Energy insurance industry nears tipping point heading into 2017

Low insurance costs could become scarce as everyday attritional losses exceed the total amount of premiums being paid

By James R. Pierce Jr, JLT Specialty USA

In the past decade, the upstream energy insurance market has been a safe port of call for investment capital looking for a home. Upstream energy companies have been the beneficiaries of the flood of capital that entered the insurance market. “Laissez les bon temps roulez” may have been the silent battle cry for the past several years. However, energy professionals long enough in the tooth know – perhaps better than anyone – that good times never last forever.

Energy insurance brokers and underwriters have worked hard to fight for energy service companies. Brokers know how hard things are for the energy service industry. Simply put, the job is to make an energy insurance portfolio a competitive advantage. An energy service company executive’s job should be to make sure the company is capitalizing on the opportunity to protect its balance sheet and enlarge EBITDA.

This article explores why the upstream energy market has been good for insurance buyers and why the paradigm will eventually come apart at the seams. It also addresses the need to make sure energy service company insurance programs are placed as efficaciously as possible. The battle cry “better late than never” comes to mind.

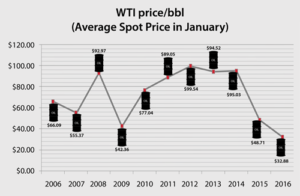

The past 10 years have proven to be quite a roller coaster ride for the global and United States economies and, interestingly though not in a similar fashion, for the upstream energy insurance market. While the world has witnessed dramatic ebbs and flows in the price per barrel of oil over that time, the US gross domestic product (GDP) has never exceeded 3% growth for 10 consecutive years.

Anemic global and domestic growth has created an investment environment where abundant capital has had a difficult time finding safe havens for deployment. The equity markets have become a familiar port of call, and it is no surprise that we have witnessed an increase in the Dow Jones Industrial Average (DJIA) from a low beneath 8,000 in 2009 to circa 18,500 today.

A cursory look at the 10-year US government Treasury inflation-protected security (TIPS) rates demonstrate just how difficult it has become for investors to find ways to achieve a return on capital employed.

With these dynamics extending over several years and pushing investors to seek alternatives to equity and treasury markets, the insurance sector became an alternative investment avenue. From 2009 to 2015, insurance market capital grew by over 30%, from $3.2 trillion to $4.2 trillion. Corporate capital at Lloyd’s of London increased by 68% from 2007 to 2016, from £16.5 billion to £27.7 billion (JLT Energy Market Review, 5 May 2016) This is germane to the upstream energy sector because Lloyd’s remains the figurative equivalent of Mecca for upstream energy insurance buyers.

During this period of time, there were no catastrophic losses. Hurricane Ike in 2008 was the last major loss to significantly impact the market. Note the consistent profitability of the energy business to the upstream insurance market.

In the upstream sector, there was a convergence of increased capital commitment and equally increasing demand for the employment of same until 2014. What happened then? Insurance underwriting capital was flowing into the market just as demand for product was escalating. CAPEX budgets in the upstream sector were exploding. Mercury, Venus and Mars were aligned.

Then, the price of oil cratered, and with it came the commensurate drop in demand for insurance product. For the first time in 30 years, investment in the oil sector dropped for two consecutive years. The industry cut spending by more than $300 billion, a drop of 48% from 2014 (International Energy Agency).

From 2014 to 2016, a classic supply-and-demand imbalance was experienced. There was simply too much supply of insurance capital in the upstream energy sector and too little demand. The result was that the bottom dropped out of pricing. In effect, while virtually all aspects of the upstream energy sector were horrible over the past two-plus years, insurance costs did nothing but drop. Insurance costs were one of the few silver linings in a very cloud-littered sky.

As stated earlier in this article, nothing good lasts forever. Low insurance costs are no exception. The energy insurance industry is now reaching a tipping point. That is the time when everyday attritional losses amount to or exceed the total amount of premium being paid into a particular sector of the market. This is where the industry finds itself as it looks ahead to 2017.

The first indicator of change will be witnessed by the 1 January re-insurance renewals. Re-insurance is what energy insurance companies buy to protect the portfolios of energy businesses they underwrite during the course of a fiscal year. The first ones to feel the pain of losses exceeding premiums are usually the re-insurers. Those in the business always look first to what re-insurers are thinking and charging for their product as a leading indicator of what one can begin to expect to see from the underwriters with whom energy business is placed.

This background information begets the question: What should a decision-maker do to best protect a company’s balance sheet and income statement?

A C-suite officer of any energy service company should make sure the company’s insurance policies are:

• In sync with its current contract exposures (risks and indemnities are different today than they were two years ago);

• Written with as broad form coverage conditions as possible; and

• Priced very competitively, given the favorable market that has existed for the past several years.

More specifically, make sure the company has negotiated state-of-the-art policy wordings in these areas:

• Named assured clauses;

• Removal of wreck and/or debris;

• Underground resources;

• Seepage and pollution; and

• Fines and penalties.

Companies may be surprised to find that they are not insured or are underinsured in those key risk arenas.

Perhaps most importantly, the energy service patch is in the throes of increased M&A activity. As a lesson learned in the past, prolonged depressions always lead to industry consolidation. There are specific insurance products in the directors and officers liabilities, reps and warranties, and environmental arenas that can represent the difference between getting a deal done or not. Whether a company is buying, selling or working through a distressed situation, insurance products are available to give the proactive company a competitive advantage.

The good times will not last forever, and now is the time and place for energy service companies to ensure they have the very best insurance products and are simultaneously availing themselves of opportunities that can be competitive differentiators. DC

This article is based on a presentation at the 2016 IADC Contracts and Risk Management Conference, 11-12 October, Houston.