Despite lingering uncertainties, NOV rig census shows recovery is afoot

Compliance with OPEC+ production cuts, healthy oil prices and fleet attrition are all contributing to higher rig utilization rates as the market continues to heal

By Tarjei “TJ” Myklebust, Karl Appleton and Kevin Scherm, NOV

If 2020 was the year of COVID-19 initial impact, 2021 has been the year of COVID-19 recovery. That is not to say the recovery is at, or even near, completion. However, in the oil and gas industry, recovery is happening sooner than many expected. Demand has improved, but more importantly, the supply of oil and gas was intentionally reduced by OPEC+, helping return oil to a healthy and somewhat stable price.

Global rig demand drastically improved from the historic 2020 census low point. Unsurprisingly, the biggest returns came from those areas that took the largest hits, such as the Permian Basin, where utilization rose from 26% to 38%.

While there is optimism, there is still uncertainty. As a result, many operators have kept their CAPEX budgets at low levels, choosing to invest their increased profits into paying down debts, delivering dividends, and preparing for the energy transition.

2021 census highlights

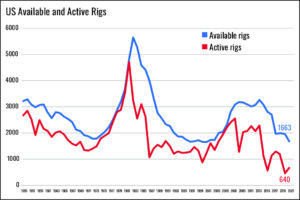

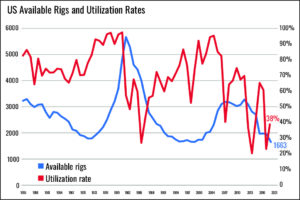

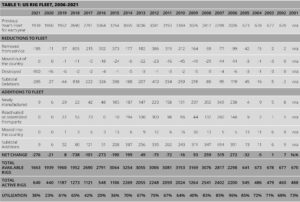

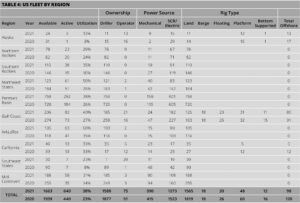

• The US available fleet, including land and offshore rigs, decreased to 1,663 due to scrapping and removal according to census rules for prolonged inactivity.

• The active rig fleet in the US increased to 640 land and offshore rigs, 45% higher than record lows set in the 2020 census. It is still far below the 1,187 active rigs seen in the 2019 census. Utilization rate was 38%, up from 23% in the 2020 census.

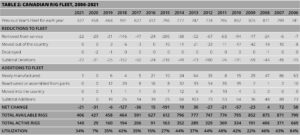

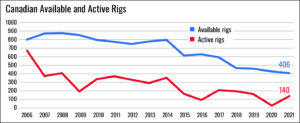

• The Canadian fleet consisted of 406 rigs. Utilization rebounded from record lows in 2020, going from 7% in 2020 to 34% in 2021. That’s close to the pre-pandemic utilization rates seen in the 2019 census.

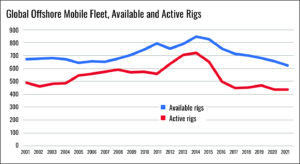

• Attrition in the global mobile offshore rig fleet continued as the fleet went from 655 available rigs in 2020 to 621 in 2021. This is the smallest available mobile offshore rig fleet seen this millennium. Utilization increased to 70%.

• Compliance with production cuts by OPEC+ members had deflated the active rig count in the Middle East by the start of 2021. The renewed buoyancy of the oil price had a positive impact on international land rigs, with a noted increase in Argentina and Colombia. A slight easing in the OPEC+ cuts during the first half of this year saw a corresponding rise in the active rig count in the Middle East.

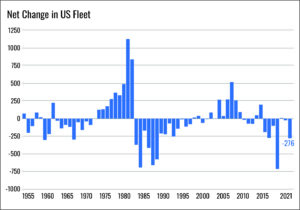

US fleet

The US rig fleet totaled 1,663 rigs. This decrease of 276 rigs is partly due to scrapping but also due to the census criteria for available rigs. The US available rig fleet has not been this low since 2000.

US rig additions

Nine rigs were added to the US rig fleet since the previous census. While this is an increase of 33%, it is still far below the 53 rigs added on average per year during the past five years. Six of the rigs added to the US land fleet are newbuilds, while the remaining three are reactivated cold-stacked land rigs that were not counted in the previous census according to census rules. Shorter-term reactivations of warm-stacked rigs are covered later in the census.

There have been no additions to the US offshore fleet since the previous census, although rigs have moved to the region following the census period.

US rig attrition

A total of 285 rigs were removed from the US rig fleet since the previous census period. This is the second-highest decrease seen in the past decade. Of that total, 100 were removed because they were scrapped, including 94 land rigs – highlighting the devastating effect the pandemic had on North American land contractors. The remaining 185 rigs were removed according to census rules.

Six offshore rigs, located in the US Gulf of Mexico, have been scrapped since the previous census, half of which were semisubmersibles and the other half jackups. The youngest of the scrapped jackups was built in 1982, while the oldest was built in 1969.

For the semisubmersibles, the youngest to be scrapped was delivered to the market in 2010, while the oldest was built in 1998.

Canadian fleet

The total Canadian rig fleet of 406 rigs decreased by roughly 5% from the last census. The offshore rig fleet decreased by one, leaving a total of seven rigs, consisting of three platform rigs, two semisubmersibles, one drill barge and one drillship. On the land side, 21 rigs were removed from the fleet, and one land rig was added during the census period.

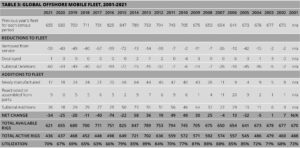

Global offshore mobile fleet

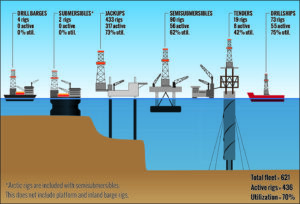

The global mobile offshore drilling units (MODU) fleet decreased by 5% this year, bringing the total to 621.

Fleet attrition accelerated by 33%, resulting in a total of 57 rigs removed. Eight of the rigs were drillships, 16 were semisubmersibles, and 33 were jackups.

There were 23 additions to the global MODU fleet. Twelve rigs were newbuild deliveries while the rest were rigs reactivated according to census rules. Ten of the newbuild rigs are jackups, and two are semisubmersibles. No drillships were delivered to the fleet for the second year in a row.

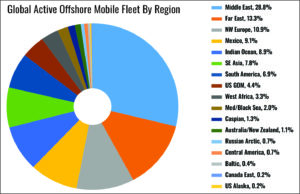

The largest region of MODUs is the Middle East, with almost 29% of the fleet – all jackups. The Far East was the second-largest region, with 13.3% of the fleet, mostly jackups. The Northwest Europe region had approximately 11% of the fleet, with a more even split between jackups and harsh-environment semisubmersibles. This is the largest region of semisubmersibles in the world. The largest region for the drillship segment was the US Gulf of Mexico, with 19 drillships located there during the census period. This region has 4.4% of the total global offshore mobile rig fleet.

US drilling activity

The NOV census counts a rig as active if it has drilled at any time during a defined 45-day period in early summer. For 2021, the window of activity was 6 May through 20 June.

There was a total of 640 active rigs in the US in the census period – 33 offshore and 607 land. The total reflects an increase of 45% compared with 2020 but is still 46% lower than in 2019. Much of the growth with land rigs came in the Permian, which had 292 active rigs, up from 184 in the previous year. This region accounted for 46% of all active rigs in the US.

With increased activity complemented by a smaller available fleet, utilization improved. Overall, US land saw 39% utilization while offshore had 34% utilization.

Offshore, jackup utilization grew from 19% in 2020 to 33% in 2021. There were no active semisubmersibles in the region in the 2021 census period, compared with 25% utilization for four semisubmersibles in 2020. The US drillship fleet of 16 active rigs in the Gulf of Mexico enjoyed an 84% utilization rate.

Looking at the US land fleet in more detail, rigs with drilling depth capacities between 6,000 and 9,000 ft continued to have the highest utilization rate: 45% this year compared with just 17% last year. It should be noted there are significantly fewer rigs in this segment (144 rigs) compared with the rigs capable of drilling 20,000 ft or more (721 rigs). These largest of the land rigs had 43% utilization, up from 28% last year. The third most utilized segment – rigs rated between 16,000 and 19,999 ft (352 rigs) – had 38% utilization.

Canadian drilling activity

The Canadian market has had an incredible rebound of activity. After hitting rock bottom in the 2020 census with only 29 active rigs, the region had 140 active rigs this year. That’s an increase of more than 380% and is only 20 rigs fewer than what was seen in the 2019 census. This reflects a utilization rate of 34%, up from a dismal 7% in 2020 and only 1 percentage point lower than 2019 utilization, albeit with a smaller available fleet than in 2019.

Offshore did not do as well. Of the seven available offshore rigs, only two were active (one drillship and one platform rig).

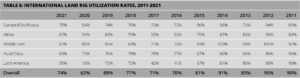

International land rig utilization

Last year the international rig count dropped to levels similar to the trough of 2016. The 2021 census period saw an increased utilization rate at 74%, up from 62% in 2020.

Argentina, Colombia and Mexico formed the mainstay of land rig activity in Latin America, with Argentina and Colombia rebounding particularly strongly. Utilization in the region rose from 18% to 55% but remains oversupplied and below levels seen in 2019.

In Asia, a slight downtick of active rigs in India was balanced by a recent uptick of 10 active rigs in Indonesia, while Australia remained flat at 14. Most regional changes are masked by China’s massive rig count. Similarly, the Russian active fleet count dominates the European region, where Turkey and Ukraine remained roughly flat year-on-year, maintaining 20 and 30 active rigs, respectively. Africa’s utilization rate is at 67%. The downward trend of the largest active rig count in the region continues in Algeria, from its mid-50s start point back in 2017 to 26 active rigs in the 2021 census. Meanwhile, the region’s second-largest fleet, in Libya, remains in the low teens.

Compliance with production cuts by OPEC+ members took a toll on active rig counts in the Middle East, which had been purposefully deflated by the start of 2021. A slight easing during the first half of the year saw a corresponding rise in active rig count in the region to 244 during the census period and a utilization of 62%. That leaves room for reactivation in those countries that had taken the highest number of rigs out of service, namely Iraq, Oman and Saudi Arabia.

Global offshore mobile activity

Although the offshore fleet was hit hard by the pandemic, the effects were not as severe and acute as what was seen in the North American land rig market. One reason for this is the longer investment perspective in the offshore market, meaning that many offshore rigs were on longer-term contracts that may have been difficult to cancel once the pandemic hit. Another reason is the fact that many national oil companies kept rigs busy despite the downturn, as they are less profit-driven in their strategies.

The global offshore fleet has responded well to the significantly higher oil prices seen in 2021. Utilization increased from 67% to 70%, the highest it has been since 2015. Unfortunately, the main reason for the increase is not increased activity but attrition. The available fleet has decreased from 825 rigs in 2015 to 621 rigs in 2021.

The number of active offshore mobile rigs in 2021 was 436, which is one fewer than in 2020.

Offshore industry trends

Optimism in the offshore market is growing as contracting activity rises, along with average contract length. The main driver is the drillship segment, but jackups are also seeing rising utilization rates.

One positive factor is that many offshore drilling contractors are emerging from Chapter 11 proceedings. With significantly improved balance sheets and even some with fresh capital, contractors have room to invest in consolidation, accelerate attrition, or invest in new technologies that increase the likelihood of their rigs receiving contracts with better dayrates. However, a substantial orderbook for both drillships and jackups could keep dayrates subdued.

There are 32 jackups, the majority of them ordered in 2014 or earlier, stranded in Korean and Chinese yards. Of those, 26 are scheduled for delivery before 2022, but some may defer further. Jackup deliveries picked up pace in 2018 as Chinese jackups were brought into the market through new bareboat charter mechanisms and through Chinese holding companies to work in China or the Middle East. Lately, some of these undelivered jackups have been converted into wind installation units.

There are 18 drillships under construction, all of which are set to be delivered by the end of 2022. Unless more drillships are scrapped, it is likely many deliveries will be deferred yet again to avoid oversupplying the market. There are examples, although few, of drillships following the Chinese model of being brought into the market through a bareboat charter agreement, demonstrating that shipyards are willing to consider new options to get the rigs out of their yards.

Semisubmersibles have a much smaller orderbook of just six rigs. Despite relatively higher scrapping activity, this segment is still suffering from oversupply, and the rebound in utilization rate has been slower.

US trends and forecast

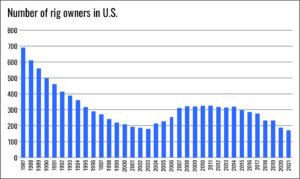

The number of individual rig owners holding available rigs, which is quantified annually, had dropped significantly from 236 in 2019 to 188 in 2020. This downward trend slowed but continued in 2021, leaving 172 rig owners, as bankruptcies and consolidation continued. Roughly 4% of the rigs in the US were owned by operators, with the rest being owned by drilling contractors.

Reactivation was the primary trend for the year, with a significant increase in rig count driven by independent oil and gas companies. Dayrates and contract lengths have increased slightly. There is growing demand from some operators for a new class of rigs featuring advanced capabilities related to digital and automated technologies, lower carbon footprints and other ESG benefits.

As was stated in last year’s report, making predictions about the future during a global pandemic is difficult. Looking back, the bottom was seen around Q3 2020. While growth started slow, the overall recovery in the US accelerated more quickly than originally thought due to healthy oil prices. That was driven by high compliance with the OPEC+ production cuts, a drawdown in storage, and an uptick in economic optimism following the COVID-19 vaccine rollout.

Looking ahead, although the Delta variant has disrupted some of the recovery, the trend should remain positive as the world reaches higher rates of vaccination. The risk does persist that future variants of the virus could bring additional impact.

US rig utilization should remain flat or continue to improve. This is supported by the return of US oil reserves to normal levels and a substantial decrease in the number of drilled but uncompleted wells. On land, such conditions are typically followed by a return of drilling activity, but that return will be balanced by the efficiency gains seen with modern rigs such that fewer rigs are needed to maintain historical production volumes. Offshore, drillship utilization will remain high in the Gulf of Mexico, and there will be a need to bring in additional rigs. Jackup and semisubmersible utilization is likely to remain low as activity is focused on deeper waters and preference given to drillships.

It is also important to note the impact the energy transition is having on rigs. In general, the world has made clear a dedication to renewable energy and a desire to shift away from fossil fuels. Many traditional oil and gas companies have rebranded into energy companies and begun to shift future investments to renewable energy technologies. This will remove dollars from oil and gas. However, in the short and medium term, the world is still highly reliant on fossil fuels. For a more sustainable industry, rigs that can explore, develop and produce oil and gas safely, efficiently and with a lower carbon footprint will be needed. DC

NOV’s 68th Annual Rig Census was prepared by Tarjei “TJ” Myklebust, Analyst; Karl Appleton, Business Development Director; and Kevin Scherm, Business Development.

IHS Markit and Enverus are the primary sources used for the global offshore and North America rig fleets. Information for the international land fleet was found using both Baker Hughes data and information collected and analyzed by NOV personnel.

US Rig Census historical data, 1955-2021. Note: Data for 1953, 1954 and 2002 are not available.

Click here to download a PDF of the 2021 NOV Rig Census article.