Dissolvable tools, plug-less and wave fracturing among innovations delivering more efficient multistage completions

Better reservoir modeling, CT-deployed systems also among efforts to maximize field economics

By Katie Mazerov, Contributing Editor

The past 12 months have been marked by market volatility, pressures to cut costs and a drastic reduction in the number of onshore wells drilled. In the unconventional sector, however, innovation for multistage completion technology has not diminished. R&D efforts are pressing on in response to operator demands to drive down costs and boost recovery.

“The great, and sometimes challenging, thing about the unconventional market is that it moves at such a fast pace. Technology has to innovate quickly as customers push the boundaries to drill longer laterals, which require higher stage counts,” said Ben Wellhoefer, Global Commercialization Manager, Unconventional Completions for Halliburton.

As oil and gas companies try to make the most of their best assets, service providers are working on solutions that eliminate steps and complexity in the completion process. New degradable, or dissolvable, tools and increasingly sophisticated reservoir modeling software are complementing ongoing efforts to better understand fracture networks, all aimed at maximizing field economics.

In the Horn River Basin unconventional gas play in northeast British Columbia, Canada, Nexen Energy, a wholly owned subsidiary of China National Offshore Oil Corp (CNOOC), has improved recovery on well pads by experimenting with a variety of multistage completion techniques. These include plug-less and wave fracturing. “We’ve learned where to land wells and how to space wells, moving from eight-well to 20-well pads,” said James Pyecroft, Senior Staff Engineering Specialist for Nexen, headquartered in Calgary.

Plug-less fracturing was developed, he said, after some perforating gun/plug misfires revealed that new perforations were being stimulated while existing perforations – where sand had been pumped – remained open. “Microseismic showed that most of the fluid was going into the new perforations, and most microseismic events occurred opposite those stages.” Wells using the technique are performing to plug-isolated expectations in three formations of the Horn River Basin.

The plug-less method offers several advantages over the conventional plug-and-perf (P&P) method, which requires over-displacement of the proppant in the wellbore. “It eliminates the cost of setting and milling out plugs and enhances fracture hit pressure monitoring because the perforations along the well are always exposed to surface pressure gauges without interference from plugs,” Mr Pyecroft said.

Wave fracturing, which has been applied with plug-less perforating, is being used by Nexen on pads configured with 10 wells drilled to the northwest and 10 drilled to the southeast. Rather than treating each well sequentially from toe to heel, Nexen treats all the wells starting in the toe by moving back and forth, in a wave pattern, from one well to another, in order to intensify fracture interference among the wells and stages and create positive fracture complexity growth, he explained.

Fracture hits across the pad are monitored with pressure gauges placed on every wellhead during stimulation. Time lapse between stages within a wellbore is 32 hours and less than one hour between stages of offset wellbores. “We believe there is an optimal relaxation period that provides an opportunity for fracture network energy to dissipate, creating more broadly stimulated and complex fracture networks without reactivating previous fracture networks,” he said.

The wave fracturing technique will be highlighted in a paper, “Interwell Hydraulic Fracture Interaction Between Multistage Stimulated Wells and a Multizone Slant Open Hole Observation Well Placed in the Canadian Horn River Basin Muskwa, Otter Park and Evie Shales,” to be presented on 11 February at the 2016 SPE Hydraulic Fracturing Technology Conference in Houston.

“The purpose of the observation, or capture, well was to gain an understanding of how fracture networks grow between wells on a pad and prove the ‘capture’ concept, which maintains fracture treatments can extend to offset wellbores,” Mr Pyecroft explained. The stacked Muskwa, Otter Park and Evie plays are separated by lower-quality shale reservoir rock, with each play exhibiting different reservoir qualities and degrees of fracture-ability. In November 2013, the open-hole slant capture well was drilled to a measured depth of 4,046 m (13,274 ft) and positioned equally between Evie and Muskwa wells spaced 150 m (492 ft) apart.

The capture well deviated at a 60° angle at the top of the Muskwa shale formation below intermediate casing set in the Horn River Basin’s Fort Simpson formation, then became horizontal when it was landed in the Evie. In July 2014, wells were hydraulically fractured in a continuous wave, or staggered, fashion – Otter Park, Evie and Muskwa – so as not to mask the pressure hits coming into the capture well, which was continually monitored with a surface pressure gauge and a bottomhole pressure and temperature recorder.

“The capture well across multiple fracture swarms enabled us to observe the number of fractures coming into the wellbore at the different layers,” he said. “The pressure responses we saw during production supported the theory that fractures can transport proppant and fluid from active wells to an offset, or capture well. The hope is that we can eventually drill these wells without fracturing them and capture some of the additional gas in between wells that may not produce.”

Reservoir modeling

Using the experience gained over more than a decade of unconventional fracturing, the industry has learned that reservoir characterization is essential for designing the right multistage completion strategy to optimize recovery and production. In 2015, Schlumberger upgraded the Mangrove unconventional fracture modeling software with a new diversion algorithm to ensure full cluster stimulation and modeling that effectively simulates the new generation of fracture fluid systems. These include the low-viscosity BroadBand composite fracturing fluids that utilize degradable fibers to create more distributed and sustained fracture conductivity in the reservoir.

“With the reservoir models we’re building, we’re gaining greater 3D understanding of the geomechanical and petrophysical aspects of these fields to determine the optimum place to land the lateral, place more stages in the best rock and, in many cases, right-size proppant volumes to boost stimulation,” said David Sobernheim, North American Stimulation Domain Manager, Schlumberger. Understanding how depletion effects and the interaction of parent/child wells impact fracture behavior is also critical. “The strategy for one well has to take into account what we’re doing on offset wells,” he said.

Fiber optic and microseismic measurements enable operators to validate designs while pumping and integrate updated data into workflows to optimize completions and determine the best way to produce wells over time, he noted. “With recovery factors in the high single-digits or low-to-middle teens, our strategy going forward is better understanding the full potential of these reservoirs to cost-effectively increase recovery factors and deliver the best return on investment.”

Much of Schlumberger’s innovation involves technology replacement versus upgrades to existing solutions. The need to eliminate mechanical intervention to mill out plugs in conventional P&P operations was a key driver in developing the Infinity dissolvable P&P system, launched in February 2015. The system performs the same way as a conventional P&P but uses fully degradable seat assemblies and fracturing balls instead of composite plugs to isolate zones, explained Isaac Aviles, Global Portfolio Manager, Multistage Stimulation, Schlumberger.

“We parted ways with the traditional plug design to develop a robust, efficient and cost-effective system that more effectively grips the casing and isolates between stages. By eliminating the mill-out phase, customers can stimulate longer laterals, with no limitations on stage count, and lower cost of operations.”

The system, designed for all well types and all major casing/hole sizes, is deployed on standard wireline with a fully dissolvable same-size ball pumped down when stimulation begins. After all stages are stimulated, the ball and seat assemblies dissolve upon contact with common completion fluids. “To date, no mechanical interventions have been required when running the system,” Mr Aviles said. “By combining the dissolvable P&P system with a dynamic diversion tool, such as the Schlumberger BroadBand Sequence fracturing service, operators can sequentially isolate fractures to ensure every cluster is optimally stimulated in the most time- and cost-efficient way available.”

The dissolvable P&P system has been deployed in most major North American plays, as well as South America and the Middle East, among other markets

A hybrid approach

In the US, an estimated 80% to 85% of multistage wells are completed using the P&P technique, with the graduated ball seat/sleeve-style completion accounting for 15% to 20% of the market, according to Matthew Crump, Global Product Line Manager, Composites, Well Completion Technology for Weatherford. Operator preference and/or regional practices typically determine which method is used. “When the Rockies region began booming five or six years ago, lack of pumping trucks and high operational costs associated with water usage and time required for P&P operations boosted use of sleeve applications,” he said. “Today, with greater availability of pumps and decreased demand, cost of the two methods is roughly the same, so we’re seeing a lot of customers switch to P&P.”

In March 2015, Weatherford launched the TruFrac Composite Frac Plug, which can be efficiently pumped downhole, securely set in place to hold fracture pressures up to 10,000 psi and milled out easily and quickly in small particles, leaving a clean wellbore through which to produce, Mr Crump said. The plug’s rubber seal features a composite backup structure molded directly into the seal, creating a smooth outer surface for easy pump-down. A composite lower slip, or anchoring system, with small inserts grips into the casing to keep the plug in place, resulting in easier mill-out over conventional cast iron anchoring mechanisms that leave large particles in the wellbore.

The plug provides for an unlimited number of stages. However, the difficulty of running coiled tubing (CT) past 14,000-ft measured depth has driven a trend of hybrid completions, with a ball/sleeve assembly run in the toe of the well and a P&P-style completion above it, closer to the heel.

“We’re seeing more customers mixing and matching techniques to maximize recovery,” Mr Crump said. In some instances, customers are running the Weatherford StealthFrac completion system, a permanent frac plug with a large inner diameter (3-in. for 5 ½-in. casing and 2 ½ in. for 4 ½-in. casing), that is paired with a large dissolvable ball in the toe. A dissolvable metal ball dropped on top of the plug dissolves on contact with chloride-based fluids, and production is flowed through ID of the plug. The TruFrac system is run above it.

As customers continue to increase stage counts, Weatherford has enhanced its multizone graduated ball/sleeve system with a maximized ball/seat interface to hold 10,000-psi fracture pressures for up to 67 stages in 5 ½-in. casing, explained Justin Vinson, Product Line Manager, ZoneSelect. Last year, the system was used in a 58-stage well in the Bakken. “Compared to a year ago, operators are drilling fewer wells but choosing their prime wells to add more stages in the same length of lateral to discretely address smaller portions of the reservoir.”

Increasingly, customers are using dissolvable balls and producing through seat assemblies that are left downhole, he noted. “Growing market acceptance of dissolvable balls, which have a higher pressure rating than composite balls, along with the added benefit of being dissolvable, have significantly driven down the cost of the balls in the past year.”

Downturn opportunities

While continued low and volatile oil prices present significant issues for the industry, they also create unique opportunities, suggests Tim Willems, Chief Operating Officer of NCS Multistage. The company developed the Multistage Unlimited pinpoint frac system, which pumps only one stage at a time as an alternative to open-hole packer systems and P&P methods. “When there is a market downtown, operators have time and motivation to evaluate everything they do, including their completion methods, to lower costs and improve well production. We’re focusing on helping them optimize their unconventional completion designs and operations.

“With conventional methods (P&P and open-hole), it is very difficult, if not impossible, to place fractures consistently because there’s no way to predict or know for sure where the sand and fluid are going without using costly third-party services,” he continued. “Our CT-deployed method combines consistent, repeatable fracture placement – both spacing and propped volume – with measured downhole pressures and temperatures, giving operators control over key variables plus valuable stage-by-stage information that allows them to truly optimize their designs from well to well across an entire field.”

The Multistage Unlimited system incorporates proprietary gauges/recorders positioned in and below the fracture zone to capture downhole data during each stage of the completion operation.

NCS Multistage has also enhanced its R&D program, improving the performance of the Multistage Unlimited frac-isolation tool. The technology has placed up to 14.1 million lb of proppant in a single well on a single CT run, according to the company. In response to the need for a reclosable frac sleeve, the company in 2014 launched the MultiCycle frac sleeve to give operators more flexibility during completions to manage production stage-by-stage.

“By closing the sleeve immediately after fracturing a stage, we can minimize proppant flowback,” Mr Willems said. “The closed sleeve holds fracture pressure in the formation while the fracture heals slowly. After formation stresses equalize, the proppant is locked in the formation to ensure good near-wellbore conductivity. After the fractures have healed, we reopen all the sleeves in a single trip. There is no need for a costly well cleanout before producing the well.”

The MultiCycle sleeve, which can be opened and closed over the life of the well, enables operators to fracture stages out of sequence and access selected intervals as needed. Thousands of the sleeves have been installed in the US and Canada.

NCS Multistage also has continued to upgrade its AirLock casing buoyancy system, which has a perfect record to date for helping land casing in difficult horizontal wells. In 2015, the company introduced a line of liner hangers and is fine-tuning its refracturing tools, used to isolate zones for re-stimulation, Mr Willems added.

Reining in completion costs

As drilling efficiencies have improved over the past decade, with unconventional wells now being drilled in as few as eight days, completions now account for approximately 60% of the cost of an unconventional well, according to Halliburton’s Ben Wellhoefer. “Our overall goal is to find the most effective designs that provide the lowest cost per barrel of oil equivalent we can, while maintaining the same number of stages and meet other requirements of our customers.”

In July 2015, Halliburton launched the fully dissolvable Illusion frac plug, a 10,000 psi-rated device that reduces production time and cost by eliminating the need to mill out plugs. The dissolvable plugs can be installed at any point in the wellbore to enable optimal placement of perforations for improved fracturing. The plug completely dissolves, leaving the wellbore unobstructed to bring production online sooner. It is being used in most of the unconventional plays in North America, according to Halliburton, and has been installed on an unconventional well in Argentina.

Design of the dissolvable plug followed the success of the company’s dissolvable frac sleeve ball, introduced in 2013, that now provides isolation for more than 50 stages, Mr Wellhoefer said. “We are working on a variety of projects around dissolvable technology because it is a way customers can directly eliminate steps and avoid intervention costs while completing wells with longer laterals and increased stage counts, which require more hydraulic fracturing. We also are looking at ways to overcome the limitations of graduated frac ball seats, which ultimately reduce the number of stages we can fracture.”

Halliburton has also continued to upgrade the RapidSuite technology portfolio of frac sleeve systems, designed as an alternative to the widely used P&P method for stimulating unconventional formations. Frac sleeve systems, which originally provided only a single entry point per frac stage, now enable continuous pumping for multiple entry points per stage across more than 50 target stages. They have become the second most popular completion methodology in the unconventional sector, Mr Wellhoefer noted. The frac sleeve, which can be used with both open-hole and cement isolation, as well as inside existing casing, eliminates thousands of barrels of water used in P&P operations just for pump-down.

Due to heightened federal and state regulations regarding pre-fracture casing testing, Halliburton has seen an uptick in interest in the RapidStart Initiator CT sleeve, a toe sleeve introduced in 2013 that is run as part of the casing string to the bottom of the wellbore to perform a casing test before launching stimulation.

“Once we perform the casing test, the sleeve opens, eliminating the need for CT intervention to establish a flow path at the beginning of the P&P operation,” Mr Wellhoefer explained. “This supports our goal of promoting environmental stewardship by ensuring the casing and the wellbore can handle pressures during fracturing. We also design the right completion for the reservoir to maximize the production and construct the wellbore in such a way that there is reduced risk of any environmental events.”

Value-added benefits

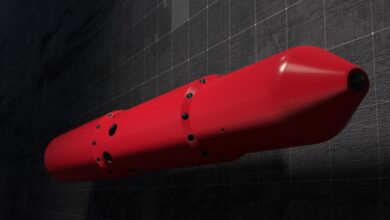

In late 2015, Baker Hughes introduced the SPECTRE disintegrating frac plug, made of a high-strength, controlled electrolytic metallic (CEM) material. “P&P is still the mostly widely used hydraulic fracturing method, but conventional operations require three to four days to drill out the composite plugs with a CT crew, which adds time and cost to bring a well on production,” explained Ryan Allen, Product Line Manager, Unconventional Completions, for Baker Hughes. “By eliminating that drill-out phase, we are passing on a value-added benefit to our customers.”

The new plug was developed in collaboration with operators who pushed for an anchoring grip that would completely disintegrate, leaving no debris in the wellbore that could compromise long-term operations, such as well rejuvenation or clean-outs, Mr Allen said. “We have other options that anchor plugs into the casing string and don’t completely disintegrate, but we went further with this system.” The plug is currently qualified to 10,000-psi differential pressure and 275° F (135°C). However, engineers are looking at ways to increase the temperature rating.

The plug and packing element are deployed from the surface on wireline and disintegrate into a fine powder upon interaction with chloride, which is produced naturally in the reservoir, and elevated downhole temperature. The powder and other debris in the wellbore are flowed out during production. “The plug can be run in any wellbore with a P&P-style completion and cemented casing string,” Mr Allen noted. “Laterals are now extending 10,000 to 12,000 ft, and a lot of operators are using wireline to extend farther into the well and reach the toe section. With the current market, many customers are putting wells into inventories that still need to be completed, and most of them are cemented, cased-hole wells for P&P completions.”

CEM is the same compound used in Baker Hughes’s IN-Tallic disintegrating frac ball that was launched in 2010 to isolate or divert fracture treatments in both open and cased holes, and the SHADOW permanent-style frac plug, introduced in 2014. The all-metallic SHADOW plug, used in cemented, cased-hole applications with the disintegrating frac ball, stays in the wellbore after fracturing, with production flowed through the plug’s large inside diameter.

Field trials of the SPECTRE plug began in June 2015 in multiple plays in Canada and the US. The plug will be fully commercialized early this year in North America, and deployments are anticipated in South America, the Middle East, Asia and Australia by the end of 2016. DC

Mangrove, Infinity and BroadBand are marks of Schlumberger. TruFrac, StealthFrac and ZoneSelect are registered terms of Weatherford. MultiStage Unlimited, MultiCycle, and AirLock are trademarks of NCS Multistage. Illusion, RapidStart and RapidSuite are registered terms of Halliburton. SPECTRE, IN-Tallic AND SHADOW are trademarks of Baker Hughes