2024 NOV census shows US onshore is leveling out overall while offshore is still growing

US shale players pivot focus to growth through M&A to achieve economies of scale, synergies

By Tarjei “TJ” Myklebust and Karl Appleton, NOV

This year’s census saw a leveling out of the decline in the US onshore rig markets, while other regions, such as the Middle East, continued their multi-year growth. Offshore rig markets remained tight, and positive developments for rig counts and dayrates in the mobile offshore drilling unit (MODU) fleet continued.

The period between the 2023 and 2024 census was defined by record levels of merger and acquisition (M&A) activity, particularly in the US shale plays. Oil prices stayed healthy for operators, drilling contractors and economic growth. Moreover, the focus switched from fixing balance sheets to growing through M&A and realizing economies of scale and synergies. This trend ties in with a continued focus on energy security, which has only grown with the unrest in the Middle East. It also acknowledges the realization that the energy transition will require a mix of both renewable and traditional sources for the foreseeable future, as global energy demand continues to climb.

Census highlights

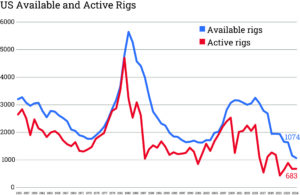

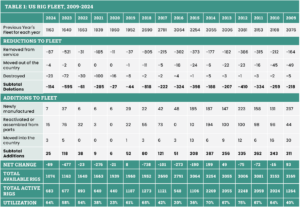

- The US available fleet, including both land and offshore rigs, decreased by 89 rigs to 1,074.

- The active rig fleet in the US increased by six rigs compared with the previous census, bringing the total number of active rigs in the 2024 census up to 683.

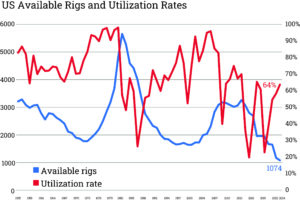

- The total utilization rate for the US land and offshore fleet increased from 58% in 2023 to 64% in 2024. While the active rig count was up, the main driver for the utilization increase was a smaller available fleet size.

- The Canadian fleet utilization of land and offshore rigs increased from 48% in 2023 to 57% in 2024. The available fleet decreased by 45 to 302 rigs.

- The global available offshore rig fleet had a second consecutive net increase, following eight straight years of shrinking fleet sizes from 2014 to 2022. The offshore fleet increased by 17 to 639 rigs. Utilization climbed to 82%, the highest since 2014.

- Activity of the global offshore rig fleet remains high as floater demand is driven by the Golden Triangle — the US Gulf of Mexico, Brazil and West Africa — while jackup utilization remains high despite the suspension of 25 rigs in the Middle East.

- The international onshore rig count is a mix of multi-year growth in Europe, Africa and the Middle East and some softening in Asia Pacific and Latin America.

US fleet

The US available rig fleet for both land and offshore was down 89 to 1,074, of which 98 were offshore. This is the smallest the fleet has been in the history of the NOV rig census, which goes back to 1955.

US fleet rig additions

The US rig fleet added only 25 rigs since the previous census, which is well short of the five-year average of 39. Of the rig additions, seven were newbuilds, 15 were reactivations of cold-stacked rigs previously removed per census rules, and three were drillships that entered the US Gulf of Mexico (GOM) ahead of the census period.

US fleet rig attrition

The removal of 114 rigs from the available fleet in the 2024 census is modest compared with the 595 rigs removed last year. Future reductions are expected to be at this lower level. Specifically, 23 land rigs were scrapped, and 87 rigs were removed due to prolonged inactivity. Four rigs moved out of the country, including two drillships and two land rigs that left for Canada.

Canadian fleet

The total available Canadian rig fleet was 302 rigs, which was down from 347 last year. While 48 rigs were removed due to prolonged inactivity, one newbuild and two rigs moved into the country from California. Meanwhile, the available offshore fleet in Canada consisted of three platforms, one drillship and one drilling barge.

Global offshore mobile fleet

After shrinking for eight consecutive years, from 2014 to 2022, the MODU fleet is now reversing that trend. The available MODU fleet has increased for the second year running to 639, an increase of 17 rigs compared with the 2023 census.

High utilization rates and increasing dayrates made owners reluctant to remove rigs from their fleets, leading to only 10 rig retirements during the period, compared with a five-year average of 28. Six of the retired rigs were semisubmersibles, with an average age of 43 years. This MODU segment has had the highest rate of retirements relative to fleet size since the 2014 downturn. Moreover, four jackups were removed from the fleet, with an average age of 44 years.

This year, 27 rigs were added to the fleet, consisting of 16 newbuilds and 11 reactivations. Among the newbuilds, six drillships were ordered before the downturn and subsequently stranded in the yard. Currently, only three high-specification competitive drillships remain stranded. Meanwhile, one newbuild semisubmersible has yet to secure a maiden contract, and seven semisubmersibles are pending delivery.

The remaining nine newbuild MODUs delivered are jackups, with contracts in the Middle East or China. Only 13 jackups are still awaiting delivery, a far cry from the 28 stranded in the yards at the end of 2021.

The Middle East was the largest MODU region globally, with 31.6% of the overall fleet, all of which are jackups. This is up from 29.2%, as more jackups have been moved into this region. However, this trend could be reversed to an extent following the suspension notices that Saudi Aramco has issued to keep Saudi Arabia’s maximum sustained production at 12 million bpd, which is 1 million bpd below the target announced in 2020.

The Far East region had 13.5% of the fleet, while Northwest Europe decreased by 1.3% year-over-year to 9.1%, as harsh-environment semisubmersibles exited the region. Despite this decline, Northwest Europe remains the largest region in the world for semisubmersibles, with 35% of the semisubmersible fleet.

South America has the largest drillship fleet, primarily driven by Brazil’s continued rig fleet expansion. This region had almost 37% of the drillship fleet, with the US GOM and West Africa making up 27.6% and 18.4%, respectively. The drillships in these three regions make up almost 83% of the entire global drillship fleet.

US drilling activity and utilization

The number of active rigs in the US rose by six to 683 in the 2024 census, with a utilization of 64%, up from 58% in 2023. Of these, 645 were land rigs, and 38 were offshore. The Permian region had the largest available fleet with 413, out of which 319 were active. That resulted in a 77% utilization, up from 59% last year. ArkLaTex, however, was the region with the highest utilization, at 78%, for its smaller fleet of 55 available rigs.

A total of 601 rigs, or 56% of the available fleet, had a depth capability of 20,000 ft or more. These advanced rigs had the highest utilization rate, with 72% active during the census period. Rigs capable of reaching depths of 16,000 to 19,999 ft were down by 24 units to 200 compared with the previous year and had the second-highest utilization rate at 67%. The lowest capability rigs, 3,000 to 5,999 ft, also had the lowest utilization, at 27% from a fleet of 45.

The US offshore fleet had 39% utilization, down from 45% in the previous census, due to three fewer platform rigs, one fewer inland barge, and one fewer jackup being active. The US drillship segment in the GOM remained strong, with a fleet of 21 drillships at a 91% utilization rate. Jackups remained stable at 12 rigs, half of which were active, and the only semisubmersible in the US GOM was active.

Canadian drilling activity

During the 2024 census period, Canada had 171 active drilling rigs, an increase of five rigs compared with the previous year. Utilization also increased from 48% in 2023 to 57% in 2024. Its three active offshore rigs consisted of one drillship and two platforms. The 168 active onshore rigs included two rigs that moved across the US border from California, which shows some of the positive sentiment around the Canadian onshore heavy oil market.

New pipelines in the region are likely to have a positive effect on rig count. Small Canadian players are expected to have new access to the existing network as the majors shift to the recently opened Trans Mountain oil pipeline and the Coastal GasLink pipeline, which is under construction.

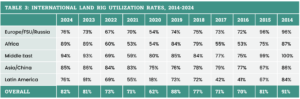

International land rig drilling activity and utilization

The international active land rig count, including estimates for Russia and China, is estimated to have risen to 2,619 with an 82% utilization. When omitting the large Russian and Chinese fleets, regional reviews reveal a mix of growth and decline.

In Europe, the rig count increased by 10% to 97 rigs. Among the region’s largest fleets, Turkey saw a slight rise to 26 rigs, while Ukraine remained stable at 46, a number higher than just before Russia’s invasion.

Africa’s multi-year regional growth continued, rising this year by 23% to 92 active rigs. Algeria led the region, increasing from 34 to 43 rigs. Libya followed, growing from 15 to 18 active rigs despite political uncertainty. At the lower end, Kenya and Uganda have three and two rigs, respectively.

The Middle East, although still not back in the 370s seen during 2020, rose by 4% to 301 rigs, showing mixed trends. Oman, Iraq and Saudi Arabia remain the region’s biggest players and show leveling fleets at 50, 62 and 73, respectively. However, lowering production targets from Saudi Arabia may reduce rig counts.

In contrast, the announced plans to increase production had a noticeable impact in Abu Dhabi, where the rig count rose by 15% to 46, and especially in Kuwait, which saw a 33% increase to 32. Egypt, meanwhile, showed a 39% decline to 19 rigs due to proximity to the conflict around Gaza, coupled with financial uncertainty.

Asia saw a regional softening of 5% to 125 active rigs from a multi-year high of 132 in 2023. The region also had mixed trends amongst three of its largest fleets. India and Australia trended down by 8% and 24%, respectively, to 54 and 16 rigs. Meanwhile, Indonesia’s count rose by 19% to 43 rigs.

In Latin America, the rig count fell by 16% to 121, continuing a decline from 149 in late 2022. Continued political opposition to drilling in Colombia, coupled with a deal to import gas from Venezuela, saw the mid-year rig count decline slightly by three rigs to 21.

In Argentina, despite having attractive plays and a new government that promises financial reform, the country’s count is down nine rigs to 48. Mexico’s count also dropped from an end-of-2023 peak of 42 to 31 rigs.

Global MODU activity

The positive developments in the MODU market that began in 2022 have continued, with the 2024 census recording 527 active MODUs. This is 37 more than in the previous census and the highest recorded number since 2015. The marketed utilization rate for the MODU segment hit 82% in the 2024 census, up from 79% in 2023. The last time the utilization rate was more than 80% was pre-downturn in 2014, at 85%.

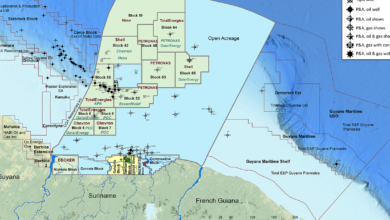

The growth in the drillship segment has been driven by the Golden Triangle, particularly Brazil. There was also some incremental rig demand in Guyana and Suriname. The marketed utilization rate for the drillship segment was 81%, which led to the delivery of six drillships from the yard and a more than 20% increase in average earned dayrates over the last 12 months. Currently, certain shorter-term contracts in the drillship segment command dayrates exceeding $500,000. In the Golden Triangle, contract durations are increasing as operators want to secure the most capable vessels.

The jackup segment had the highest marketed utilization rate at 86%. This growth has been driven by significant expansion in the Middle East over the past couple of years. Also, the tight market has led to average earned dayrates increasing by more than 20% since the last census. However, the full impact of Saudi Aramco’s one-year suspensions had yet to be felt in the 2024 census period.

Semisubmersibles are the least utilized at 69%, despite a significant reduction in fleet size over the last 10 years. There are some positive signs, however. The market for harsh-environment semisubmersibles is tightening as several rigs left the North Sea in the past few years to work in regions such as West Africa and Australia. With the market picking up in Norway, several contracts have been signed at dayrates above $500,000. Brazil is also picking up some semisubmersibles, although drillships are still favored.

Offshore industry trends

Despite higher dayrates and utilization rates that historically have triggered newbuild orders, a wave of orders is not expected in the next couple of years. Dayrates would need to increase significantly — perhaps by an additional $150,000 in the drillship segment — to trigger any orders. Both contractors and shipyards are cautious, as they remember what happened in the downturn after the previous build cycle. Shipyards will not offer the same attractive payment terms as in 2014, and contractors will not order a rig without a firm commitment from an operator with a long-term contract at attractive terms.

Rigs ordered before 2015 are now finally being delivered. The orderbook has shrunk significantly over the past two years, and with no newbuild orders on the way, we are reaching a fixed market state as most of the available supply that can be reactivated has been taken. Only eight drillships are left in the shipyards, including unfinished ones in Brazil, and only three of these have specifications that allow them to compete on the international market. Thirteen jackups remain on order, but several are of less favored designs. Meanwhile, seven semisubmersibles are still on order, as there have not been many deliveries in this segment.

Moving forward, the drillship segment is expected to remain tight, and dayrates are anticipated to rise as demand grows, driven by the Golden Triangle. Brazil, which has seen a steady influx of about five drillships per year over the past few years, appeared to be slowing down. However, some positive developments in licenses to explore the Equatorial Margin mean there could still be demand for three to four new rigs over the next year. Contract durations in Brazil are also increasing, going from 2+1-year contracts to three- and four-year contracts. The US GOM is expected to stay fully utilized with roughly the same number of drillships as at present. In West Africa, a small uptick is possible since Angola and Namibia require both drillships and harsh-environment semisubmersibles. Guyana and Suriname will also continue to contract drillships.

The semisubmersible segment will continue to have lower utilization rates than the other two segments, but the utilization rate will still climb. The harsh-environment semisubmersible market has been heating up, with increasing demand in Norway, West Africa and Australia expected to push dayrates higher.

The jackup segment is expected to soften slightly in the near term due to the Saudi Aramco rig suspensions. However, the excess supply is likely to be soaked up by the market in the medium to long term. Several of the suspended rigs have already found work in other Gulf Coast Consortia countries, where the demand is strong, or in regions like West Africa or Asia Pacific.

A consequence of the rig suspensions is a softening of the dayrates, especially in regions such as Asia Pacific, where lower-spec rigs will likely find work. There is talk of dayrates being negotiated down in tenders as the suspended rigs start competing for work with the available rigs already in the region. However, some factors suggest dayrates will continue to climb in the medium term: an aging fleet, a relatively small orderbook of the most favored jackup types, and rigs returning to work after a year’s suspension.

US industry trends

This year, the number of rig owners dropped from 138 to 131, primarily due to M&A. Of the 1,074 rigs in the US available fleet, 37 are operator owned.

The major trend for the US drilling market since the previous census is the wave of consolidation. As oil prices dropped from the highs seen in 2022, so did the gap between the company valuations and the price potential buyers were willing to pay. This led to several mega-deals as operators sought to acquire territories adjacent to their own assets and build up their oil reserves. They were also looking for economies of scale and realizing synergies.

Meanwhile, the consolidation is not limited to operators, as contractors have executed large deals. Some are trying to expand their fleets, while others are looking to increase their global footprint since the dayrates for US land rigs have been declining over the last year and the rig count has remained fairly flat.

US forecast for next year

OPEC+ has continued its strategy of withholding production to defend oil prices. This approach has helped WTI oil prices stay in the high $70 to low $80 range, which is a healthy level for both operators and drillers. OPEC+ has extended its production cuts of 3.66 million bpd until the end of 2025, with an expected gradual phase-out of their additional cuts of 2.2 million bpd from October 2024 to September 2025. It remains to be seen if OPEC+ can do this without significantly impacting the oil price. However, barring any significant shocks to the market, WTI oil prices are projected to stay healthy next year.

The US onshore rig market is expected to remain fairly flat in the near term. Improved drilling technologies have led to efficiency gains, enabling far fewer rigs to maintain record-high US production. A large increase in rig count is unlikely unless gas prices improve significantly, leading to more demand for gas drilling.

M&A activity among operators and drilling contractors is likely to continue but will shift away from the Permian Basin, as limited opportunities remain in what has been the hot spot up until now. DC

IHS Markit is the primary source for the global offshore fleet, while Enverus provided the source material for the US and Canadian onshore fleets. Information for the international land fleet was found using both Baker Hughes data and Spears information, which NOV personnel collected and analyzed.

Click here to access the full version of the NOV rig census in the digital edition.