Oil & Gas Markets

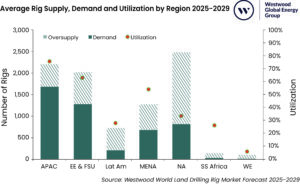

Westwood forecasts Asia Pacific will lead demand for land rigs in 2025-2029, followed by Eastern Europe

The latest edition of Westwood’s World Land Drilling Rig Market Forecast presents a broadly positive picture for the land rig market over the next five years. Rig demand is forecast to average 4,704 between 2025 and 2029, which is an uplift of 18% on the hindcast average. Global demand is forecast to be led by Asia Pacific (36%), with China continuing to be the largest country for rig demand. Eastern Europe, where demand outlook is driven by Russia, follows at 27%, with North America third at 17%.

From a supply standpoint, North America has the largest fleet. However, it is chronically underutilized, with many rigs being cold stacked for multiple years. This reflects a step change in rig demand in the Lower 48, where operator consolidation, strict capital discipline and a drive to increase the production rate of each well drilled have fundamentally changed the US rig market, leaving significantly more rigs available than are in demand.

As a result, utilization is expected to average just 33%, significantly below Asia Pacific (76%) and Eastern Europe & FSU (63%). This low utilization is also expected to spur rig contractors to relocate part of their fleets into other markets, which has already become a growing trend in the past couple of years.

The report further pointed out that, while 72% of forecast rig demand is expected to come from just four countries – Canada, China, Russia and the US – these are not necessarily growth markets for rig contractors as they offer limited expansion opportunities. China is well served by domestic land rig contractors, led by CNPC and Sinopec, which have the two largest rig fleets globally at approximately 1,100 and 650, respectively. Russia, meanwhile, remains under heavy sanctions, limiting international contractors’ ability to operate in the country.

However, there are a number of other countries with growth opportunities, the report noted. These include Argentina and Australia, two countries being fueled by investment into unconventional projects. The MENA region also holds major growth potential. Along with increased conventional drilling in places such as Algeria, Kuwait and Turkey, new opportunities are emerging in unconventional developments, led by efforts in Saudi Arabia and the UAE.

US oil tariffs on Canada, Mexico would significantly impact NAM crude flows

The proposed US oil tariffs on Canada and Mexico (10% and 25%, respectively) would initiate a significant shift in crude flows in North America (NAM), according to a report (“How Would Trump Tariffs Affect North American Oil Markets?”) issued by Wood Mackenzie in early February.

In a 25% tariff scenario on Mexican oil, Mexico exports would largely shift away from the US to other outlets in Europe and Asia. This could impact 600,000 barrels per day (bpd) of imports from Mexico into the US.

“Backfill options for heavy barrels in the US crude slate, especially in the US West Coast and US Gulf Coast, would need to come from waterborne imports via Latin American and Middle East countries,” said Dylan White, Principal Analyst, North American Crude Markets.

In a 10% tariff scenario on Canadian oil, Wood Mackenzie expects Canadian crude would continue largely being consumed in the US Midcontinent and US Gulf Coast.

“Refineries in the Midcon are landlocked and have limited access to alternate sources of heavy crude and are, therefore, dependent on Canadian supply,” Mr White said. “However, Canadian outlets to non-US destinations become advantaged. The Trans Mountain Pipeline – including TMX – provides access to the Pacific Basin and would likely facilitate increased shipments of Canadian crude to Asia and away from the US West Coast in a tariff scenario.”

Re-exports of Canadian crude via the US are not subject to tariffs and would provide optionality to Canadian barrels transiting the US. However, Wood Mackenzie does not expect a 10% tariff would be substantial enough to shift Canadian barrels into Asia.

In the US, Wood Mackenzie projects that the tariffs would drive oil demand 50,000 bpd lower by 2026, in part due to modestly higher refined product prices.

Relief from domestic producers is unlikely, as Wood Mackenzie continues to forecast measured US Lower 48 production growth in the years to come.

Energy companies investing more in cyber as attacks become more sophisticated

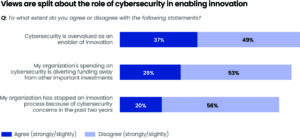

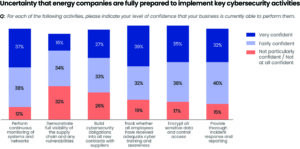

Energy companies are taking cyber threats seriously at the highest levels, as two in three energy professionals (65%) say their leadership views cybersecurity as the greatest current risk to their business, according to the Energy Cyber Priority report from DNV Cyber.

More than two-thirds (71%) of the 375 energy professionals surveyed globally said they expect their company to increase investment in cybersecurity this year. Three-quarters (75%) report that their organization has increased focus on cybersecurity because of growing geopolitical tensions over the past year. Some 72% are concerned about the potential for attacks directed by foreign powers, up from 62% in 2023. Nearly eight in 10 (79%) are concerned about the threat from cyber-criminal gangs, up from 50% in 2023. The research also records a rise in concern about malicious insiders, up to 62% from 51% in 2023.

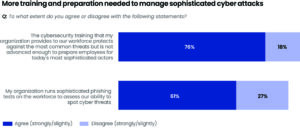

Challenges are also growing as threat actors become more sophisticated. Generative AI’s increasingly human-sounding tone and capacity for detail enables cyber criminals to launch more convincing scams. Two-thirds of energy professionals (66%) agree that the use of AI in phishing attacks has made it more difficult to determine whether emails are genuine. Cybersecurity professionals also understand that neglecting AI will put them at a disadvantage, as almost half (47%) fear they will fall behind adversaries unless they harness AI.

Energy professionals did cite successes in some areas, including greater awareness at the leadership level, with 78% expressing confidence that their leaders sufficiently understand cyber risk. There have also been improvements in employee training, as more than eight in 10 (84%) say they know exactly what to do if they are concerned about a potential cyber threat.

Further, growing attention is being paid to operational technology (OT) cybersecurity – securing the systems that manage, monitor and automate physical assets. Recognizing that connecting physical infrastructure to modern IT architectures and other assets creates new vulnerabilities, two-thirds (67%) said they expect greater OT security investment in the year ahead.