2018 OTC Spotlight on New Technology Awards highlight 17 innovations

OTC announced the 17 technologies that are receiving the 2018 Spotlight on New Technology Award, two of which are being recognized in the Small Business category.

The Spotlight on New Technology Awards – a program for OTC exhibitors – showcases the latest and most advanced hardware and software technologies.

Aegion Coating Services (ACS), producer of ACS HT-200

Aegion Coating Services (ACS), producer of ACS HT-200

ACS HT-200 is an ultra-high temperature subsea wet insulation system for pipelines, risers, field joints and subsea equipment with operating temperatures up to 204°C (400°F). This end-to-end deepwater solution is comprised of an anticorrosion coating covered with an insulation layer and topped with a tough polypropylene exterior.

The N-type “Icemann,” a motion-compensated gangway system, enables safe people transfer year-round in harsh winter conditions up to 18°F/-28°C.

The fully enclosed and insulated system is operational in sea states up to 3.5 m significant wave height and certified under the winterization design code DNV-GL-OS-A201.

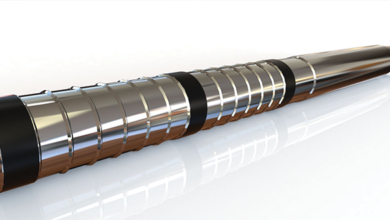

Baker Hughes, a GE company (BHGE), producer of TerrAdapt adaptive drill bit

Baker Hughes, a GE company (BHGE), producer of TerrAdapt adaptive drill bit

Unlike conventional bits that are limited to a single depth-of-cut (DOC) control setting, the TerrAdapt adaptive drill bit autonomously adjusts DOC to mitigate stick-slip and expand the smooth drilling window with no surface interaction.

Adaptive DOC-control elements automatically adjust the bit’s aggressiveness based on the formation it is drilling.

BHGE, producer of DEEPFRAC deepwater multistage fracturing service

BHGE, producer of DEEPFRAC deepwater multistage fracturing service

The DEEPFRAC deepwater multistage fracturing service leverages tools and techniques perfected in the unconventional plays to improve the efficiency and economics of offshore completions.

The service comprises DEEPFRAC ball-activated sleeves and patented BeadScreen flowback control technology to simplify operations, accelerate completion times and enable rapid stimulation of 20-plus stages in a single trip.

Delmar Systems, producer of RARPLUS

The RARPLUS technology gives drilling rigs the capability to completely release from their moorings within minutes to evade ice floes, cyclonic storms, well emergencies or to simply increase rig move efficiency.

With a backup mechanical release function, the system provides reliable flexibility to dynamically positioned/moored rigs operating in shallow waters.

Dril-Quip, producer of Hands-Free Marine Drilling Riser System (HFRE)

Dril-Quip, producer of Hands-Free Marine Drilling Riser System (HFRE)

The HFRe is an automated system designed for high-pressure, high-temperature applications incorporating SmartSpider technology. It reduces risk and operational costs by providing critical feedback and eliminating rig floor personnel during installation.

HFRe utilizes a boltless, fatigue-resistant 4-million-lbf coupling that has been tested beyond API 16F/TR7 requirements.

Expro, producer of Next Generation Landing Strings (NGLS)

Delivered in accordance with API 17G standards, NGLS provide the optimal subsea well intervention and commissioning system by combining cutting-edge technology with ground-breaking analysis and validation.

Halliburton, producer of GeoBalance Automated MPD System

Halliburton, producer of GeoBalance Automated MPD System

The GeoBalance Automated MPD System is a suite of software and hardware enabling automated managed pressure control from drilling to completion. It combines automatic chokes, rig pump diverters, flow metering and advanced control algorithms with proven hydraulics modeling to provide accurate pressure control at discrete points throughout well construction.

Halliburton, producer of 9 1/2-in. Azimuthal Lithodensity (ALD) lWD Service

The 9 ½-in. ALD logging-while-drilling (LWD) service is first large-borehole LWD service capable of delivering azimuthal density, photoelectric and ultrasonic caliper measurements to enhance reservoir understanding and reduce well time in borehole sizes ranging from 14 ½ in. to 17 ½ in.

LORD Corp, producer of 10K Completion Workover Riser Flexible Joint

LORD Corp, producer of 10K Completion Workover Riser Flexible Joint

The compact size of the 10,000-psi flexible joint allows smaller vessels to operate a top-tensioned riser without a stress joint or telescopic joint, enabling lower-cost high-pressure interventions. When replacing a bottom stress joint, the significantly lower moment on the wellhead enables more workovers per well, extending field life.

National Oilwell Varco (NOV), producer of NOVOS

NOVOS is the industry’s only reflexive drilling system, automating repetitive drilling activities, benefiting contractors by allowing drillers to focus on consistent process execution and safety, and benefiting operators by optimizing drilling programs. The system provides the ultimate control and consistency for any operation.

Seabox makes it possible to treat seawater at the seabed and provide high-quality water for reservoir pressure support. Driven by the suction pressure of a downstream pump, Seabox provides disinfection and sedimentation capabilities without adding chemicals.

Oceaneering International, producer of E-ROV System

The E-ROV is a battery-powered, remotely operated vehicle system capable of operating for extended periods without being recovered to surface. Comprising an electric ROV, 4G connection buoy and subsea cage, the system reduces cost and risk.

Oliden Technology, producer of GeoFusion 475 Laterolog Resistivity and Imaging ![]() LWD tool

LWD tool

GeoFusion is a drilling, formation evaluation and production optimization solution. It provides high-resolution and high measurement range array quadrant resistivities even while sliding. It’s augmented by bit resistivity and high-resolution wellbore resistivity images and azimuthal gamma images.

Teledyne Marine, producer of FlameGuard P5-200 electrical penetrator

Teledyne Marine, producer of FlameGuard P5-200 electrical penetrator

The offshore industry’s first patented fire-resistant electrical penetrator reduces risk to personnel and assets. The penetrator, rated for 5 kV and 200 A at 5,000 psi, is designed for safe operation in potentially flammable atmospheres where ATEX and IEC Ex standards apply.

Small Business winners

CoreAll, producer of Intelligent Coring System

CoreAll, producer of Intelligent Coring System

The Intelligent Coring System provides real-time transmission of formation evaluation data to surface. Along with downhole diagnostics and core jam indicators, this improves data quality and saves time and cost in exploration activities.

Luoyang Wire Rope Inspection Technology, producer of TCK.W Automatic Real-time Online Wire Rope Inspection System

The TCK.W Automatic Real-time Online Wire Rope Inspection System improves periodic human visual inspection by bringing in-process safety monitoring to its highest state through continuous inspection.

C6 Technologies runs comtrac intervention technology in Norwegian north sea

C6 Technologies has completed an application of its ComTrac technology in conjunction with its parent company, Archer. The system comprises a reel of spoolable 12-mm diameter semi-stiff carbon composite rod with electrical conductors. To date, the technology has been proven to operate at lengths of up to 8 km. The two-week project in the Norwegian North Sea, which was operated by Archer, is the first time the composite rod has been used with a tractor.

This enables intervention beyond the capabilities of conventional wireline technology in terms of length and load, particularly for horizontal wells, the company said. The scope included fishing, fluid saturation logging and perforating with long sections of high shot density guns. The low friction, stiffness and almost non-existent stretch of the carbon composite rod eliminate the problem of “stick and slip” experienced with wireline cables.

Delmar installs first set of RAR units in Gulf of Mexico

Delmar has installed the first set of RAR Plus units. These nine rig anchor release units were deployed on a moored semisubmersible in the Gulf of Mexico with the company’s releasable MOOR-Max system. RAR Plus features an independent manual backup release method and increased ultimate and release load ratings. It can also transmit both direct and indirect line tension measurements from internal sensors for real-time display onboard the rig.

BlueCoil achieves more than 2.2 million running feet

In the Permian Basin, a coiled-tubing service company was running conventional tubing strings that were lasting approximately 425,000 running ft. Tenaris then offered its BlueCoil, a heat-treated coiled tubing that is designed to last two to four times longer than conventional coiled tubing. The customer ordered a 25,900-ft long, 2.375-in. diameter hT-125 BlueCoil string. For nearly a year, the service company continued to run the string longer and longer and to push the fatigue limits further. The company has since achieved a record of 2.2 million running ft at 99% fatigue on its model.