Rig count rising: Bakken drillers appear positioned for fresh growth

Bakken rig count hits 60 for first time since 2015 just as production reaches record high

By Julie Francis, Wood Mackenzie

The state of North Dakota reached a milestone in the last week of March 2019 – the rig count rose to 60 for the first time since December 2015. The achievement comes on the back of another important breakthrough from January – Bakken production hit a record-high 1.376 mmboe/d.

While 60 is the highest rig count for the state in more than three years, it’s still eclipsed by the levels reached before the oil price crash of late 2014. The downturn forced Lower 48 operators to improve their working practices: They hired fewer rigs and completed fewer wells. But those wells were better quality, cost less and produce at better rates than many that were spudded pre-crash.

Rig counts hovered above 100 for the majority of the time between 2010 and 2015 in North Dakota – yet, overall oil recovery was lower. After oil prices dropped, the game changed, and the rig count went into free fall – from a peak of 220 in 2012 down to 30 in 2016. More than 100 rigs were stacked in the Williston Basin alone in just a 12-month period.

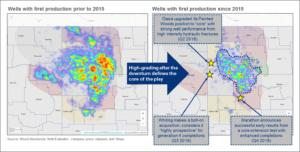

Today, drillers know how to do more with less. Prior to 2015, the wells with first production were broadly scattered across the state of North Dakota. After the crash, operators zeroed in on the core Bakken assets – clustering in the region with the lowest breakevens. This focus on the core drove results; well productivity surged following the downturn. In addition to high-grading wells in the best acreage, operators fine-tuned completion designs.

In the Williston Basin, rigs have come back as core infill opportunities still exist in McKenzie, Williams, Mountrail and Dunn counties. Breakevens in these areas are as low as $38/bbl, thanks to new well designs and better cost structures. Improved economics and new pipelines helped turn Bakken production around in 2017.

In January, Bakken producers got even more coastal access for mounting crude output, loosening up transportation constraints that could hinder growth plans. The Dakota Access Pipeline (DAPL) system expanded by 45,000 bbl/day earlier than expected, giving Bakken barrels additional tidewater access. The pipeline’s operator, Energy Transfer, has already begun to indicate that it could further increase capacity, by increasing horsepower, as demand merits.

The good news from DAPL is countered by uncertainty from another potential Bakken takeaway project, the proposed Phillips 66 Liberty pipeline project. The project hasn’t yet received an FID and wouldn’t provide additional transport relief to Guernsey until Q4 2020.

Rest of US Seeing Declines

The total US oil rig count has dropped by nearly 70 since November as operators adopt even more efficient drilling practices. With less money on hand, US E&P budgets are down 12% from 2018, and as companies work to generate cash flow for their investors, spending is falling. The increased capital discipline amongst US producers has the biggest influence on the declining rig count.

The lower spending is likely to lead to a decline in well completions this year. While completions improved by 20% last year, Wood Mackenzie forecasts an 8% drop from 2018 to 2019. In addition to lower activity levels associated with capital discipline, the move to longer laterals will also play a part. Operators will need fewer wells to get the same – or more – production as a result.

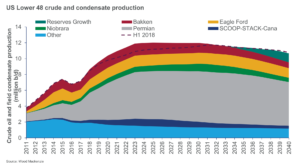

Companies continue to forecast output growth in 2019 as smarter operations, increased efficiency and better prospect targeting increase Lower 48 output. A group of 92 companies that released this year’s production guidance have published expectations to produce 1.5 million BOED – that’s 7% more than 2018. As inferred earlier, midstream infrastructure developments – both inland and coastal – could make or break the continued US oil production growth ambition.

Lower 48 onshore crude production will grow by about 5 million bbl/day from 2017 levels to a peak of 12 million bbl/day by 2025. Wood Mackenzie has seen a continued trend of initial production rates outperforming expectations, improving economics and increasing near-term growth potential. The latest forecast incorporates new subsurface data that give analysts the ability to measure oil-in-place by reservoir.

The Bountiful Bakken: Geology Driving Results

After focusing on core acreage for the past four years, Bakken producers are getting bolder in their exploration of non-core land. This has paid off. The basin’s subsurface benefits from two geological advantages: robust oil-in-place and highly brittle rock that’s conducive to hydraulic fracturing.

The core of the Bakken is deeper, with higher reservoir pressure that leads to improved production rates. The Bakken is highly competitive within the top Lower 48 tight oil plays from a type-curve perspective. The leading sub-plays in the region continue to break even below $50/bbl. Within eastern McKenzie County, there is an estimated single-well recovery of 625 mboe (68% oil) from the Bakken formation, over 30 years.

Bakken production will start to plateau as a whole in the mid-2020s.

On the Fringe of Bakken Core

Stronger oil prices in 2018 gave three Bakken operators the support needed to explore the western and southern edges of the Bakken play with modern completion designs in non-core acreage. All three companies expressed they were encouraged by the results and will continue to work in these areas.

• Marathon Oil: Preliminary tests of the four-well Ajax pad are giving Marathon confidence to extend the core southward. Early Middle Bakken production results yielded an average 30-day initial production rate of about 2,400 BOED, with 84% oil.

• Whiting Petroleum: The Foreman Butte asset acquisition, west of the core, was called “highly prospective.” The company plans 17 wells this year with more flexible Generation 4 and 5 completions that aim to optimize induced fracture size, depending on geology and existing well spacing.

• Oasis Petroleum: Just north of Whiting’s acreage, Oasis upgraded its Painted Woods position to “top tier” after promising well results from high-intensity hydraulic fractures. Subsurface maps indicate locally high oil-in-place volumes in this area.

As the Bakken play matures, the fringe production trends will play an important role in future output growth. Non-core performance has improved substantially since the downturn. Average 30-day initial production rates have increased year-on-year, rising by 78% since 2014. Wells drilled in 2018, however, saw much steeper declines, suggesting potential drainage by older wells in these lower reservoir quality areas. DC