, yet few challenge if the initial performance on the curve was as low as practicably possible or if the learning curve itself was as steep as possible.

Tender process

Tendering processes vary by company type. Large companies usually have a defined process controlled by supply chain management (SCM) or finance departments. The small companies tend to allow their engineers and operations managers to collect proposals and make decisions. Large companies often define the industry contracting methodology due to their size and financial footprint. In recent years, it has become apparent that major oil companies have corralled their tendering processes into their finance or SCM departments.

Observations suggest that this has developed a commodity-style approach where standard requests and supplier price ranking dominate the selection process. While this methodology works well for large-scale facility projects that purchase large quantities of standard equipment, it does not work well in the service-based drilling industry. Drilling wells relies upon services provided from a large variety of contractors, many of whom have specialist knowledge not available within the oil companies. Delivery of these services entails use of that specialist knowledge and application of specialist equipment.

The services offered by various service companies contain advantages and disadvantages when considered against the value the operator wishes to achieve in drilling a well or groups of wells. Simply assessing each on pricing creates a situation where the supplier considers that the customer is simply interested in costs and not value.

SCM groups in major operators have tended to take control of tendering processes with a drive to reduce costs. In this drive, they have focused on rates for services instead of well costs or the effect of a particular service on well costs. Many suppliers have been selected by the SCM group in isolation of the drilling team. This is an unproductive process and creates animosity among the SCM department, the drilling department and their suppliers.

Analysis of industrial projects shows that all of the engineering procurement design (EPC) lump-sum contracts that were won on significantly low bids failed, confirming that contract awards based on low bids risk losing value. Operators that wish to increase value from drilling operations must develop a more advanced and intuitive approach to selecting suppliers. Transferring responsibility from drilling departments to SCM is detrimental to value delivery.

Similarly, a formal tender process is required to ensure compliance with company policies.

Lean manufacturing

Lean Manufacturing was coined by a researcher in the late 1980s during a major study of global automobile manufacturing undertaken by the Massachusetts Institute of Technology. This study concluded that the Toyota Production System (TPS) “achieved more with less.”

Six Sigma is another methodology that is sometimes offered as a means to improve well construction. Developed by Motorola in 1981, Six Sigma became well known after Jack Welch made it a central focus of his business strategy at General Electric in 1995. Six Sigma is a statistical modeling term that defines a level of process in which 99.99966% of the products manufactured are statistically expected to be free of defects.

The initial development of the Six Sigma program was in high-frequency manufacturing and was based on detailed measurements with statistical reviews. It is hard to conceive of it being successfully applied to drilling and completion operations because many of the performance parameters in this complex and fragmented process are poorly measured. Further, variations in drilling and completion performance tend to be large and significantly offset from the technical limit.

The TPS did not require Six Sigma to achieve extremely high levels of quality; it contains inherent techniques that reduce defects and measure quality at source. Further, TPS distinguishes step-change improvement from continuous improvement; effective continuous improvement can only be achieved after step-change improvement.

Lean Manufacturing applications in both project-type wells and routine wells have delivered exceptional results. Important foundations to apply Lean Manufacturing to drilling operations include organizational architecture and work flow. Applying the principles of Lean Manufacturing leads to an organizational architecture based on tiered systems of delivery that fully integrate to the final customer value. This architecture has limited alignment to the standard contracts used for suppliers to support the delivery of a well. Currently, the development of the ideal architecture requires that drilling teams are organized with limited or no regard to the contractual structures. Workflow commences well in advance of the spud date and involves multiple departments, as well as suppliers to each department.

The application of Lean Manufacturing entails the development of smooth and continuous workflow in the planning process; this requires integration across functions and balancing of the work load and flow. In companies where the high-performance drilling of wells becomes a reality to deliver production growth, the delivery of well locations, both surface and subsurface, has to accelerate and become synchronized within the complete workflow.

In Lean Manufacturing parlance, the delivery of these locations – design, permits – becomes the result of a pull process by the customer – the drilling organization. This creates a huge mental shift for subsurface personnel who are accustomed to medium and large oil companies developing a portfolio of opportunities before handing them over to be drilled. This shift is a clear indication of a need to change business models to achieve performance improvement. The net result is Manufactured Wells.

Organizational architecture

Organizational architecture describes the way an organization works. Effectively, it is a map of the key workflows that deliver value. When organizations are randomly constructed, with little or no focus on the final value delivery, they inevitably struggle and fail to deliver. Drilling operations are performed by a very large cast of actors who owe allegiance to their own companies; this provides the primary driver for their performance. Contracts are the means to define the alignment of these participants from various companies to the goal of the drilling operation. Rarely are drilling and service contracts designed to do this.

Definition of a tiered organizational architecture that is fully aligned to the well objectives in a manner that best-in-class performance can be delivered is a prerequisite to defining scopes of work for contracting services. This is similar to the System of Systems (SOS) that occurs in hierarchical systems architecture. In the architecture, a systems integrator is defined as the company that specializes in bringing together subsystems into a whole, ensuring that those subsystems function harmoniously. This creates an organization that is focused on the systems integrator’s objective enabling significantly easier management of all players and interfaces between them.

TPS developed its organizational architecture through in-sourcing and outsourcing such that each system is responsible for an outcome in which they can have pride and accountability. These whole pieces of work enable suppliers to understand the value they are expected to deliver and how they influence improvement in cost, schedule and functionality.

Suppliers are better able to meet customer needs if they are enabled to deliver a system that has functionality toward the customer’s final objective rather than a component over which they have limited control as to its application or even selection. Delivering a system provides the opportunity to involve the supplier in the planning phase of the work, adding opportunity for value creation. Defining organizational architecture enables scope boundaries to be developed such that they deliver more value to the customer. Further, it enables the interrelationship of multiple scopes of work to be viewed for both overlap and gaps.

Impact of drilling systems automation

The application of automation to drilling systems is advancing quickly as a combination of needs for reduced personnel and reduced human input and as the capability of automated and autonomous systems advances. It has become clear that an integrator is required to accumulate all data from sensors, process it and deliver commands to a variety of machines and tools to truly enable drilling systems automation. The perception in the industry is that few integrators have stepped forward to take on this responsibility. Two oil companies, one a major and one a large independent, have been developing their ability to control the whole drilling process. The major continues to invest in this development while the independent has spun off the technology into a drilling contracting business. IPM companies appear well suited to being the integrator for automation; one such company is known to be pursuing this as a means to differentiate themselves and deliver lower-cost wells on lump-sum contracts.

Another integrator solution is being pursued by an original equipment manufacturer (OEM) through development of a system that sources data inputs and sends control signals to the drilling machines. This solution offers oil companies the ability to load their own applications for programming the control algorithms applied to the drilling process.

Drilling systems automation (DSA) will advance; the issue relative to the business model is how far and how fast. DSA requires interoperability between various companies and various sensors/equipment that necessitates sharing data. The segmented business created by current contracting practices is not conducive to enabling such interoperability. Successful application of DSA across these various entities requires an integrator with the leadership role to drive the application. It also requires an SOS architecture that provides the framework for automation application. Tiered delivery organization architecture offers such a solution.

Value has been demonstrated from early applications of drilling performance control systems. However, current dayrate contracts do not reward the provider for adding this value or the cost of developing/applying the new technology. A reward system based on value delivered through tiered organization architecture provides a system to reward technology advancements.

Rio Tinto, a metals and mining corporation, has developed mining pits operated by autonomous machinery supervised from a remote control center 1,300 km away. The rapid uptake of its automation and autonomous machines was created by Rio Tinto taking the role of integrator and rewarding the OEMs for supporting its program. This example has lessons for DSA.

Key drivers affecting change

Drivers for change do exist, but there are many drivers for the status quo. In many regards, operators feel comfortable focusing on adding reserves and not paying similar attention to the value of drilling/completion performance on their company economics. To pursue operational excellence, some have segregated their drilling department such that it can behave as a GC. For many companies, this could mean developing a wholly owned subsidiary that is aggressive in achieving schedule and cost goals yet retains the linkages to address the functionality and quality of delivered wells.

Drilling contractors are strongly driven by financial markets to manage return on assets. This return is driven primarily by dayrates and the utilization rate of the asset. Drilling performance is a complex driver in this business model because it drives two competing impacts. One is increased utilization through reputation, which creates a competitive advantage for securing future work, and the other is decreased utilization from earlier completion of a work program, which can lead to earlier contract termination. In a few cases, the reputation of the drilling contractor also derives a higher dayrate. At what point in the current dayrate market does the performance reputation reward yield sufficient benefit to overcome the drive to remain on contract for a longer period? Financial markets appear to prefer the leasing model while oil companies prefer an operating model. This dichotomy indicates the industry ought to change its practices in terms of contracting and managing drilling rigs.

Many operator organizations tender for work based on standard documents that are copied from previous operations. These documents were probably modified as a result of negotiations and are themselves not a good representation of a base case. This may be a harsh observation for those who operate professionally and deliver quality documents, yet it is an all too common practice.

The industry has transitioned knowledge and expertise for technology selection and application from the oil companies to the suppliers (service companies/drilling contractors). This has to be recognized in the competency assessment of who does what best when designing an organizational architecture.

It is true that major technology innovations were driven by oil companies in the 1970s. Today, next-generation tools and technologies are being developed and applied by major and specialist service companies with limited contribution from oil companies. The transition of drilling technology development and application from oil companies to suppliers has to be recognized when developing the most effective combined organization architecture.

The role of operator changed; they are now the buyer of technology and, as such, must become a knowledgeable buyer. Simply seeking low cost is not a solution to technical excellence and value delivery in terms of well construction.

Analysis has shown that successful business alliance models include a detailed description of the integrated technical processes between customer and supplier, mutually defined goals and shared benefits. Industrial project reviews suggest a clear definition of the GC, distinction for engineering and production from construction and a clear definition of all roles, responsibilities and interfaces involved in delivering wells. Lessons from the highest-performing industrial organizations show that tiered organization architecture of systems and subsystems, including suppliers, aligned through KPIs and rewards, is a driver to best performance. These are all drivers of performance in well construction and can be accessed through a suitable and relevant organizational architecture.

Value delivery roadmap for the drilling business

Organizational architecture is the most critical aspect in the roadmap to success for drilling operations contracting. Usually this is not a key driver in the rig and services contracting process. This architecture defines how the work will be organized to deliver the well. Lean Drilling is designed to maximize the delivery of value through the organization of subsystems that are able to take responsibility to deliver their own contribution to the value. This becomes a tiered hierarchy of systems and subsystems.

This architecture is modeled on the TPS and incorporates suppliers into the hierarchy such that they become an integral part of the planning and execution process. The subsystems are designed to deliver a key facet of well construction that forms a critical element of the well delivery. Examples include wellbore integrity and well placement. A subsystem is formed through in-sourcing and outsourcing products and services to create a subsystem with the capability to deliver and measure value in alignment with the well objectives. Consequently, contract scopes of work must be developed from the organization architecture.

The ideal solution to contract products and services to deliver the highest value in terms of well construction is to:

1. Design an organization architecture that contains of all the products and services involved in well delivery such that it aligns all participants to the value objectives of the well(s).

2. Design the interdependencies between well construction and the predecessors of subsurface and the hand-over to production, including delivery of wellbore data to modelers.

3. Define the GC for well construction and its interdependence with well design and production operations.

4. Within the architecture, develop systems and subsystems that are able to stand alone in delivering their component of the well construction process on a value basis. Define the measures of value delivery through a hierarchical system of KPIs.

5. Include interdependencies between each system and between each subsystem such that they reconcile cross-system issues to the benefit of the whole organization and not to the benefit of one subsystem and detriment of another.

6. Design systems and subsystems that deliver critical management processes across the whole architecture; scheduling, risk and uncertainty management, cost management and control, logistics, well basis of design, drilling and completion programs.

7. Define the scope of work, KPIs and reward structures in contracts that match the systems and subsystems in the organization architecture. Encourage bidders that are unable to offer the required packages of products and services to align themselves with other providers and offer the package together through a single bid.

8. Distinguish the role of lessor of drilling units and performance operator such that rig contracts recognize the former and reward the latter.

9. Award contracts based on the highest net value calculated from a model of the drilling program(s) with high and low outcomes to assess sensitivity. Do not award on lowest price alone.

10. Include in the contract scope of work the planning phase of the operation. For single remote exploration wells, this becomes a project approach; for multiple similar wells, this becomes a manufacturing approach where the plan is developed and then continuously improved.

11. Treat all personnel as part of the well delivery team and not as individual companies performing a supply service.

12. Develop a strong relationship between the onsite execution team and the office-based planning/support team.

Enable the onsite team to perform through delegation of responsibility with information and authority.

Conclusions

Integration of the GC with well engineering and production (commissioning), as well as exploration (data delivery), must not be lost; a structured interdependency will enable the forces of interdependence and independence to coalesce to an optimum outcome for the operator.

IOCs in the US have established an advantage in their cost to develop horizontal wells in shale formations. This differentiation offers a lesson in the value of a high-performance focus, organizing the business toward delivery and retaining ownership of contractual decisions within the operations department.

Typical contracting follows traditional scopes of work based on standalone services. The contracts usually do not address how these services will work with other products and services to deliver value. The coordination of these services is left to the drilling engineer/drilling supervisor, who rarely designs a team architecture based on value delivery.

In larger companies, the contracted services are handed from SCM to the drilling team for management during operations. In smaller companies, the operations department has more control over the contracting process, which leads them to solicit scopes of work that are better aligned to performance delivery. Developing organization architecture and using the systems and subsystems within it to define scopes of work for contracts will bring significant value to oil companies. The next oil price drop will draw a distinction between those companies able to align and leverage their suppliers and those who choose the low-bid methodology.

This article is based on IADC/SPE 167933, “The Drilling Business Model: Driver or Inhibitor of Performance and Innovation,” presented at the 2014 IADC/SPE Drilling Conference, 4-6 March, Fort Worth, Texas.

Lean Drilling and Manufactured Wells are trademarks of DE WARDT AND COMPANY.

References

Allan, M. E., Gold, D. K., Reese, D.W.; Application of Toyota’s Principles and Lean Processes to Reservoir Management; SPE Western Regional & AAPG Pacific Section Meeting, Joint Technical Conference, Apr 19 – 25, 2013, Monterey, CA, USA. SPE 165331

Bond, D.F., Scott, P.W., Page, P.E., Windham, T.M., Applying Technical Limit Methodology for Step Change in Understanding and Performance; Journal SPE Drilling & Completion, Volume 13, Number 3 Pages 197-203, September 1998. SPE 51181

Brett, J.F., Craig, V.B., Wadsworth, D.B., Pile, K.E., Brett, K.V; When Do Drilling Alliances Add Value? The Alliance Value Model; SPE Annual Technical Conference and Exhibition, 6-9 October 1996, Denver, Colorado. Journal SPE Drilling & Completion Volume 14, Number 3 Pages 208-216, September 1999 SPE 36576 / 57729

Charles, S R., Deutman, R., Gold, D.K.; Implementing Lean Manufacturing Principles in New Well Construction; SPE Heavy Oil Conference Canada, 12-14 June 2012, Calgary, Alberta, Canada. SPE 157907 / ISBN 978-1-61399-207-4 de Wardt, J.P (1990); Drilling Contracting in the Nineties; SPE/IADC Drilling Conference, 27 February-2 March 1990, Houston. SPE 19902

de Wardt, J.P (1990), Drilling Contracting in the Nineties, SPE/IADC Drilling Conference, 27 February-2 March 1990, Houston, Texas. SPE 19902 / ISBN 978-1-55563-554-1

de Wardt, J.P (1993), Drilling in the Twilight Zone: Somewhere Between Dayrate and Turnkey, SPE/IADC Drilling Conference, 22-25 February 1993, Amsterdam, Netherlands. SPE 25742 / ISBN 978-1-55563-494-0

de Wardt, J.P (1994 a), van Gils J.M.I.; Strategies and Structures for Drilling and Service Contracts in the 1990’s; Journal SPE Drilling & Completion Volume 9, Number 3 Pages 153-160, September 1994. SPE 23860

de Wardt, J. P., (1994b); Lean Drilling-Introducing The Application of Automotive Lean Manufacturing Techniques To Well Construction; SPE/IADC Drilling Conference, 15-18 February 1994, Dallas, Texas. SPE 27476

de Wardt, J.P (2000), Cook, A, Smook, R W; Step Change Improvement in Drilling Performance – Repeatable Worldclass Performance; IADC/SPE Drilling Conference, 23-25 February 2000, New Orleans, Louisiana. SPE 59203

de Wardt, J.P (2004), Deepwater Success Through Predictable and Distinctive Drilling and Completion Performance, IADC/SPE Drilling Conference, 2-4 March 2004, Dallas, Texas. SPE 87117

de Wardt, R.H., (2007), A view on the ICI Experience of Managing Construction Contracts (Unpublished White Paper)

de Wardt, J.P (2010), Title Well Delivery Process: A Proven Method to Improve Value and Performance While Reducing Cost; IADC/SPE Drilling Conference and Exhibition, 2-4 February 2010, New Orleans, Louisiana. SPE 128716

de Wardt, J.P. (2013), Behounek, M., Chapman, C.D., Putra, D., Drilling Systems Automation – Preparing for the Big Jump Forward; 2013 SPE / IADC Drilling Conference and Exhibition, Mar 05 – 07, 2013, Amsterdam, The Netherlands. SPE 163422 / ISBN 978-1-61399-232-6

Gomersall, S, Klein, B, Clark, G, Sneddon, I, Simpson, M; Andrew Well Engineering Alliance: A New Industry Model; European Petroleum Conference , 22-24 October 1996, Milan, Italy. SPE 36872

Herbert, R.P., Drilling in the 90’s: A Service Company Perspective; SPE/IADC Drilling Conference, 11-14 March 1991, Amsterdam, Netherlands. SPE 21904 / ISBN 978-1-55563-532-9

Macpherson, J.D., de Wardt, J.P., Florence, F., Chapman, C.D., Zamora, M., Laing, M.L., Iversen, F.P., Drilling Systems Automation: Current State, Initiatives and Potential Impact; SPE Annual Technical Conference and Exhibition, 30 September–2 October 2013, New Orleans, Louisiana, USA. SPE 166263 / ISBN 978-1-61399-240-1

Mazerov, K., Mine of the Future program may hold important lessons for drilling automation; Drilling Contractor, Feb 27 2013

Merrow, E. W.(2011); Industrial Megaprojects – Concepts, Strategies and Practices for Success; John Wiley & Sons, 2011, ISBN 978-0-470-93883-9

Merrow, E. W. (2012); Oil and Gas Industry Megaprojects: Our Recent Track Record, Journal Oil and Gas Facilities Volume 1, Number 2 Pages pp. 38-42 April 2012. SPE 153695

Moomjian, C.A., Incentive Drilling Contracts: A Logical Approach for Enhancement of Drilling Efficiency; Journal SPE Drilling Engineering, Volume 7, Number 1 Pages 9-14 March 1992. SPE 21902

Nims D.G, Doig, M.J, Townhill, R; BP’s Well Construction Strategy – A Way Forward? SPE/IADC Drilling Conference, 15-18 February 1994, Dallas, Texas. SPE 27457

Osmundsen. P., Sorenes, T., Toft, A., Oil Service Contracts: New Incentive Schemes to Promote. USAEE-IAEE WP 09-028 December 2009

Pink, T., Bruce, A., Kverneland, H., Applewhite, B., Building an Automated Drilling System Where the Surface Machines are Controlled by Downhole and Surface Data to Optimize the Well Construction Process; IADC/SPE Drilling Conference and Exhibition, 6-8 March 2012, San Diego, California, USA. SPE 150973 / ISBN 978-1-61399-186-2

Rankin, M. D., The Economics of the Offshore Contract Drilling Industry: Implications for the Operator; SPE Annual Technical Conference and Exhibition, 4-7 October 1981, San Antonio, Texas. SPE 10329

Robins, K.B, Roberts, J.D; Operator/Contractor Teamwork is the Key to Performance Improvement; Journal SPE Drilling & Completion, Volume 11, Number 2 Pages 98-103, June 1996

Rushmore, P., Anatomy Of The “Best In Class Well”; How Operators Have Organised The Benchmarking

Of Their Well Construction and Abandonment Performance, SPE/IADC Drilling Conference and Exhibition, 1-3 March 2011, Amsterdam, The Netherlands. SPE 140172 / ISBN 978-1-55563-326-4

Teague, J. U., New Concepts in Drilling Contractor-Operator Relationships; Drilling and Production Practice, 1955, American Petroleum Institute.

Thorogood, J.L., Delivering Step Change in Performance From Well Construction Teams, SPE/IADC Drilling Conference, 4-6 March 1997, Amsterdam, Netherlands. SPE 37572 / ISBN 978-1-55563-414-8

Walrick, E., van Zandvoord, J.J., Skilbrei, O., Wong, SS., Wong, J., Nones, N., Applying Lean Principles to Achieve Breakthrough Performance Gains from Existing Assets; Asia Pacific Oil and Gas Conference & Exhibition, 4-6 August 2009, Jakarta, Indonesia. SPE 123538 / ISBN 978-1-55563-259-5

Warren, J.E., Economic Trends In Contract Drilling; API Drilling and Production Practice, 1947. #47-037

Williams, R., Observations from the Day Rate Report, RigData News & Analysis.

Wijning, D.B., Roodenburg J., Deul, H., van den Broek, L., MacKinlay, W.; Practical Experience Gained Operating a Compact Ultradeepwater Drill Ship; 2013 Offshore Technology Conference, May 06 – 09, 2013 2013, Houston, TX, USA. ISBN 978-1-61399-241-8

Womack, J. P., Jones, D.T., Roos, D., The Machine That Changed the World: The Story of Lean Production– Toyota’s Secret Weapon in the Global Car Wars That Is Now Revolutionizing World Industry. ISBN-13: 978-0743299794