Technology Development: A game of risks vs rewards

Industry investing in new generation of forward-thinking technologies even as it works to overcome old mindsets, barriers

By Katie Mazerov, contributing editor

When National Oilwell Varco (NOV) unveils its open-platform drilling automation system NOVA in 2014, it could be the step-change to autonomous drilling that will alter the future of hydrocarbon recovery.

Development of the system is marking a shift from product-thinking to process-thinking, a transition that must occur for the industry to move forward, says Hege Kverneland, vice president and chief technology officer for NOV. “We need to look much more at the process of drilling a hole in the ground more efficiently – better, faster and safer,” Ms Kverneland said.

“Most of the new product development will be focused on the well and well safety, and the drilling process related to that, by making equipment like robots and taking humans out of the middle.”

Major service companies also continue to be leaders of innovation, particularly in the development of downhole tools. Foremost among those are data delivery technologies. But with the tremendous amount of data to process, many believe the focus now should be on ways to more meaningfully process the data.

“Data is important, but even more important is taking that data and turning it into useful information that enhances the quality of the decisions being made and to provide a holistic view of rig operations and the health of the well,” said Mark Mitchell, vice president, drilling optimization for Weatherford.

In an age of hard-to-extract, tight oil and gas reserves, new attitudes about technology development are moving the industry to the next generation, powering the boom in unconventional oil and gas production, exploration of new frontiers in ultra-deepwaters and ventures into extreme environments that were previously out of reach. Most agree that new technology must have the right stuff to make it in this high-stakes business – that is, bring value by reducing risk, enhancing safety and delivering greater efficiency.

The push is coming from inside the industry and out – large independent and major oil companies, forward-thinking national oil companies, major service providers, drilling contractors, equipment manufacturers and entrepreneurs – all aiming to expand the envelope in oil and gas recovery.

Earlier this year, for example, BP announced the establishment of the $100 million International Centre for Advanced Materials (BP-ICAM) to promote the understanding and use of materials for a variety of energy and industrial applications. The 10-year investment program, headquartered at the UK’s University of Manchester, initially will focus on three areas:

• Structural materials, such as new metal alloys and composites for deepwater production and high-pressure, high-temperature (HPHT) reservoirs;

• Smart coatings for increased protection from the elements and improving a structure’s usable life, protecting pipelines and offshore platforms from corrosion; and

• Membranes and other structures for separation, filtration and purification of oil and gas, water and chemicals in production, refining and biofuels processes and petrochemicals.

Changing the mindset

However, the challenge is often not developing the technology itself but changing the mindset, Ms Kverneland of NOV maintains. “The technology is there,” she said. “Today, there are factories producing auto parts that don’t even have the lights on because the work is all being done by robots. The mining industry has had fully automated rigs for years that are remotely operated. We need to adopt these systems, start using them and trust that they will work. Trust is the biggest barrier we have.”

NOV expects its drilling automation system to gain early adopters in 2013 while most companies will take a wait-and-see attitude. NOVA encompasses a new operating control software platform – NOVOS – which includes a planning component that builds the well program into the control system, allowing the rig to automatically follow the well plan, similar to a flight plan. The surface control system will have an application management system, allowing a service company, for example, to write an “app” to the control system and perform intelligent well functions using the system as an interface to the rig.

Ms Kverneland believes the US unconventional shale market will be a testing ground for such automation because of the high volume of wells that need to be drilled efficiently. “If we can improve drilling performance on each well by 30% or 40%, it makes good economic sense.”

Managed pressure drilling (MPD) is another technology that’s expected to make inroads in the coming years, not only in ultra-deepwater fields but also for land applications. Chevron is currently testing a dual-gradient system in the Gulf of Mexico that, if successful, could help to make MPD equipment standard on more offshore rigs. “MPD equipment should be as standard as an iron roughneck or pipe-handling equipment, both offshore and onshore,” Ms Kverneland noted. “We’re not there yet, but we will be in the future.”

Overcoming the barriers

Among the leaders of drilling innovation is Maersk Drilling, an early promoter of rig automation and “green rig” designs. “We at Maersk see ourselves as a forward-thinking company with an emphasis on the high-end jackup market, especially in Norway,” said Frederik Smidth, chief technology officer. The company is currently building three jackups and four deepwater ships as it works to expand its deepwater operations. “For example, we see automated pipe handling as a given today, not a new technology. Our latest generation of rigs offers a high degree of automation, meaning more machines can be operated in one sequence without human interface.”

The risk/reward balance is an important consideration as the industry pushes the boundaries for bigger, heavier deepwater rigs and 20,000-psi blowout preventer (BOP) stacks. “There are a number technological barriers and risks, but the commercial barriers are bigger for the ultra-deepwater,” Mr Smidth said. “We can overcome the technological risks, but any new technology needs to make economic sense, and operators need to share that risk with the drilling contractors. A new technology must offer improved safety, deliver efficiency for our customers and be cost-effective.”

The Arctic serves as a good case study for that view as the industry considers ways to make year-round drilling feasible in that extreme environment. “For year-round drilling, we need a very robust unit that can be permanently stationed as an offshore hub to launch operations,” he said. The concept is in the early stages of development.

Looking ahead, Mr Smidth sees more integration of surface equipment with downhole tools, with the traditional boundary between drilling contractors and service companies becoming less defined and operations trending to a more open-platform concept. “Drilling contractors need better access to real-time information during the drilling process,” he said. “The current contractual model tends to isolate the contractors from information and prevents us from using new technology.”

He also believes the industry will become more strict in requiring companies to conduct formal testing of software, or software verification, a process Maersk is currently doing to a high degree. “Problems with new equipment are often the result of issues with the software.”

Making data useful

The overriding goal still comes down to relevance and value. “It doesn’t matter how good a particular technology is if it is poorly commercialized,” said Weatherford’s Mark Mitchell. “It won’t be readily available for industry uptake, and it won’t see the benefits of further investment or refinement.”

“In terms of well construction, we like to talk about the concept of investing in drilling reliability and well integrity, meaning consistently delivering planned results with no uncontrolled loss of fluids coming or going with good zonal isolation,” said Brent Emerson, Weatherford’s vice president for well construction products. In that regard, he believes advances in micro-annulus-sealing technology, such as the MicroSeal, which combine older, reliable methods with new technology, has brought significant value to a client’s well integrity.

There is also a significant pursuit of tools and equipment to take the industry into deeper waters, with higher pressures and temperatures, Mr Mitchell noted. “Deepwater has proven to be a great incubator for many drilling technologies, such as MPD, top drives, rotary steerables, ERD and 3-D seismic. Today, automation is very much on the critical path, with most efforts aimed at reducing risk associated with surface operations, separating people from hazardous tasks and optimizing the drill floor. We are now starting to see a good deal of focus on closed-loop control systems, such as with automated MPD, to optimize drilling operations, especially in high-risk or highly complex wells.”

R&D investment needs to be a balance – evolving and enhancing technologies to keep production going while developing out-of-the-box technologies that are true game-changers, Mr Emerson added.

“From a service company perspective, the biggest opportunity is in situations where there are a lot of wells and a repeatability factor, as we’re seeing in the unconventional US shale plays. But, if you’re going to be a full-service provider, you have to play in all the arenas. There are not thousands of wells in the Arctic, but the prize is big. Operators see that the reserve potential is enormous in ultra-deepwater and the Arctic, but they have to find a way to drill those areas economically,” Mr Emerson said.

He also believes the industry is investing a tremendous amount of money in new technology, most of it on the right things. “The oil industry is fundamentally very risk-averse, and bringing technology to market takes a long time. And, regardless of how great it is, if it doesn’t work with the processes being used today, it will create a culture gap and become stranded.”

Finding resources, lowering cost

Bringing technologies to market is the mission of Lime Rock Partners, a venture capital firm that funds entrepreneurial firms where many innovations for the oil and gas industry are conceptualized.

“There are two types of technology – one that finds more oil and has a very obvious high-value proposition, and technology that reduces cost,” said Trevor Burgess, managing director at Lime Rock Partners. “Typically, anything related to drilling is about reducing costs, while finding more oil is related to exploration. While there is more excitement in the industry for technologies that increase reserves, those tend to be much harder to develop. Most of the research and development money being spent nowadays is on reducing costs or extending the boundaries of existing technology.”

Independent oil companies are willing to support field testing in the North American land market, which is a strong arena for testing new tools, Mr Burgess noted. But new technologies also are being pushed by what Mr Burgess says are some “enlightened” national oil companies, notably Statoil and Saudi Aramco. “These two companies publish a list of their major challenges and where they believe the best value propositions will be, and challenge the industry to come up with solutions. Then, they help the industry develop the technologies.

“At the same time, the large service companies tend to focus on product evolution, developing technologies designed to improve what they already have,” he continued. An example is the evolution of motors to rotary steerable systems and logging technology. “For these companies, there is lower risk in advancing their own products, or acquiring technologies that can enhance their systems.”

In any case, technology development takes years and significant capital to develop and involves much more than simply commercializing the latest and greatest widget. The ability of a new tool to work in concert with existing systems is critical and an important criterion for Lime Rock.

“We try to find niches where we can introduce technologies that are easily integrated into the oilfield and add immediate value,” said Mr Burgess, who is also chairman of the board of Reelwell, a Norwegian company that is advancing innovative technologies for improving riserless and ERD in wells.

“Anything that has the words ‘revolutionary’ or ‘game-changing’ is a turnoff. Certain work practices have taken years to develop, and new tools need to fit in with the current structure and optimize it.”

In that regard, he is frustrated by criticism that the industry is slow to adopt new technologies. “When one looks at what has been accomplished in the last 20 or 30 years, there have been some outstanding developments,” he said. “Natural gas is cheaper in the US now because of technology. We’re drilling in water depths that 20 years ago were considered unimaginable, and the number of exploratory wells that fail to come to fruition is far less than in it was 30 years ago. The industry has made tremendous strides in lowering the risk of exploration and drilling wells more efficiently and safely. All of this has been made possible with technology.”

Prime examples are horizontal drilling and multi-stage fracturing, which have fueled the industry’s success in tapping North American oil and gas shales. “Any discussion of technology has to address the technology dividend, for example, lower natural gas prices that have led to a reduction in the cost of power, all made possible through these two significant technology breakthroughs,” said Tom Bates, senior advisor for Lime Rock and chairman of the board for Hercules Offshore, Independence Contract Drilling and Global Energy Services.

Balancing risk, reward

While it is difficult to quantify the current level of R&D spending in the industry, Mr Bates believes it is where it needs to be for today’s challenges “You must balance risk and reward,” he said. “People won’t invest if they don’t see a return.” Sources of investment have shifted over the last 30 to 40 years, he noted. In the early 1970s, most R&D spending was by international oil companies, while the 1980s and ’90s saw more spending by the major service companies, he noted. “Today, there are substantial dollars being invested from non-traditional sources.” Much of the research into the basic sciences is occurring in the field of nanotechnology, the study of microscopic particles.

“What the industry is waiting for now is the ability to put processing equipment on the seabed and thereby eliminate the need for high-cost platforms,” Mr Bates said. “This has huge cost incentives as the industry pushes into deeper waters.”

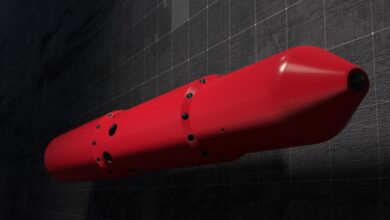

The burgeoning deepwater market is indeed proving to be a catalyst for developing high-value innovations, such as the Reelwell Drilling Method (RDM), an extended-reach technology that provides access to fields that are currently too risky or expensive to reach. By extending the drainage from a fixed platform, the system improves recovery and lengthens the life of the field. Reelwell is in the process of commercializing the technology and will embark on a pilot project with several major operators for wells with reaches up to 20 km (65,616 ft), said Reelwell CEO Jostein Aleksandersen.

“With this new method, we can develop reserves from an existing platform and infrastructure, avoiding the need for additional platforms and costly subsea installations,” he said. The system also can facilitate ERD from onshore locations in sensitive regions such as the Arctic, where the thick ice cap presents drilling challenges. “We are talking with a number of operators developing Arctic fields, who need to reach multiple wells from a single land location.”

The drilling method also can be used in reservoirs with hard-to-manage downhole pressures and hole-cleaning issues, commonly seen in horizontal wells, by providing a closed-loop flow circulation system for returning drill cuttings to the surface, Mr Aleksandersen explained.

The company is also developing a riserless drilling method and later this year will embark on a project with a major operator. This riserless drilling method can deliver a significant savings benefit to operators, Mr Aleksandersen said. “Using third- and fourth-generation rigs for deepwater wells implies a 25% to 35% cost reduction,” he noted. “Longer-section slender wells based on 13 5/8-in. wellheads implies 20% to 30% reduced time overall to drill a well, and in cases where the two can be combined, the savings could be in excess of 45%.”

Streamlining the process

At the other end of the spectrum is a new method of recovering and disposing of drilling waste at the rig site. After developing the technology 12 years ago, Total Waste Management Alliance (TWMA) now provides integrated drilling waste management, engineering and environmental services and technologies for the onshore and offshore oil and industry. The company entered the US land market in 2011 in the Bakken and Eagle Ford plays with its mobile TCC RotoTruck cuttings treatment system.

“We take solids control and cuttings disposal a step beyond traditional shaker and dryer methods to meet increasingly stringent environmental standards and reduce costs for operators,” said Ronnie Garrick, managing director, TWMA. Using the TCC RotoTruck and RotoMill technologies, along with a cuttings collection and distribution system, the company can separate hydrocarbon-contaminated drill cuttings into the constituent parts of water, oil and solids using an alternative process to emulsion. The system can process up to nine tons of cuttings per hour at the rig site. Once cleaned and dried, the cuttings are environmentally safe to be discharged into the sea, disposed of onsite or sent to a non-toxic landfill.

“Corporate responsibility in meeting environmental standards, along with operational challenges of increasingly deviated and deeper wells and more HPHT conditions have been huge drivers in the development of this technology,” Mr Garrick said. “Operators are looking for clean, cost-effective compliance.”

The mobility of the system, through the RotoTrucks, also addresses the logistical and financial challenges of handling waste processing in increasingly remote offshore and land locations, he noted.

MicroSeal is a trademarked term of Weatherford.