By Katie Mazerov, contributing editor

The tide is turning for offshore drilling. An outlook that six months ago was on a flat-to-downward trajectory is showing what many in the industry believe is the beginning of a turnaround. Buoyed by signals that the global recession is fading, an increase in oil prices, increased global energy demand and the call for new, more sophisticated rigs to construct increasingly complex wells, drilling contractors are feeling generally optimistic about the current and near-term offshore drilling market.

Newbuild activity, particularly for jackups, is robust, with several companies ordering new rigs for delivery over the next two to three years and planning to ramp up their work forces. Rig utilization is expected to recover, as are dayrates, with operators willing to pay higher rates for rig designs that feature improved safety, more automation and greater hoisting and pipe-handling capacity at greater depths and in harsher environments.

Despite concerns about unrest in the Middle East and frustration over the pace at which permits are being issued for post-Macondo Gulf of Mexico, contractors believe they are at the dawn of an uptick in business in most regions, including the newest deepwater frontiers – West Africa and Brazil.

“We’re starting to see evidence of a recovery coming, particularly in the jackup space,” said Tim Juran, executive vice president, Seadrill Americas, which focuses on ultra-deepwater drilling but also owns one of the world’s largest modern jackup and tender drilling fleets. “Plans by operators outside the Gulf of Mexico look quite encouraging,” he noted. Seadrill’s 18 jackups have, until recently, been deployed primarily in Southeast Asia and the Far East, but the company is seeing opportunities in West Africa and the Americas.

“We’re not pleased at the speed with which regulators are approving GOM permits,” Mr Juran said. “We are nowhere near approaching the level of activity that needs to be going on there to put this industry back in a robust condition and put people back to work. But once we do see that recovery in the Gulf, there is strong optimism that the deepwater and jackup sectors will be strong.”

In the meantime, Seadrill’s deepwater fleet is deployed in Brazil, the North Sea, Far East and West Africa. Nigeria and Angola, along with a number of smaller countries, offer strong near- and long-term opportunities, despite ongoing logistical challenges to procure the key support organizations and partners to meet government requirements, Mr Juran said.

“We are extremely active in both the deepwater and the jackup space,” he said, noting that Seadrill has taken delivery of 11 deepwater rigs since 2007 and has three more on order with two additional options. The company also recently acquired two rigs that were owned by Seadragon, with the first of those delivered in March. “We will take delivery of five newbuilds later this year,” he said. Last year, Seadrill also acquired a controlling interest in Scorpion Offshore, assimilating that company’s seven jackups into its fleet.

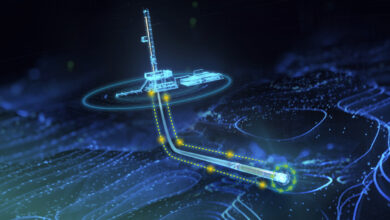

“The push is on expanding the drilling envelope in terms of well depths, water depths and improving the efficiency with which wells can be constructed,” Mr Juran continued. “In our fleet, growth has been characterized by moving away from moored, upgraded deepwater rigs to fully dynamically positioned rigs with all the control and interface technology that goes along with that.

“For the two drillships currently on order from the Samsung shipyard, the design is essentially the same as that of rigs we have taken delivery of over the last few years,” he continued. “However, the new ships will have 12,000-foot water depth capability and be capable of hoisting 1,250 tons, which is a huge advantage, particularly in places like the Gulf of Mexico.”

In the jackup sector, the bifurcation in the marketplace continues, driven in large part by an aging worldwide jackup fleet, with many of those rigs reaching the end of their viable economic lives. “As long as that bifurcation continues, we are not concerned about capacity or overbuilding,” Mr Juran said.

“The newer rigs will continue to work, while the older rigs will be retired, as the cost of refurbishing them is not cost-effective compared to the cost of building a new asset.”

To service its newbuild deliveries, Seadrill plans to hire at least 1,000 workers over the next 18 months.

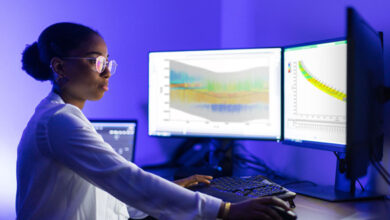

“In addition to the numbers, competency-building is probably the biggest single challenge for our industry,” Mr Juran said. “At Seadrill, we are moving toward an improved competency framework that will be up and running and in place by the end of this year.”

Diamond Pre-salt Presence

One of fastest-growing deepwater markets is Brazil, which is also the largest market for Diamond Offshore Drilling. The company has ultra-deepwater presence in the pre-salt and is active in mid-water depths, with 16 offshore rigs displaying the Black Diamond logo. Recently, two new sixth-generation rigs, the Ocean Courage and Ocean Valor, began operations for Petrobras. “In addition to drilling for Petrobras, we are active with the new company, OGX,” said Lyndol Dew, senior vice president. Worldwide utilization of the company’s 38 marketed rigs is at 97%. Two high-spec drillships – the Ocean BlackHawk and the Ocean BlackHornet – designed to operate in water depths up to 12,000 ft, are on order with deliveries scheduled for 2013.

“Our customers want large vessels that can operate safely, minimize flat spots in a drilling curve, and that can move from location to location quickly,” Mr Dew said. “Automation is also important, as long as it improves safety. Operators also want to have some kind of offline or dual activity, a lot of quarters capacity, multiple office spaces, large deck space and multiple mud systems.”

Specs for the new drillships include features that Mr Dew says will add value for operators. “We’ve specified a seven-ram blowout preventer, which will give us a lot of flexibility depending on what may be mandated by the latest government and/or operator requirements,” he said. “We’ve also chosen five mud pumps, giving us three pumps on the hole, one on the riser and one spare.” The drillships also include larger quarters, for 210 people.

As delivery of the new rigs approaches, Diamond will ramp up accordingly. “The skill set required for these newer rigs is significantly different than that for a jackup built in the 1980s,” Mr Dew noted. “Our preference is to grow organically and promote from within by taking employees through our Global Excellence Management System (GEMS) training and competency programs and bringing them along. We are in the process of looking at accelerated programs so that we can adequately and competently man our rigs on a go-forward basis.”

While oil price stability remains an industry concern, Mr Dew doesn’t see the recent price increases – in part a reflection of a falling US dollar – having a market effect on recession recovery. “Expansion is continuing in big population centers, such as India and China, and Western countries are coming out of the recession and starting to increase manufacturing capacity,” he said. “In response, we are responding to our customers’ requirements and upgrading and adding to our fleet in a cautious and conservative manner.”

Maersk high-capacity jackups

Maersk Drilling has two high-capacity jackups on order, with the first scheduled for delivery in late 2013 and the second in 2014. The rigs, which will be among the largest and most advanced harsh-environment jackups in the world, have been designed for the Norwegian sector, a niche market for Maersk, said Claus V Hemmingsen, chief executive officer of Maersk Drilling and member of the executive board of AP Moller-Maresk. “We’ve been an established and leading jackup contractor in Norway for more than 20 years,” he said. “We want to maintain our position there and also grow the deepwater segment of our business.”

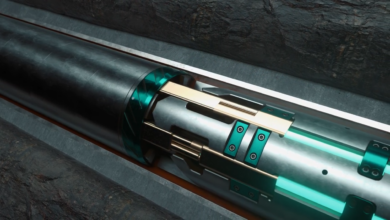

The new jackups offer a package that includes a fully remote-operated pipe-handling system; a top drive capacity of 1,000 tons to drill to 35,000 ft; extended cantilever reach to a record 110 x 80 feet; dual mud system; derrick capacity that allows drill pipe to be racked in quads and casing stands in triples; and a large drive pipe support deck to support a 150-ton vertical load and 100-ton horizontal load.

In keeping with Maersk Drilling’s culture of prioritizing safety and environmental compliance, the green rig design features energy efficiency and controlled discharge specifications to reduce the carbon footprint, and waste heat recovery systems to retain and utilize some of the thermal energy that normally is lost.

“The Norwegian regulations are among the strictest in the world, and we have always worked to go beyond what is required in that regard,” Mr Hemmingsen said. “Operators are looking at safety aspects more critically in the aftermath of Macondo. We are seeing a market differentiation starting to occur, both with operators selecting newer and more modern equipment, and with dayrates being significantly higher for newer, modern rigs because of drilling capacity and safety features.“

The new jackups also will provide single-room accommodations for up to 150 people. “The contractor that is able to attract and retain the best people in the industry will be the one that is able to run a safe and efficient operation,” Mr Hemmingsen continued. “That is why we are putting some extra features into the new rigs to optimize the working environment and make sure our people have a more comfortable life on board.”

In terms of outlook, Mr Hemmingsen believes demand for oil will be strong as the world emerges from the recession. “That trend is not moving very fast, but it doesn’t have to,” he said. “It only takes a very small increase in demand for oil to require a lot of drilling activity. I think we will see a demand for oil, both to optimize production of current fields and marginal fields, and also to do more exploration drilling. The outlook for solid oil prices is there, and that will lead to good activity in our business.”

While dayrates have come down, the deepwater market has been strong enough to handle the adjustment, he said. “Now that the GOM moratorium is lifted, most of us are going back to work. Short- to medium-term, we expect a steady, stable and relatively strong market.”

The big challenge, he contends, is personnel – to hire qualified, competent people to construct more complex wells in deeper water and in saturated reservoirs while also anticipating a retirement issue. “This is my biggest concern; we are all up against it,” Mr Hemmingsen said. “At Maersk Drilling, we’re doing a lot in terms of education, with training programs onshore and offshore. We try to be on the forefront of offering good career development and making sure we are an attractive employer.”

Atwood bolsters personnel training

Atwood Oceanics has bolstered its personnel training and competency assurance efforts since Macondo to support an anticipated sustained business uptick and the company’s high-specification newbuild activity, which includes three ultra-deepwater rigs and three jackups.

“Most E&P operators believe high oil prices are here to stay, so they are increasing their exploration budgets and extending their presence in offshore drilling,” said president and chief executive officer Robert Saltiel.

He is also optimistic about the gradual reopening of the Gulf of Mexico to deepwater drilling. “Operators lost a full year of drilling opportunities due to the moratorium, but the Gulf of Mexico remains a basin with excellent prospects, attractive fiscal terms and proximity to the large US market, all of which keep operator interest high in resuming deepwater drilling,” he noted. “We think demand for offshore drilling services worldwide will increase through 2011 and into 2012 and that dayrates for rigs will likely move upward in response.”

The outlook for Africa remains somewhat mixed, with unrest in North Africa curtailing offshore drilling plans for the Mediterranean Sea, and regulatory uncertainty remains a challenge in Nigeria, Mr Saltiel continued.

But the West African picture looks more promising. “Angola, Gabon and Ghana are seeing increased activity as prospects remain encouraging and new discoveries are made,” he said. “Liberia and Sierra Leone are emerging as potential deepwater areas in West Africa, as are Tanzania and Mozambique in East Africa.”

In Asia Pacific, offshore drilling activity is growing in shallow-water markets, including Thailand and Vietnam, and new deepwater exploration efforts are boosting floater activity in Malaysia, Indonesia and the Philippines, Mr Saltiel noted. “Australia drilling activity remains strong and looks to increase further on the back of prolific offshore natural gas discoveries and optimism for new LNG production projects to serve export markets in Asia.”

Atwood’s ultra-deepwater newbuilds reflect an evolution of proven technologies, offering such features as high-torque top drives for drilling deeper wells in deeper waters with broader safety margins; enhanced BOP stack configurations and capabilities for improved well control; larger cranes for deployment of subsea trees; and larger quarters for additional personnel. The company’s jackup newbuilds are suitable for drilling in all major basins that are not harsh environment, and they will provide clients with larger deck space, expanded fluids storage, offline tubular handling and 150-person accommodations, among other features.

“We recognize that our clients are increasingly engaged in more challenging drilling applications and that the premium on operations integrity and incident-free performance is higher than ever,” Mr Saltiel said. “Deepwater drilling is the major growth segment in the offshore drilling industry, and we expect to have a significant presence there while we also want to expand our high-specification jackup fleet to remain competitive in shallow-water drilling.”

The Atwood Osprey semisubmersible will be delivered from the Jurong shipyard this spring and begin a three-year program drilling the Greater Gorgon development in Australia for Chevron and its partners. The Atwood Condor, a 10,000-ft water depth semisubmersible with an enhanced drilling package and well control system, is scheduled for delivery by mid-2012.

The Atwood Advantage, an ultra-deepwater drillship with dual-derrick drilling capabilities for water depths up to 12,000 ft, is set for delivery in September 2013. The Atwood Mako, Atwood Manta and Atwood Orca – Pacific-class 400-ft jackups being constructed at PPL Shipyard in Singapore – are set for delivery in September 2012, December 2012 and June 2013, respectively.

Ensco sees HPHT as key growth area

As evidenced by the recent announcement of its planned acquisition of Pride International, Ensco will become the second-largest offshore drilling company in the world, with the youngest fleet of ultra-deepwater rigs, said senior vice president Mark Burns. “With the rise in oil prices and the significant investments being made in the deepwater sector, we are optimistic about future drilling demand,” Mr Burns said.

Together, the two companies have seven rigs under construction, which will require a significant increase in staffing and provide many career advancement opportunities for current employees.

“Pride has a major presence in some of the largest and fastest-growing markets, such as Brazil and West Africa. Pride also has drillships, which we do not,” Mr Burns noted. “Pride will benefit because we have the largest fleet of active premium jackups in the world, and Ensco is a dominant player in places like Asia and the North Sea. So this is a very good fit.

“In the deepwater arena, we’ve seen an increased level of customer inquiries for drilling over the last six months,” he continued. Ensco has four contracted ultra-deepwater rigs in the Gulf of Mexico, with one being sublet to French Guiana. “Our ENSCO 8500 Series rigs were the first to receive regulatory acceptance that included third-party certifications of BOPs and shear ram capabilities,” Mr Burns said. “As a result, we got back to work quickly in the Gulf on approved projects, even during the moratorium.”

In the shallow-water market, two of Ensco’s jackups were the first to be approved to drill GOM wells under new regulatory requirements. “We have been proactive and worked very hard to comply with the new safety requirements,“ Mr Burns said. Ensco expects to see utilization of its total premium jackup fleet in the low 80 percentage range by the end of the year.

A key growth area in the shallow-water sector will be high-pressure, high-temperature (HPHT) wells, particularly in the North Sea, Mr Burns said. Ensco has two ultra-premium, harsh-environment jackups on order, both scheduled for delivery in 2013, and options for two more. The rigs will be operational in water depths up to 400 ft, will have HPHT equipment, a 2.5 million-lb quad derrick and fully automated pipe-handling systems.

“Our outlook for the HPHT market is positive, as we see this as an area of increasing demand,” Mr Burns said. “That was part of our strategy in our purchase last July of ENSCO 109, an ultra-high-spec jackup with HPHT capabilities operating in Asia Pacific. At that time, rigs of that design were at 100% utilization, with dayrates averaging $150,000. We are fully contracted for the back of the year in the North Sea. And in terms of the newbuild jackups, our customers are preparing development plans to tackle these challenging HPHT wells.”

Hercules markets 11 jackups for GOM

Shallow-water contractors also are cautiously optimistic about prospects in the Gulf of Mexico, where, by the end of March, more than 30 permits had been issued by the US Bureau of Ocean Energy Management, Regulation and Enforcement (BOEMRE) since the moratorium was lifted.

“We’re seeing permits start to flow a little more consistently,” said John Rynd, chief executive officer and president, Hercules Offshore. “They are not being issued quite at the level we would like, but we’ve seen things become consistent, which enables us to keep more rigs at a higher utilization and also plan better.”

Hercules is marketing 11 jackups for the GOM, with 10 contracted.

A bigger concern is the price of natural gas. “That is the big challenge we still face in the Gulf of Mexico,” Mr Rynd said. “Natural gas is the primary driver for our customers in shallow water GOM. To gain more confidence, we need to see natural gas prices move closer to $5/mcf.” But, with the significant level of land drilling in US shale plays, he does not see that shift occurring in the next six to 12 months.

On a more positive note, Mr Rynd said the recent increase in oil prices is motivating customers to spend more, resulting in what he sees as the beginning of a global up cycle. He noted, however, that the recent run-up in oil prices to more than $100/bbl in response to upheaval in the Middle East comes with risk.

The industry is optimistic about the outlook for the global jackup market, which likely will be led by international business, Mr Rynd believes. “Overall, we’re poised for a global recovery in utilization. As large oil companies such as PEMEX, ONGC, Saudi Aramco, Chevron, Shell and ExxonMobil start to ramp up their activity, we anticipate growth in rig demand,” he said.

Hercules has two jackups contracted to ONGC in India, two contracted to Saudi Aramco, one contracted to Murphy Malaysia, and one to Chevron Angola. One platform rig is contracted to PEMEX.

“Long term, I am bullish on the West Africa jackup business, which is predominantly oil,” Mr Rynd said. “A lot of the major operators do business there, and we believe that region will start to turn around. We think the Asia Pacific region also is positioned to see some nice growth, driven principally by ONGC.”

Demand from customers for high-capacity jackups, a reflection of both the growing complexity of offshore wells and the aging fleet worldwide, is increasing, he continued. “Operators are wanting jackups that can access water depths in excess of 350 ft and have capacity for 1.5 million or greater drilling hookloads, three high-pressure mud pumps and variable deck loads to carry a lot of the operator’s equipment and consumables.”

He believes the age of the jackup fleet and the rate at which older rigs are being retired will offset the potential for oversupply.

While global dayrates vary, averaging from the high $70,000s to the low $80,000s, newer rigs are commanding much higher rates, which justify the capital investment, Mr Rynd said. “Domestically, rates for a standard 250-foot jackup are $35,000 to $40,000 per day. The bigger rigs are in the low $70,000s, and the newer models are $130,000 and up. For the new rig class we’re building, the average rate is just shy of $200,000 per day.”

Earlier this year, Hercules purchased the assets of Seahawk Drilling and formed, and owns 8% of, Discovery Offshore, a Luxembourg-based company specializing in ultra high-specification jackups.

Two such rigs, both for use in harsh environments, are on order from the Keppel FELS shipyard in Singapore and scheduled for delivery in Q2 and Q4 2013. The company has fixed-price options, which must be exercised in July and October this year, for two more high-spec rigs, for delivery in 2014.

“We felt the timing for this investment was right, as we believe we’re in the early stages of a nice recovery in our business,” Mr Rynd said.

ENSCO 8500 Series is a registered trademark of Ensco.