Dual-fuel systems power up

Market for technologies to fuel drilling, well stimulation operations with natural gas expanding rapidly

By Katherine Scott, associate editor

Technology that seamlessly switches between diesel and natural gas– most call it dual fuel – is finally hitting its stride. Making an impact in both drilling and fracturing operations, dual-fuel systems have been estimated to save operators hundreds of thousands of dollars a year while offering them a choice in the fuel they use, whether its LNG, CNG, field gas or, when natural gas supply isn’t readily available, diesel; to many, it’s a win-win.

“It’s about the optionality. The magic about these dual-fuel kits is that you can run it on diesel, but it can run on a mix if it’s available at the time,” Alexander Robart, a principal with PacWest Consulting Partners, a strategy consultancy and market intelligence firm, said.

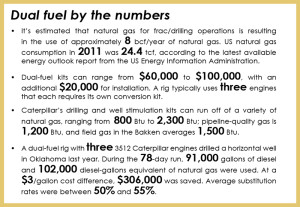

Simply stated, dual-fuel involves the ability to run engines on a combination of diesel and natural gas, allowing companies the flexibility to choose which fuel to use based on cost, supply and operation. Within the oil and gas industry, the use of dual fuel so far has mostly been limited to onshore North America in drilling rig and frac pump applications. PacWest estimates that more than 100 drilling rigs in the region now have dual-fuel capabilities. “We estimate that natural gas for frac/drilling operations is resulting in the use of about 8 bcf/year of natural gas. Most of it is being consumed for drilling,” James Coan, consultant with PacWest said. In its 2013 Annual Energy Outlook, the US Energy Information Administration estimated that the total natural gas consumption in the US in 2011 was 24.4 tcf.

While drilling technologies using dual fuel have been under continuous albeit slow development since the first application in 2006, this year it’s been all about fracturing operations, Mr Robart said. Describing it as being in an “experimental stage,” he said 2013 is the first year to really come on the scene in the context of fracturing. “But now everyone is testing it out in fracturing operations for the first time to see what their experiences are and then figure out what to do with it from there.”

Compared with drilling, fracturing operations require significantly more power, and it can be a challenge ensuring a consistent and quality supply of natural gas for such applications. “Frac spreads are anywhere from 16,000 to 24,000 horsepower or even higher, so that horsepower demand requires a significantly larger amount of natural gas supply,” Karl Blanchard, VP of Halliburton said. “There’s a big difference in being able to manage and deliver that much.”

This growth in dual-fuel fracturing is driving strong growth overall in dual-fuel technologies, Ed Wolf, sales manager for Iowa-based American Power Group, said. His company has doubled the number of fracturing units they’ve equipped with dual fuel since last year. “The drilling sector has been strong for quite a few years, but just in the last year the fracturing industry has really come on board. There’s some rumors that the fracturing industry is going to be using more dual fuel than the drilling rigs eventually.”

Like most new technologies trying to make a meaningful impact in the oilfield, the use of dual-fuel technologies comes down to cost. “Right now we’re just not in the booming market we were in before, so people are thinking, ‘how can I reduce costs across the board?’ It’s the question of who is going to drive it by spending the money and then how they are going to share those savings,” Mr Robart said. “It’s not going to be one group that makes the decision; it needs to be made together to push this forward. There are a lot of complex pieces here to build the capacity and create the demand.”

Cost pressures have increased over the past year and half, he said, particularly in gas plays like the Marcellus. “The gas plays is where dual fuel makes the most sense because you’ve got readily available gas,” he said, adding that dual-fuel kits can range from $60,000 to $100,000, with an additional $20,000 required for installation. If these kits can enable cost savings beyond the initial investments and boost project margins, “that makes perfect sense.” Typically, a rig utilizes three engines that each requires its own conversion kit.

Another important factor in the cost saving equation is the type of natural gas that can be used in a dual-fuel operation. “The long-range goal that most people have is to work toward being able to use conditioned field gas. It’s abundant. It’s relatively cost effective. It’s environmentally positive,” Mr Blanchard said.

Mr Coan agreed, noting that savings of nearly 2.5% to 5% of the total well cost could be achieved by using field gas, assuming a substitution rate of 50% and that diesel for fracturing operations accounted for 5% to 10% of total well costs.

Dual-fuel technology

At the 2012 Natural Gas for High Horsepower Applications Summit, held 26-28 September in Houston, Caterpillar announced its intentions to invest heavily in natural gas and to manufacture more natural gas-fueled equipment and engines. Joel Feucht, the company’s director of gas engine strategy for energy & power systems, stated at the summit, “We have decided to go all-in on gas. We are going to invest because we see a long-term, global opportunity. Large engines are going gas. It’s not debatable; it’s our conclusion.”

Two components of the company’s “all-gas” initiative are its Dynamic Gas Blending (DGB) kits, one for drilling that was launched in May 2012 and one for well stimulation, including fracturing applications, launched at the 2013 Offshore Technology Conference. Both operate under the goal of displacing as much diesel as possible with natural gas, which can include blends with ethane and propane, while maintaining the engine’s power and transient capability, according to the company.

Most dual-fuel projects so far have involved retrofits of current equipment “because of the large diesel-only engine population already in the field today and the relative ease of the retrofit procedure,” Russ Goss, a Caterpillar project manager in the Global Petroleum group, said. The kits can be installed in the field in approximately three days.

“The fuel savings achieved with this system depends on a number of variables, including the application, the quality of the gas, the pressure and available volume,” Mr Goss added. “But by retrofitting existing generator sets with this technology, a typical drill rig operator can save as much as $400,000 in one year, based on DGB’s substitution capabilities on a typical three-engine drilling rig with engines seeing around 4,000 hours per year. It’s also based on average fuel costs of around $3.50/gal diesel and $4/MMBTU field gas, along with assuming gas availability 70% of the time.”

Caterpillar currently has multiple drilling rigs and frac spreads operating in the US, Canada– in the Piceance basin, Marcellus, Barnett, and Haynesville – and is operating kits in production applications in Russia.

On the frac side, requirements are different because frac engines must run at variable speeds, as opposed to a constant speed for drilling, Scott Roberts, Caterpillar well service product marketing manager for the marine and petroleum power division, said. The DGB kit for fracturing, which is certified to Tier 2 emissions, has a maximum substitution rate of just over 60% at 100% load. “Our system can detect the changes in the fuel quality and adjust itself without someone having to go fix settings or recalibrate anything,” he added.

Both the drilling and well stimulation kits can run off a variety of natural gas ranging from 800 Btu to 2,300 Btu; pipeline-quality gas is 1,200 Btu, and field gas in the Bakken averages 1,500 Btu, Todd Krueckeberg, North America sales & service manager for global petroleum for Caterpillar, said. “You have to distinguish between pipeline quality, which is almost like LNG and CNG, and then literally what comes out of the wellhead. The raw gas at the wellhead is where you get the money savings.”

Field implementation

Although it may be operators who ultimately drive the adoption of dual-fuel technologies, particularly in well stimulation applications, it’s clear that drilling contractors also have a significant role to play. Engines on existing rigs can be retrofitted with dual-fuel kits, and newbuild rigs can be equipped with dual-fuel engines from the outset.

Scandrill, which installed its first dual-fuel retrofit in late 2012, is running five SCR rigs with dual-fuel systems – four in the Carthage, Panola county area and one in the Bryan-College Station area. “Dual-fuel systems are here to stay,” Paul Mosvold, vice president of Scandrill, said. “We continue to look at ways of offering the most effective and efficient rig combination to our customers, and one of the ways of doing that is integrating the dual-fuel system in any newbuilds in the future.” Most rigs with dual-fuel systems also have rig-walking systems, which allow them to stay on a single location for months at a time. This allows for greater economics of scale when installing gas supply lines to the rig.

Scandrill and Anadarko agreed to participate in a 2011 field-testing program for Caterpillar’s drilling DGB kit. “We have operated two Caterpillar DGB systems successfully on our Scan Endeavor rig and recently installed the system on the third rig engine. We have also chosen to install four American Power Group (APG) systems on four additional rigs.” All are operating on field gas, and Mr Mosvold said his company has seen substitution rates in the mid-60% range with Caterpillar’s system and mid-40% on the APG system.

“In the areas we operate, field gas or pipeline gas has been in most cases readily available, but early planning when building locations and sourcing of gas will help make the dual-fuel transition a success for both operator and contractor,” he continued.

Precision Drilling also says it has seen a steady increase in operator interest in dual-fuel systems, Darcy Whitten, the company’s manager of engines, said. The company currently has four dual-fuel rigs in the US – two each with Noble Energy and with Southwestern Energy – and eight in Canada working for EnCana. “Within typically 10 months, depending on what type of fuel they’re using, you can see your rewards start to pay off. I know a lot of contractors are hoping that they’ll have 10 to 20 dual-fuel rigs in the next year or so,” Mr Whitten said.

He added that operators have been willing to pay for the retrofits through higher rig rates. “The dayrate of the rig increases until the total cost of the system is recovered, then the dayrate returns to the original amount,” he explained of Precision’s dual-fuel rigs.

Mr Whitten also noted that he has seen no impact on engine life with dual-fuel systems so far. “We ran a dual-fuel system on a rig for 10,000 hours and stripped the top end (of the engine) off and checked for any signs of wear, and there was absolutely nothing. That engine has no idea that you’re putting natural gas into it.” Precision Drilling installed its first dual-fuel system on Rig 520 in 2008 for EnCana and continues to use the same dual-fuel kit today, Mr Whitten said.

The company is now even going a step beyond dual fuel by retrofitting two rigs with 100% natural gas Waukesha engines. The rigs are working for Antero Resources in the West Virginia/Marcellus Shale and Ohio/Utica Shale area. “Obviously that’s part of how the market is driven, but as a power systems manager, it’s better for me to just put the dual-fuel system on, and I can use it or not use it.”

For contractors who prefer to enter the dual-fuel market with built-in technology rather than retrofits, China-based Honghua Group and its US subsidiary Honghua America are developing a next-generation onshore rig for shale drilling that will come equipped with dual-fuel engines. A prototype for the rig is under construction at the company’s Houston yard and scheduled for completion in late 2013 or early 2014. “Dual-fuel engines, or more specifically mixed-fuel engines, have been maturing in the European and United States markets for the past 15 years and is only now more widely used, not only in applications of power rigs but also fracturing engines,” Zhang Mi, chairman and president of Honghua Group, said.

In China, too, he sees a growing prevalence in dual fuel, particularly for unconventional oil and gas exploration. “The trend of dual-fuel systems being adopted throughout North America and other countries is already quite noticeable, but in China a few companies, such as PetroChina Xinjiang Oilfield, have also begun pilot programs. Future demand will be quite large, especially in America, as companies are beginning to develop processes to purify the unpurified gas that is expelled from wells.” Better processes for conditioning field gas will expand dual-fuel applications for the future, he said.

Dual-fuel fracturing

Looking beyond the scope of drilling, service companies have continued to develop a number of products implementing dual-fuel technologies.

With the increasing activity in shale plays, Halliburton has seen a significant increase in the amount of equipment at wellsites. “Our environmental footprint, business footprint and the human capital at a typical location are the largest they’ve ever been. We recognize that as an opportunity to make a step-change in our equipment suite,” Ivan Blanco, program manager at Halliburton’s Duncan Technology Center, said.

The company is developing a suite of tools called Frac of the Future, designed to reduce wellsite footprint, improve environmental performance and enhance onsite equipment reliability. Components of the suite include technologies to reduce bacteria in fracturing fluids, recycle flowback and produced water and utilize solar power for proppant storage. There’s also the Q10, a dual-fuel fracturing pump where natural gas enters a gas train and is then filtrated and metered to sub out diesel. “This 2,000-hp unit running on diesel alone can burn 100 gallons an hour at full load. We’re able to substitute a max of 60% of that diesel with natural gas at full load, whether it’s CNG, LNG or conditioned field gas.”

The company has been working with Apache and Caterpillar since January 2012 to develop dual-fuel technologies for pumping equipment and just commercialized it in January of this year with 12 pumps at 24,000 hp.

Halliburton started the dual-fuel pilot with Apache in October 2012 in the Granite Wash and was able to run an entire frac spread with 12 Q10 dual-fuel pumps by January, Halliburton’s VP Mr Blanchard said. “We substituted north of 50% of the fuel demand with natural gas.” This spread is still running and has completed over 35 jobs for Apache.

Within Halliburton’s own operations, the company also is switching to natural gas when possible. In May the company deployed approximately 100 light-duty bi-fuel trucks across several US field locations. Bi-fuel in this case means the vehicle runs on natural gas until the tank runs out, then the engines and controls automatically switch to a reserve tank of gasoline.

Under this US pilot program, the bi-fuel trucks will eventually be assigned to 15 locations across seven states – Texas, Oklahoma, Colorado, California, Louisiana, Utah and Pennsylvania. “We selected these locations based on existing public CNG infrastructure, so the hope is that, as the demand grows, the infrastructure will follow. Once we gather the information from the pilot program, we’ll look at how we can make a larger-scale adoption globally,” Mr Blanchard said.

Pioneer Energy Services is another company that is testing CNG-powered vehicles with three Chevrolet 2500HD 4X4 Extended Cabs that have been converted to run on both gasoline and CNG using an AutoGas America system. The truck starts with a gasoline engine but then switches automatically to run on CNG. When the CNG runs out, the engine switches back to run on gasoline. “CNG was the fuel of choice for powering light-duty vehicles at Pioneer because of its reliability and growing availability as a transportation fuel,” Daniel Hindes, well servicing district manager for Pioneer, said. The company is converting its existing pickups for $8,500 to $10,000 depending on the engine and CNG tank size.

He added that the decision to test the new trucks was driven primarily by cost considerations. “We have paid CNG prices of $1.08 up to $2.24 of gas-gallon equivalent. The mileage is the same when running on CNG, so the comparison is simple math. When CNG is $1.99 per gas-gallon equivalent and gasoline is $3.50 per gallon, we are saving $1.51 per gallon. We expect to recoup the additional cost for the CNG conversion within 24 months depending on how much the driver can operate the vehicle on CNG.”

Although the company doesn’t plan to convert more existing trucks beyond the three they have now, it is evaluating CNG bi-fuel as an option on any vehicles purchased new. “The economics of converting an existing pickup are highly sensitive to the age and mileage of the truck. With today’s conversion prices, you need a pickup with low mileage to justify the expense of conversion over the life of the pickup,” Daniel Hindes, Pioneer’s well servicing district manager, said. “The option when ordering CNG through the dealer for 2013 is $11,000.”

One of the three trucks is being driven by management and sales staff for frequent trips to and from a Pioneer office in Bryan, Texas, and the Houston area. The other two are being used in daily operations to and from wellsites. “We are recording mileage information and figuring up the cost difference between running on CNG and running on gasoline… As we replace our existing fleet, we will definitely consider CNG bi-fuel vehicles for the locations that have CNG available,” Mr Hindes said.

Houston has six commercial CNG filling stations around the city, and others are located in Conroe, Bryan, Katy and Beaumont. Still, Mr Hindes acknowledged that CNG availability remains low, and this has significantly impacted the project. “Our tests have shown the economics of the expense for the conversion are highly sensitive to the percentage of the time that you can run the vehicle on CNG versus gasoline. We are shooting to run our pickups in Bryan on CNG 80% of the time. If we can run our pickups 80% of the time on CNG, the economics are very attractive.”

Pioneer is also researching options to convert well-servicing rigs and pumps to run on CNG and is testing the fuel-blending kits for engines on its drilling rigs. The company has installed the Caterpillar DGB kits on two of its drilling rigs and is in the very early stages of use.

Hythane Company, an alternative fuel company dealing with various engine combustion technologies, in 2011 commercially launched the OptiBlend retrofit technology for diesel generator sets. The technology can burn a mixture of up to 70% natural gas and 30% diesel fuel, but John Nadeau, the company’s director of sales, marketing, & business development, contends that it’s all about performance. “Nobody would be using this technology if it weren’t for its performance…If the operators had to give something up in order to get this, it wouldn’t be nearly as appealing.”

Mr Nadeau explained that the system injects natural gas, whether it’s pipeline gas, vaporized LNG or wellhead gas, into the air intake stream of the engine. “It goes into the combustion chamber and creates additional combustion, and the OEM control system reacts by adding less diesel to the mixture.” The amount of gas injected is based on several engine output parameters, such as engine vibration, exhaust temperature, generator frequency, and generator load via a PLC unit. “It’s a continuous feedback loop so we’re constantly adjusting the amount of gas going into the engine.”

Another system that monitors the engine to constantly adjust the amount of natural gas to feed in is the Turbocharged Natural Gas electrical control unit (ECU) from AGP. “Our ECU lets us determine how much gas substitution we need and when to use it,” APG sales manager Mr Wolf said. “We use a variable throttle body to determine the gas amounts at each of those different loads, and it reacts in milliseconds as the engine moves the loads back and forth.”

Depending on the engine and operation, Mr Wolf said, substitution rates with APG’s kit range from 30% at 10% load to 50% to 60% at 75% load. He noted, however, that companies should aim for an overall average substitution rate in the 50% to 60% range because running substitution at 70% or above could cause heat problems with the engines, and this could reduce equipment longevity. “We feel the safe way is in the 50% to 60% for substitution for longevity of the engine and actually an increase in its longevity because it burns cleaner.”

Last summer during a drilling application in Oklahoma, a dual-fuel rig with three 3512 Cat engines was used to drill a horizontal well. Over the course of the 78-day run, a total of 91,000 gallons of diesel and 102,000 diesel-gallons equivalent of natural gas were used. “The difference in the cost between diesel and natural gas was $3 a gallon, so it saved $306,000,” Mr Wolf said. Average substitution was between 50% and 55%.

In May, FTS International (FTSI) partnered with Cabot Oil & Gas to field-test a dual-fuel technology on pressure-pumping equipment for a fracturing operation in northeastern Pennsylvania. The aim was to use only gas from a producing gas well. “CNG or LNG could be used, but these do not provide as much opportunity to improve efficiency and reduce truck traffic to the wellsite as with using field gas,” Shawn Stroman, VP of engineering for FTSI, said. The unit tested at the Cabot site provided an approximately 63% substitution rate, according to the company.

The Marcellus is an especially good basin in which to test dual-fuel technology, Kevin Krebs, FTSI senior VP of manufacturing, said, because “wells produce a very ‘dry’ methane gas, which is very engine-friendly and doesn’t require additional refining to be used to power our pumps. The only step between the pipeline from the well and the engine is a gas-processing unit that reduces gas pressure from the well pipeline. In other parts of the country where the natural gas is not as engine-ready, additional processes must be put in place to prepare the gas for use in the engines.”

In order to operate using natural gas during the Pennsylvania field test, FTSI’s mobile pressure-pumping unit at the site was retrofitted with Caterpillar’s DGB kit. However, Mr Krebs expects that engine manufacturers will soon begin selling engines built as duel fuel from the get-go. “The main advantage to purchasing a dual-fuel engine, as opposed to converting an existing engine, is the economy that results from the engine being built with all the parts required for dual fuel already in place. With a conversion situation, some existing parts must be replaced with parts suited for dual fuel.”

Specializing in natural gas dedicated engines

Like Precision Drilling, other companies are also moving beyond dual fuel toward entirely natural gas-reliant products. Noble Energy, for example, kicked off a pilot program in 2011 in the DJ Basin to compare the benefits of diesel versus natural gas. The program gathered 12 months of operating data on three land rigs – two LNG-dedicated rigs and one running solely on diesel. The purpose was to demonstrate the operational and economic viability of powering the majority of Noble’s rigs with LNG, Bryant Dear, drilling engineer-DJ Basin for Noble Energy, said at the 2013 IADC Drilling Onshore Conference in Houston earlier this year.

As of May, Noble was operating one LNG-dedicated rig and four dual-fuel rigs. Each of the dual-fuel rigs is equipped with a GTI Altronic bi-fuel kit set up on three Caterpillar engines, Mr Dear said. “It’s too early to tell what our (fuel substitution) rates are, but we’re working to increase those as technology gets better and these systems get better… One thing we do know is you’ve got to displace as much diesel as possible (to achieve maximum cost savings).”

To support this extra demand for LNG, which Noble decided was the best natural gas option due to its higher energy density and consistent quality, the operator is even building an LNG plant in Weld County, Colo. “That’s going to bring our price much further down,” Sean Howley, senior business analyst for Noble Energy, said. Noble plans to build a portfolio of LNG-dedicated and dual-fuel rigs and is expanding LNG applications to its frac fleet as well. At the time of his presentation, Mr Howley said Noble had one dual-fuel frac engine that was running on LNG in the DJ Basin and expected to start a second in June. “If we don’t need (the LNG) on a frac job, we can roll it over to one of our rigs. When we don’t need it on the rig, we can roll it over to a frac job. It provides some really nice synergies for us.”

At Ensign Energy Services, engineering manager Brian Murphy said the company has seen an upswing in interest from operators in using natural gas as fuel, including 100% natural gas-dedicated rigs. The company first partnered with operator EnCana to use a natural gas-dedicated engine in 2006 in Wyoming’s Jonah field. The reduced emissions footprint allowed the field to be developed more rapidly, he said.

Today, out of Ensign’s 300+ drilling rigs, 17 run solely on natural gas and three are dual fuel. The most recent addition was a 100% natural gas-dedicated rig that headed to California for a major operator in late August. “With a dedicated natural gas engine, we believe that we can save in excess of $1 million a year on fuel. With dual fuel, you’ll save around $200,000 to $300,000 a year.” If the field gas supply is expected to be intermittent, dual fuel would make sense. Otherwise, if you’re operating in a field that has the infrastructure and the reliability of quality field gas, “that’s the first place where you want to apply dedicated natural gas engines; it’s the biggest bang for the buck,” Mr Murphy said.

In terms of performance, he added that he’s not seen much difference between the two types of engines. “A diesel engine operates on compression. It compresses the fuel, squeezes it, causing the fuel to ignite and then you generate power,” he explained. With natural gas engines, there are lean-burn and rich-burn versions, but in both an electrical spark ignites the fuel. “Rich burn engines are more diesel-like in performance,” he said, but they are also much heavier than lean-burn engines and require extra emission control features.” A lean-burn engine refers to a higher air-fuel ratio, whereas a rich-burn has a balanced air-fuel ratio.

In July, two of GE’s Waukesha natural gas-powered engines – VHP L5794GSI and VHP L7044GSI – received EPA certification for mobile application in non-road use, Aaron Trexler, power generation product line director for GE’s Waukesha gas engines, said. “With our rich-burn combustion technology, drill rig operators can power their site on almost any field gas, pipeline gas, propane gas, or CNG and LNG. The emissions are already approved by the EPA, so any location in 49 states these engines can be moved and operated.”

The two engine models, which meet the EPA non-road mobile Tier 2 emissions requirements, produce up to 95% less emissions compared with a diesel engine in terms of NOx and carbon monoxide, and there’s very little particulate matter, he said. A key differentiating feature is the engine’s ability to run on fuel in the 950 to 1,650 BTU range and accepting large load changes from the rig operation without interruptions to the power supply. “I think it’s going to get to a point where the driller’s not really going to know a difference other than they’re going to be saving money and having less emissions.”

Looking to the future, Mr Trexler said the rapid growth of LNG infrastructure in North America is changing the game in terms of widespread LNG adoption. “Even in the last six months, the LNG build-out infrastructure is moving at a very quick pace to meet the challenges of getting gas to sites that maybe don’t have much field gas or maybe supply is a little uncertain at times,” he explained. “Just talking to some of the contractors and the producers, they’re able to write contracts this year for LNG supply where last year it wasn’t even on the table.”

PacWest’s Mr Coan stated that four oil and gas companies are investing in the expansion of LNG facilities in North America for upstream and downstream needs. “Most of the LNG currently consumed comes from existing small-scale plants that utilities built long ago to store natural gas for emergency situations.” Shell is planning to build at least two small-scale LNG facilities in Geismar, La., and Sarnia, Ontario, each with a production capacity of 250,000 gallons/year. Stabilis intends to build five facilities, each capable of producing 100,000 to 250,000 gallons of LNG per day, and Noble Energy is constructing a facility in Keota, Colo., with production capacity for 100,000 gallons of LNG per day. ConocoPhillips has announced that it is also planning a facility but additional details are not available yet.

PacWest’s Mr Coan stated that four oil and gas companies are investing in the expansion of LNG facilities in North America for upstream and downstream needs. “Most of the LNG currently consumed comes from existing small-scale plants that utilities built long ago to store natural gas for emergency situations.” Shell is planning to build at least two small-scale LNG facilities in Geismar, La., and Sarnia, Ontario, each with a production capacity of 250,000 gallons/year. Stabilis intends to build five facilities, each capable of producing 100,000 to 250,000 gallons of LNG per day, and Noble Energy is constructing a facility in Keota, Colo., with production capacity for 100,000 gallons of LNG per day. ConocoPhillips has announced that it is also planning a facility but additional details are not available yet.

PacWest’s Mr Robart added that there’s a range of different industries like locomotives or waste management that are increasingly experimenting with natural gas. “I do firmly believe that this represents a tip-of-the-spear initiative to convert over to natural gas. The oil and gas industry represents a really meaningful early-stage set of investments to start converting things over, and I think there will be an overflow for this investment to drive natural gas demand across other related sectors.”

Could you supply CNG guel gas feed system for dual fuel eigine on vessels?

Dear sir, I would like to know if you will be interested in a project in IRAQ for drilling fuel and its in a safe area.

My Tel; 00961-76-929221 I am milad kesserwany from Lebanon, beirut